Saturday Feb 07, 2026

Saturday Feb 07, 2026

Tuesday, 23 December 2025 02:47 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The Treasury Bill auction due today will see a total volume of Rs. 150.00 billion on offer, making it the largest offered amount in 28 weeks. This marks the first instance that the offered amount is significantly above the corresponding maturity volume estimated to be around Rs. 95 billion, signalling a clear departure from the undersupply seen in recent weeks.

The auction will consist of Rs. 35 billion on the 91-day maturity, Rs. 70 billion on the 182-day and Rs. 45.00 billion on the 364-day maturities.

At the weekly Treasury Bill auction held last week, the weighted average rates remained steady at 7.51%, 7.91% and 8.03% respectively on the 91-day, 182-day and 364-day maturities. However, the auction was undersubscribed, raising only 84.64% or Rs. 40.63 billion out of the entire Rs. 48 billion offered.

The National Consumer Price Index (NCPI; Base 2021=100) for the month of November decreased for the first time in five months to 2.4% on its point to point against its previous month’s figure of 2.7%.

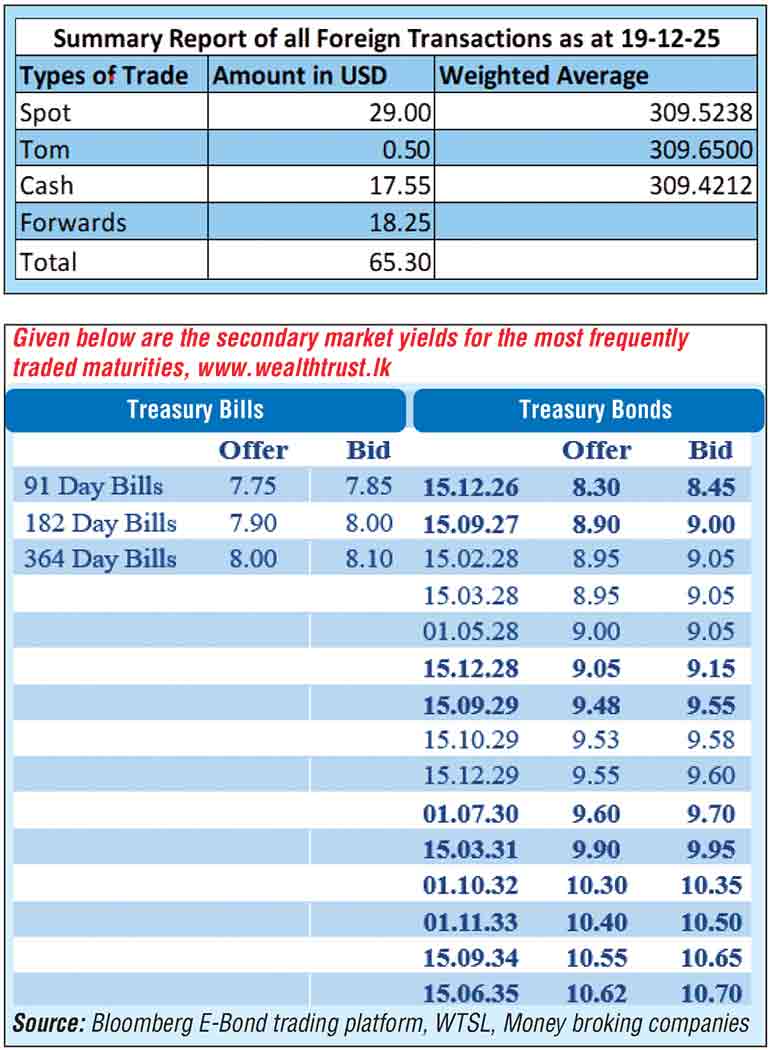

In the meantime, the secondary Bond market saw limited trades on selected maturities with 15.12.29, 15.03.31 and 01.10.32 changing hands at levels of 9.55%, 9.96% and 10.30% respectively.

The total secondary market Treasury Bond/Bill transacted volume for 19 December was Rs. 10.46 billion.

In money markets, the net liquidity surplus increased by Rs. 22.48 billion yesterday to Rs. 88.40 billion while the weighted average rates on overnight call money and Repo stood at 7.99% and 8.04% respectively.

Forex Market

In the Forex market, the USD/LKR rate on spot contracts to closed the day broadly steady at Rs. 309.50/309.65 yesterday as against its previous day’s closing level of Rs. 309.50/309.60.

The total USD/LKR traded volume for 19 December 2025 was $ 65.30 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)