Saturday Feb 07, 2026

Saturday Feb 07, 2026

Thursday, 2 October 2025 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

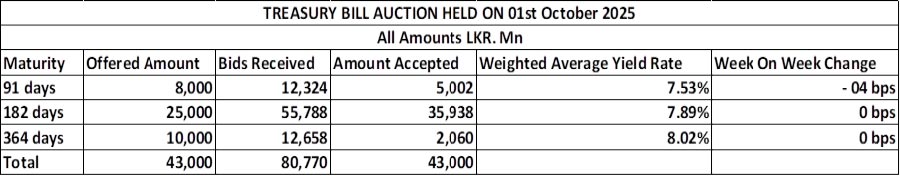

The weekly Treasury Bill auction conducted yesterday saw the entire Rs. 43.00 billion total offered amount fully subscribed. This marked the first instance in six weeks that a T-Bill auction raised the entire targeted offered amount. The bids received to offered amount ratio stood at 1.88 times.

The weekly Treasury Bill auction conducted yesterday saw the entire Rs. 43.00 billion total offered amount fully subscribed. This marked the first instance in six weeks that a T-Bill auction raised the entire targeted offered amount. The bids received to offered amount ratio stood at 1.88 times.

The weighted average rates held broadly steady, with the exception of the 91-day maturity which registered a 4-basis point decline to 7.53%. The 182-day and 364-day tenors remained unchanged at 7.89% and 8.02% respectively. This marks the 11th week where T-Bill rates have stayed virtually tethered around prevailing levels.

The Phase II of subscription on for 91- and 364-day tenors is now open until 3 p.m. of business day prior to settlement date (i.e., 02.10.2025) at the WAYRs determined for the said ISINs at the auction. See details of the auction (Phase 1).

The secondary Bond market yesterday experienced a further uptick in yields, influenced by external developments such as news of the US Government shutdown.

In addition, news that the Asian Development Bank had revised Sri Lanka’s GDP growth forecast for 2026 down slightly to 3.3%, amid the imposition of US tariffs also weighed down on market sentiments.

However, robust renewed buying interest emerged at the higher levels curtailing further upwards movement.

Despite this secondary market two-way quotes closed the day higher. Market activity and transaction volumes were seen at healthy levels earlier in the day but tapered off during the latter trading hours as market participants switched back into a wait-and-see stance.

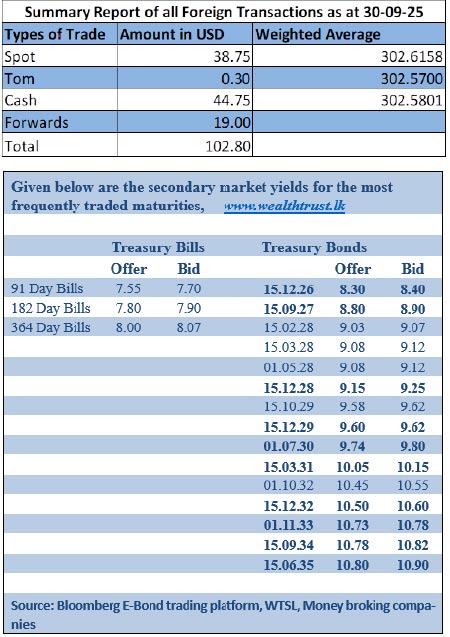

The 01.02.26, 01.06.26 and 01.08.26 maturities traded at the rates of 8.05%, 8.25% and 8.30%. The 15.01.28, 15.02.28, 15.03.28 and 01.05.28 maturities trading at the rates of 9.00%, 9.05%-9.04%, 9.10%-9.09% and 9.10%.

The 15.10.28 and 15.12.28 traded at the rates of 9.18% and 9.20% respectively. The 15.09.29 and 15.10.29 maturities both traded at the rate of 9.60%.

The 15.05.30 maturities traded within traded within the ranges of 9.78%-9.74%. The 01.10.32 and 15.12.32 maturities traded at the rates of 10.50% and 10.55% respectively.

In the secondary Bills market, trades were observed on January 2026 maturities at the rates of 7.67%-7.66%.

The total secondary market Treasury Bond/Bill transacted volume for 30 September was Rs. 5.93 billion.

In money markets, the weighted average rates on overnight call money and Repo stood at 7.87% and 7.88% respectively.

The net liquidity surplus was recorded at Rs. 169.03 billion yesterday. An amount of Rs. 22.50 billion was withdrawn from the Central Bank’s SLFR (Standing Lending Facility Rate) of 8.25%, while an amount of Rs. 191.53 billion was deposited at Central Bank’s SDFR (Standard Deposit Facility Rate) of 7.25%.

Forex market

In the forex market, the USD/LKR rate on spot contracts to closed appreciating slightly to 302.47/302.53 as against its previous day’s closing level of Rs. 302.55/302.60.

The total USD/LKR traded volume for 30 September 2025 was $ 102.80 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)