Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Wednesday, 24 September 2025 00:10 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The Treasury Bills auction scheduled to be conducted today will have a total offered amount of Rs. 38 billion, a decrease of Rs 37 billion over the previous week. The auction will be consisting of Rs. 10 billion on the 91-day, Rs. 12 billion on the 182-day and Rs. 16 billion on the 364-day maturities.

The Treasury Bills auction scheduled to be conducted today will have a total offered amount of Rs. 38 billion, a decrease of Rs 37 billion over the previous week. The auction will be consisting of Rs. 10 billion on the 91-day, Rs. 12 billion on the 182-day and Rs. 16 billion on the 364-day maturities.

For context, at the previous weekly Treasury Bill auction held on 17 September 2025 the weighted average yields remained broadly steady. Accordingly, the rate on the 182-day and 364-day tenors remained unchanged at 7.89% and 8.02% respectively.

The 91-day maturity registered a marginal dip of 01 basis point to 7.57%. This marks the 9th week where T-Bill rates have stayed mostly unchanged at auctions. Only 72% of the total offered amount was raised, with successful bids amounting to Rs. 54 billion against the Rs. 75 billion on offer in the first phase of competitive bidding.

This marked the fourth consecutive auction that fell short of fully raising the targeted amount. An additional amount of Rs. 3.26 billion was raised at the second phase.

Meanwhile, the secondary Bond market saw yields continuing to hold broadly steady yesterday, with sideways trading in a narrow band. Activity and transaction volumes were seen at healthy levels earlier in the day but tapered off to a virtual standstill during later trading hours.

Market participants were seen adopting a wait-and-see approach ahead of Monetary Policy Review No. 05 for 2025 due to be announced today at 7.30 am.

To recap: At its 4th Monetary Policy Review for 2025 held in July, the CBSL held the Overnight Policy Rate at 7.75%, following a 25-bps cut in May. Accordingly, the SDFR and SLFR remained at 7.25% and 8.25%, while the SRR was unchanged at 2.00%.

Bloomberg Economics in an article titled ‘SRI LANKA PREVIEW: Central Bank Is Set to Keep Rates on Hold’ stated that it expects the Central Bank of Sri Lanka (CBSL) to maintain its policy rate at 7.75% for a second consecutive meeting. Having already delivered 825 basis points of cuts since June 2023, the articled opined that the easing cycle is seen as complete. The article cited the following as the rationale for this prediction:

Real Rates & Inflation: The forward-looking real interest rate is now in the neutral range (2.5%–3%). Inflation is projected to rise above the CBSL’s 5% target in 2026 before converging back.

Growth Outlook: Economic activity remains strong, with GDP expanding 4.9% in Q2 and 4.8% in Q1. The output gap has turned positive, suggesting limited room for further monetary stimulus.

External Stability: Further easing could increase import demand, complicating efforts to rebuild FX reserves. CBSL aims to raise reserves to USD 9.3 billion by end-2026, up from USD 6.2 billion currently, in line with IMF program commitments.

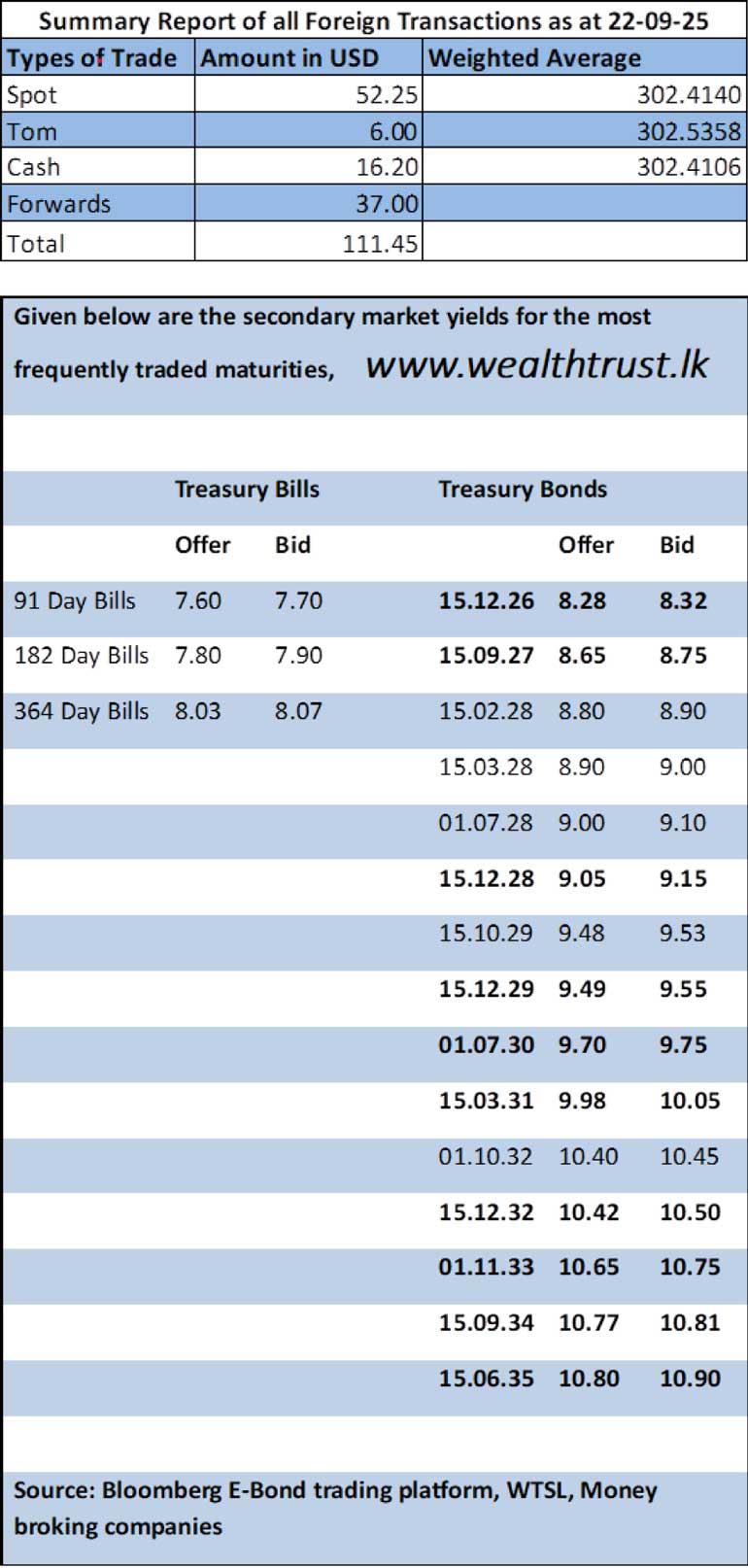

In secondary market Bond transactions, the 01.02.26 and 01.08.26 maturities were seen trading at the rates of 7.97% and 8.20% respectively. The 15.09.29 maturity was seen trading at the rate of 9.50%. The 15.10.32 and 15.12.32 maturities were seen trading at the rates of 10.40% and 10.45% respectively. The 15.09.34 and 15.06.35 maturities were seen trading at the rates of 10.80% and 10.85% respectively.

The secondary market Bills remained active, with healthy volumes transacted. Accordingly, December 2025 maturities were seen trading at the rates of 7.50%-7.60%. March 2026 maturities were seen trading at the rates of 7.88%-7.80% and August 2026 maturities at the rate of 8.05%.

The total secondary market Treasury Bond/Bill transacted volume for 22nd September was Rs. 26.25 billion.

The net liquidity surplus was recorded at Rs. 135.41 billion yesterday. An amount of Rs. 15.50 billion was withdrawn from the Central Banks SLFR (Standing Lending Facility Rate) of 8.25%, while an amount of Rs. 150.91 billion was deposited at Central Banks SDFR (Standard Deposit Facility Rate) of 7.25%.

The weighted average rates on call money and repo were registered at 7.86% and 7.87% respectively.

Forex market

In the Forex market, the USD/LKR rate on spot contracts closed the day steady Rs. 302.45/302.60 unchanged against the previous day.

The total USD/LKR traded volume for 22nd September was $ 111.45 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, money broking companies)