Saturday Feb 21, 2026

Saturday Feb 21, 2026

Friday, 14 November 2025 00:02 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The Treasury Bond auctions held yesterday with a total offered amount of Rs. 80 billion across two available maturities, was fully subscribed at the 1st phase in competitive bidding. Total bids received exceeded the offered amount by 2.73 times. This marked the 1st instance in 7 consecutive Bond auctions to raise the entire offered amount. The weighted average rates reflected the bullish sentiment in the secondary Bond market stemming from the rally which has been seen in the recent weeks.

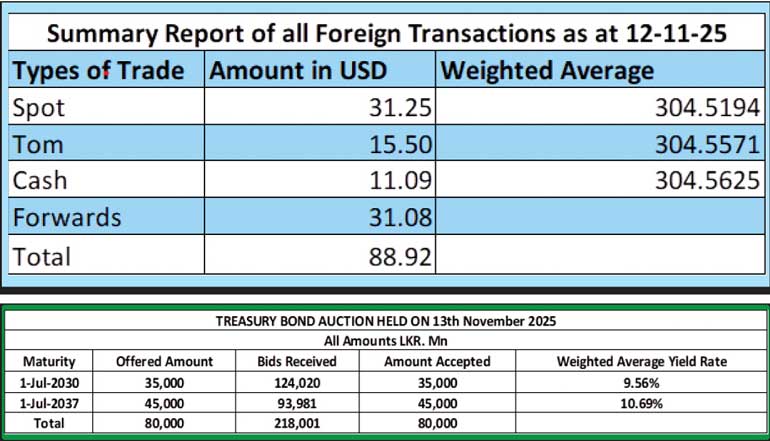

Maturity-wise the results were as follows:

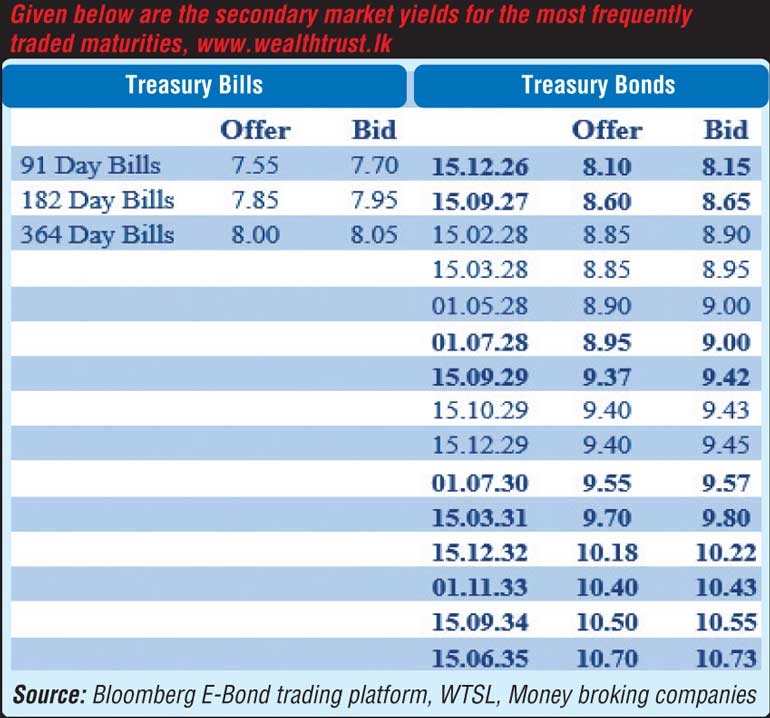

The secondary Bond market yesterday saw yields overall trade sideways and fluctuate within a narrow band. Despite the bulk of the market consolidating, selected maturities such as the 2028s, 2029s and 2032 tenors saw two-way quotes dipping down to close the day lower. Activity and transaction volumes continued to be seen at healthy levels.

The 15.12.26 maturity was seen trading at the rate of 8.12% and the 01.05.27 maturity at the rate of 8.50%. The 15.03.28, 01.05.28 and 01.07.28 maturities traded at the rates of 8.90%, 8.95%-8.94% and 9.00%-8.95% respectively. The 15.09.29, 15.10.29 and 15.12.29 maturities were seen trading at the rates of 9.45%, 9.42%-9.40% and 9.45%-9.40% respectively. The 01.07.30 maturity was seen trading within the range of 9.57%-9.54%. The 15.03.31 maturity was seen trading at the rates of 9.80%-9.79% respectively. The 01.10.32 and 15.12.32 maturities were seen trading at the rates of 10.23%-10.18% and 10.20% respectively. The 01.06.33 and 01.11.33 maturities traded within the rates of 10.42%-10.40% and 10.40% respectively.

The total secondary market Treasury Bond/Bill transacted volume for 12 October was Rs. 19.60 billion.

In money markets, the weighted average rates on overnight call money and Repo stood at 7.90% and 7.96% respectively.

The net liquidity surplus was recorded at Rs. 162.43 billion yesterday deposited at the Central Banks SDFR (Standard Deposit Facility Rate) of 7.25%.

Forex Market

In the Forex market, the USD/LKR rate on spot contracts closed the day depreciating to Rs. 305.50/305.90 as against Rs. 304.60/304.65 the previous day.

The total USD/LKR traded volume for 12 October was $ 88.92 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)