Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Wednesday, 9 July 2025 00:04 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The weekly Treasury bill auction conducted yesterday was undersubscribed. The auction raised 91.74% or Rs. 66.51 billion out of the entire Rs. 72.50 billion offered at the 1st phase in competitive bidding. This was despite total bids received exceeded the offered amount by 1.72 times.

The weekly Treasury bill auction conducted yesterday was undersubscribed. The auction raised 91.74% or Rs. 66.51 billion out of the entire Rs. 72.50 billion offered at the 1st phase in competitive bidding. This was despite total bids received exceeded the offered amount by 1.72 times.

The weighted average yield rates were seen increasing across the board for the first time in 14 weeks since the 2 April auction. Accordingly, the weighted average rate on the 91-day tenor increased by 05 basis points to 7.60%, the 182-day tenor by 06 basis points to 7.84% and the 364-day tenor by 06 basis point to 7.99%.

The Phase II subscription for the 91-day and 364-day tenors is now open until 3.00 p.m. of business day prior to settlement date (i.e., 09.07.2025) at the WAYRs determined for the said ISINs at the auction.

Given below are the details of the auction (Phase 1);

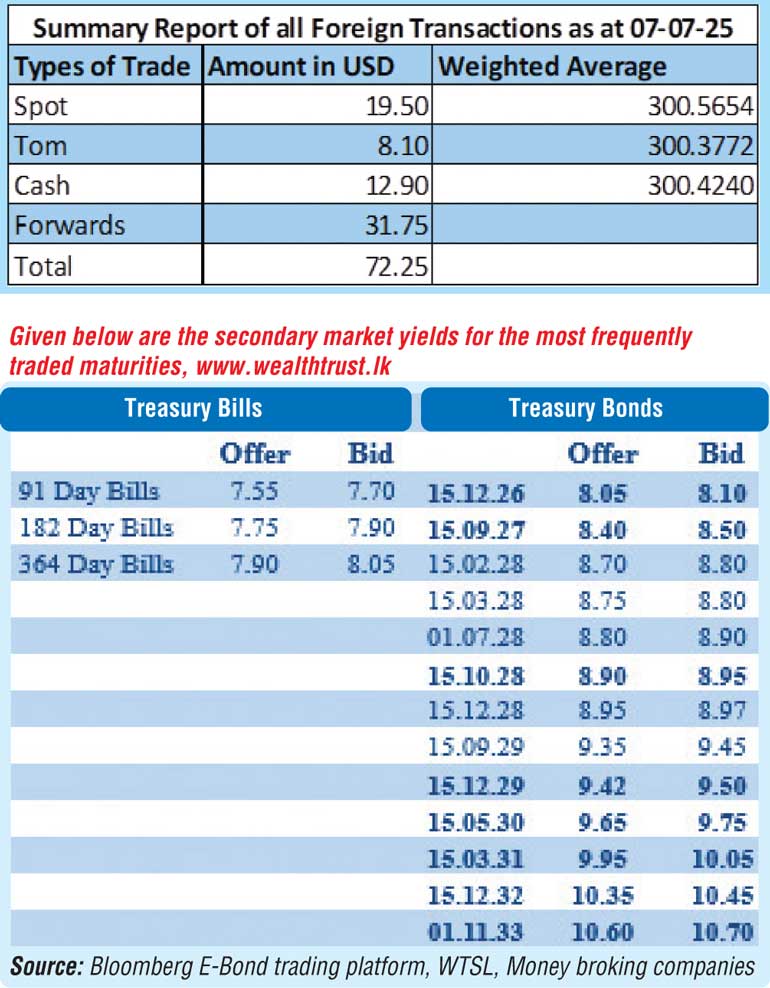

Meanwhile, the secondary bond market yesterday saw yields continue to hold broadly steady as market participants were seen adopting a watchful stance ahead of the upcoming Treasury bond auction due on Friday and against the backdrop of uncertainty stemming from the ‘Reciprocal Tariffs’ proposed to be imposed by the US.

The 15.12.26 maturity traded at the rate of 8.10%. The 15.10.28 maturity was seen trading at the rate of 8.92%. The 01.12.31 maturity was seen trading at the rate of 10.10%. The 01.11.33 maturity was seen trading at the rate of 10.62%.

In money markets, the weighted average rates on overnight call money and Repo stood at 7.75% and 7.75% respectively whiles the net liquidity surplus stood at Rs. 104.96 billion.

Forex Market

In the Forex market, the USD/LKR rate on spot contracts appreciated to close Rs. 300.75/300.85 as against its previous day’s closing level of Rs. 301.00/301.40.

The total USD/LKR traded volume for 07 July was

$ 72.25 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)