Thursday Feb 05, 2026

Thursday Feb 05, 2026

Thursday, 29 January 2026 04:40 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

At the first Monetary Policy Review for 2026 announced yesterday, the Central Bank of Sri Lanka (CBSL) decided to hold the Overnight Policy Rate at 7.75%.

At the first Monetary Policy Review for 2026 announced yesterday, the Central Bank of Sri Lanka (CBSL) decided to hold the Overnight Policy Rate at 7.75%.

This marked the fourth consecutive monetary policy decision to keep rates on hold. The Standing Deposit Facility Rate (SDFR) and Standing Lending Facility Rate (SLFR), which are linked to OPR with pre-determined margins of ± 50 basis points, also remained unchanged at 7.25% and 8.25%, respectively. The statutory reserve rate was also left unchanged at 2%.

The Monetary Policy Board stated this decision was taken after considering domestic conditions and global uncertainties, and that the current stance will support steering inflation towards the 5% target.

The press release also noted the following:

Inflation remains low but is expected to rise toward target: CCPI inflation stayed at 2.1% in December 2025, though food prices increased due to Cyclone Ditwah disruptions and festive demand. Inflation is projected to gradually accelerate towards 5% by 2H 2026.

Private sector credit continues expanding amid resilient growth: The economy grew by 5.0% in 9M 2025, with early indicators showing resilience despite cyclone-related slowing. Private sector credit growth remained notable, supported by improving activity and higher vehicle imports.

External buffers strengthened despite wider trade deficit: The current account recorded a sizeable surplus in 2025, supported by healthy remittances. Gross Official Reserves increased to $ 6.8 billion by end-2025, while the rupee depreciated 5.6% in 2025 but has remained broadly stable so far in 2026.

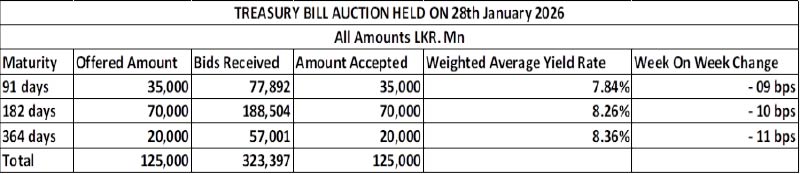

Meanwhile, the weekly Treasury Bill auction conducted yesterday registered a positive outcome. Weighted average yields registered declines across all maturities for the second consecutive week. The rate on 91-day Bill declined 9 basis points to 7.84%, while the rate on the 182-day Bill dropped 10 basis points to 8.26%. The 364-day Bill saw its yield ease by 11 basis points to 8.36%.

The auction was fully subscribed, raising the full Rs. 125 billion on offer, highlighting strong investor demand. Total bids reached 2.59 times the offered amount.

The Phase II subscription across all three maturities is now open until 3.00 pm of business day prior to settlement date (i.e., 29.01.2026) at the WAYRs determined for the said ISINs at the auction.

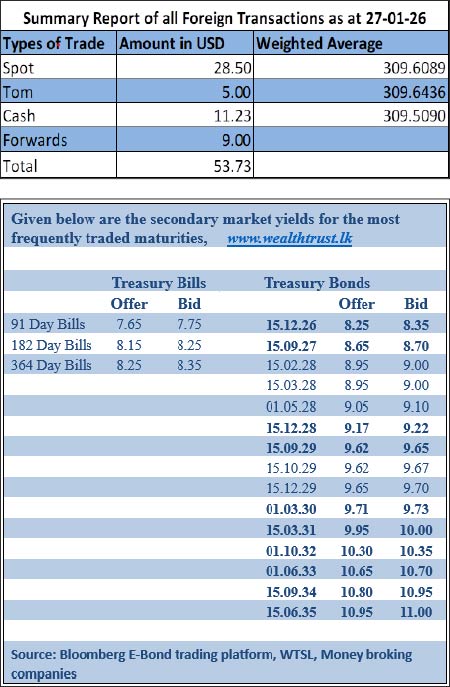

The secondary Bond market yields were seen dropping on the short end of the curve particularly on 2026-2028 tenors. Traders were seen chasing shorter tenor securities as buying interest remained supported by the persistently strong money market liquidity conditions and the corresponding drop-in money market rates. This dynamic was further reinforced by the positive outcome at the Treasury Bill auction. However, the medium to long end of the yield curve held broadly steady, resulting in a steepening of the yield curve.

In terms of the Secondary Bond market trade summary, the 15.05.26 maturity was seen trading at the rate of 8.21%-8.20%. The 01.05.27 maturity traded down the range of 8.80%-8.62% and the 15.09.27 maturity down the range of 8.75%-8.70%. The 15.02.28 maturity traded down the range of 9.00%-8.99%. The 15.10.28 and 15.12.28 maturities traded at the rate of 9.20%. The 15.10.29 maturity traded within the range of 9.65%-9.63% and the 01.03.30 maturity at the rates of 9.72%-9.71%. The 15.03.31 maturity changed hands at the rate of 10.00% while the 01.10.32 maturity traded at the rate of 10.30%.

This comes ahead of the Treasury Bond auction, scheduled to be conducted today, 29 of January. The round of auctions will have a total offered amount of Rs.205.00 billion across three available maturities.

The auction will be comprised of: Rs. 60 billion from a 1 March 2030 maturity bearing a coupon rate of 9.50%; Rs. 80 billion from a 1 June 2034 maturity bearing a coupon rate of 10.75%; Rs. 65 billion from a 1 July 2037 maturity bearing a coupon rate of 10.75%. Settlement will be held on 2 February 2026.

For context, the previous bond auctions conducted on 12 January successfully raised 90.14% or Rs. 184.79 billion out of the Rs. 205 billion total offered amount across four available maturities. Maturity-wise the short end and the long end of the offered maturities saw rates anchored at market levels and in line with pre-auction rates. However, the middle tenors offered, exhibited an uptick compared to market levels.

The shorter tenor 01.03.30 maturity was issued at a weighted average of 9.74% and the maturity-wise offered amount was fully raised at the first phase in competitive bidding. This was in line with market expectations.

The 01.06.33 maturity was also fully subscribed at the first phase and was issued at the weighted average rate of 10.65%. This was above market expectations.

The 15.06.35 maturity went undersubscribed at the first and second phases maturity and was issued at the weighted average of 11.08%. This was well above market levels as the maturity was quoted at the rate of 10.73%/10.77% pre-auction.

The 15.08.39 maturity again was fully subscribed and was issued at the weighted average rate of 11.09%. This not only displayed a very narrow term premium over the 15.06.35 tenor but also came in line with pre-auction market levels.

The total secondary market Treasury Bond/Bill transacted volume for 27 January was Rs. 15.20 billion.

In money markets, the net liquidity surplus surged to Rs. 211.53 billion yesterday hitting the highest level in over a year since mid-December 2024. An amount of Rs 211.66 billion was deposited at Central Bank’s SDFR (Standing Deposit Facility Rate) of 7.25% as against an amount of Rs. 0.13 billion withdrawn from the Central Bank’s SDFR (Standing Deposit Facility Rate) of 8.25%.

The weighted average rates on overnight call money and Repo stood at 7.70% and 7.73% respectively.

Forex market

In the Forex market, the USD/LKR rate on spot contracts closed the day at 309.60/309.67 as against its previous day’s closing level of Rs. 309.65/309.75.

The total USD/LKR traded volume for 27 January was $ 53.73 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)