Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Tuesday, 12 August 2025 01:12 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The Treasury Bond auction scheduled to be conducted today will have a total offered amount of Rs. 65 billion across two maturities.

The settlement for which will be held on 15 August 2025.

For context, at the previous round of Treasury Bond auctions held on the 29th of July: a total offered amount of Rs 122.00 billion across two available maturities, went undersubscribed. The auctions raised only Rs 71.06 billion or 58.24% in successful bids across both phases, despite total bids received exceeding the offered amount by 1.70 times. This marked the third consecutive bond auction to raise less than the offered amount. Maturity-wise the results were as follows:

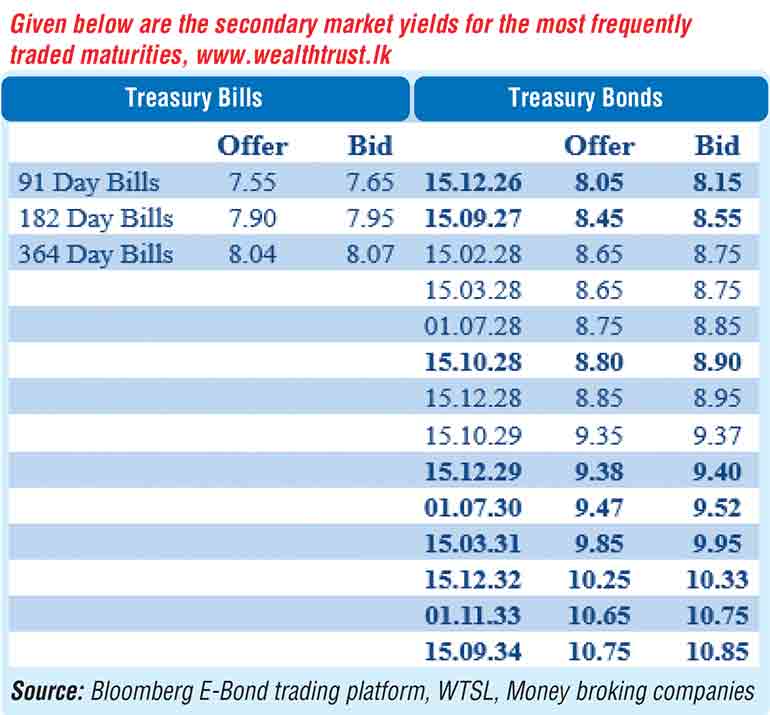

Meanwhile, the secondary bond market held largely steady yesterday, with yields anchored near prevailing levels. Trading activity remained subdued, as market participants gravitated towards the sidelines in a cautious “wait-and-see” mode ahead of the upcoming Treasury Bond auction.

Trades were observed focused on the short end of the yield curve. The 01.05.27 and 15.09.27 maturities traded at the rates of 8.35% and 8.50%. The 15.09.29 maturity traded at the rate of 9.37%.

The total secondary market Treasury Bond/Bill transacted volume for 7 August was Rs. 3.98 billion.

In money markets, the weighted average rates on overnight call money and Repo stood at 7.86% each.

The net liquidity surplus was recorded at Rs. 110.68 billion yesterday. An amount of Rs. 0.05 billion was withdrawn from the Central Bank’s SLFR (Standing Lending Facility Rate) of 8.25%, while an amount of Rs. 110.73 billion was deposited at Central Bank’s SDFR (Standard Deposit Facility Rate) of 7.25%.

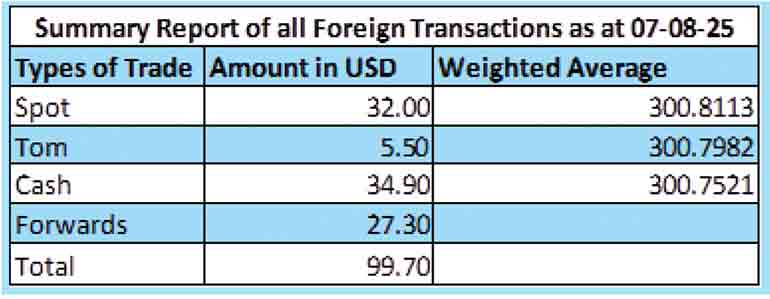

Forex Market

In the Forex market, the USD/LKR rate on spot contracts closed the day depreciating to Rs. 300.85/301.00 as against Rs. 300.70/300.78 the previous day.

The total USD/LKR traded volume for 7 August was $ 99.70 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)