Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Wednesday, 3 September 2025 00:12 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

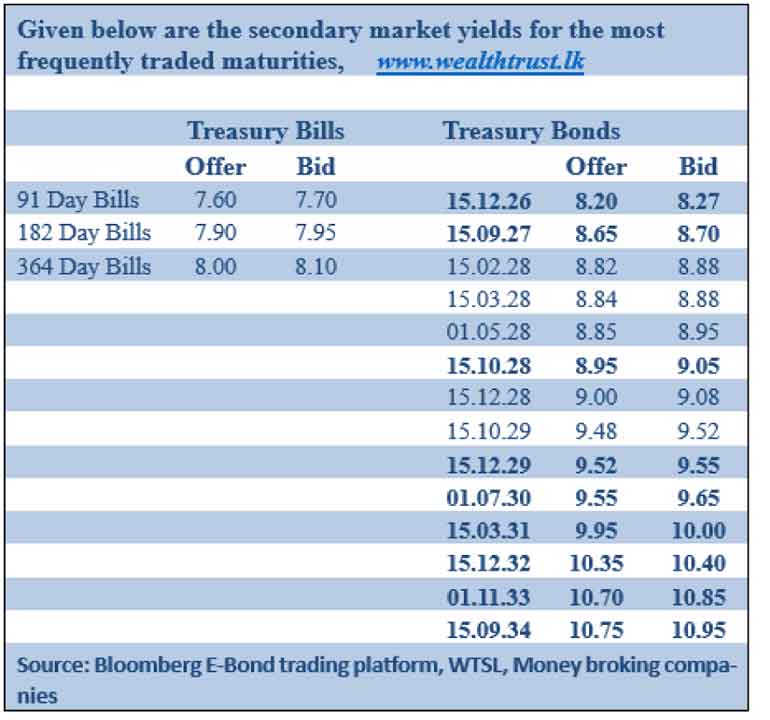

The Treasury Bills auction scheduled to be conducted today will have a total offered amount of Rs.74 billion, a decrease of Rs. 8.00 billion over the previous week. The auction will be consisting of Rs. 14.00 billion on the 91-day, Rs. 30.00 billion on the 182-day and Rs. 30.00 billion on the 364-day maturities.

To recap, the weekly Treasury Bill auction held last Wednesday (27/08/25), only raised 62.37% or Rs. 51.14 billion in successful bids out of the total offered amount of Rs. 82.00 billion at the 1st phase in competitive bidding. The weighted average yields overall held broadly steady, as the rate on the 182-day and 364-day maturities remained unchanged at 7.89% and 8.03% week-on-week respectively. However, the weighted average yield rate on the 91-day maturity registered a marginal decline of 01 basis point week-on-week. Notably, this marked the 4th consecutive week where the weighted average yield on at least one tenor recorded a decline. Further to the auction, an additional amount of Rs. 20.00 billion was raised at the phase II.

Meanwhile, the secondary market bills which has experienced a pick-up in activity in recent times, remained active. January 2026 maturities were seen trading at the rate of 7.95% and May 2026 at the rates of 8.03%.

Nevertheless, the secondary Bond market continued to remain subdued for a second consecutive day, with overall activity and transaction volumes persisting at muted levels. In the early trading hours, activity briefly picked up, pushing yields higher. However, renewed buying interest soon emerged, leading to a recovery. As a result, rates closed broadly steady. Most market participants continued to largely stay on the sidelines, maintaining a cautious wait-and-see approach in the absence of strong directional cues.

The 15.01.27 maturity traded at the rate of 8.30%. The 01.07.28 and 15.10.28 maturity traded at the rate of 8.98% and 9.00% respectively. In the 2029 space, the 15.09.29, 15.10.29 and 15.12.29 maturities were seen trading within the ranges of the rates of 9.53%-9.50%, 9.52% and 9.56%-9.54%. The 01.10.32 traded at the rate of 10.45%.

The total secondary market Treasury Bond/Bill transacted volume for 2 September was

Rs. 14.77 billion.

In money markets, the weighted average rates on overnight call money and Repo stood at 7.85% and 7.87%.

In the money market, the net liquidity surplus increased to Rs. 127.35 billion yesterday.

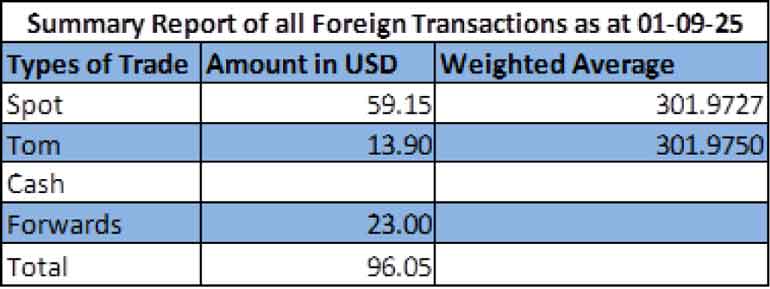

Forex market

In the Forex market, the USD/LKR rate on spot contracts closed the day depreciating to Rs. 302.12/302.20 as against Rs. 301.97/302.07 the previous day.

The total USD/LKR traded volume for 1 September was $ 96.05 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)