Saturday Feb 21, 2026

Saturday Feb 21, 2026

Friday, 13 February 2026 00:08 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The Bond auctions conducted yesterday delivered a decisively positive outcome, with the Public Debt Management Office raising the entire Rs. 51 billion on offer across two maturities.

This reflected the bullish momentum in the secondary Bond market fuelled by elevated liquidity levels, declining money market rates and mirroring the decline in yields at the T-Bill auction held the previous day.

For context, the money market net liquidity surplus remained elevated at Rs. 296.71 billion yesterday while the weighted average rates on overnight call money and Repo notched lower to 7.64% and 7.65% respectively.

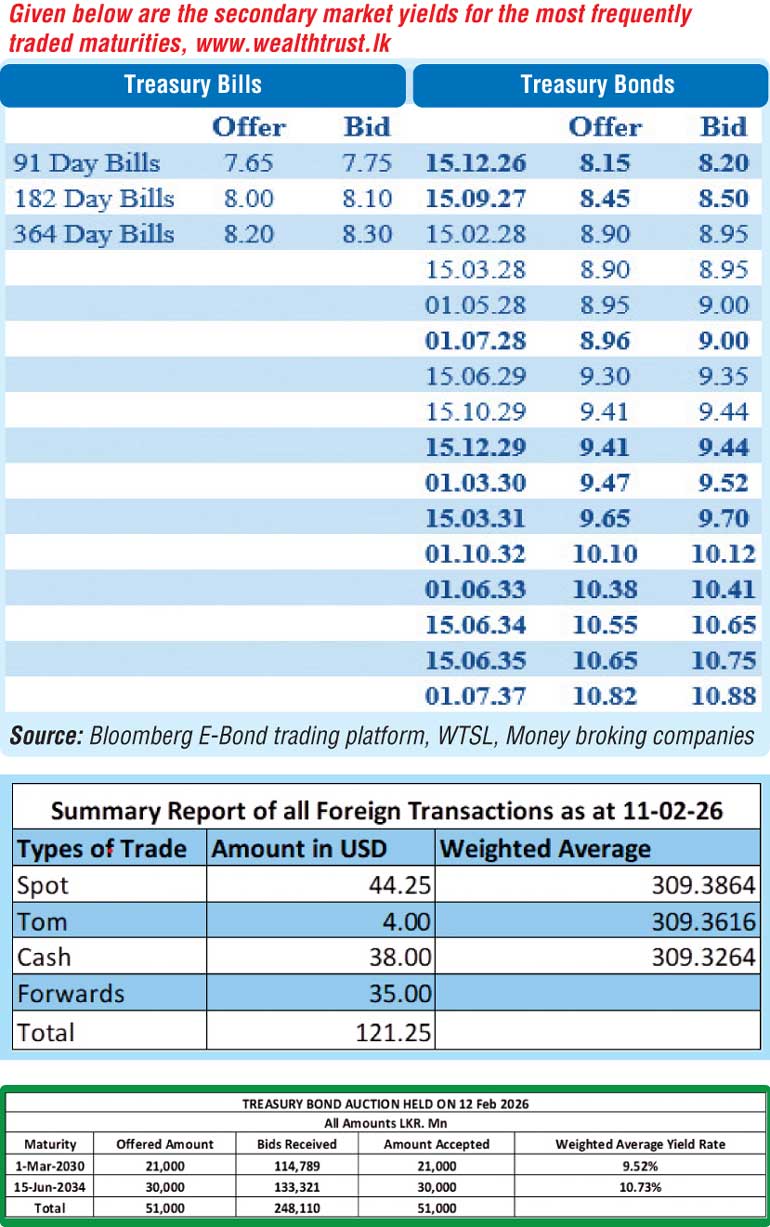

At the Bond auction, weighted average rates across the board were seen coming below or in-line with market levels. The bids received to accepted amount ratio stood at a staggering 4.86 times. Maturity-wise the results were as follows:

The shorter tenor 01.03.30 maturity was issued at a weighted average yield of 9.52%, and the entire maturity-wise offered amount was fully raised at the 1st phase of competitive bidding. This was in line with market expectations, as the maturity was quoted at a two-way price of 9.52%/9.57% pre-auction.

The 15.08.36 maturity -a brand-new ISIN- was also fully subscribed at the 1st phase, and was issued at the weighted average yield of 10.73%. This was well below market expectations as a shorter tenor 15.06.35 maturity was seen quoted at the rate of 10.73%/10.77% just prior to the auction and also came in well below the 01.07.37 maturity which was quoted at 10.94%/10.97% just prior to the auction.

An issuance window for the 2030 and 2036 tenor is now open until 3.00 pm of 13.02.2026 at the Weighted Average Yield Rates (WAYR) determined for the said ISIN at the auction, up to 10% of the respective amount offered. Given in the table are the details of the auction.

The secondary Bond market yesterday extended its rally and saw rates continue to decline on the back of strong demand. Both before and after the Treasury Bond auction, yields were seen trending lower and touching fresh lows, with momentum picking up further following the announcement of the results. The activity and transaction volumes remained robust, supported by several block trades.

Accordingly, the 01.05.27 maturity was seen trading at the rate of 8.40% and the 15.09.27 maturity at 8.50%. The 01.07.28 maturity was seen trading at the rate of 8.96%. The 15.06.29, 15.09.29, 15.10.29 and 15.12.29 maturities were seen trading lower at the rates of 9.34%, 9.43%-9.41%, 9.45%-9.43% and 9.47%-9.42% respectively. The 01.03.30 maturity was seen trading down the range of 9.58%-9.50%. The 15.03.31 maturity saw its yield drop down the range of 9.75% to 9.70%. The 01.10.32 and 15.12.32 maturities traded at the rates of 10.10% and 10.12% respectively. The 01.06.33 maturity traded down the range of 10.45%-10.38%. The 15.06.34 maturity traded within the range of 10.62%-10.60% and the 15.06.35 maturity traded at the rates of 10.75%-10.73%. The 01.07.37 maturity witnessed a steep decline of over 10 basis points from an intraday high of 10.96% to a low of 10.85% on the back of concentrated demand. The 15.08.39 maturity traded at the rate of 10.90%.

The total secondary market Treasury Bond/Bill transacted volume for 11 January was Rs. 32.71 billion.

Forex market

In the Forex market, the USD/LKR rate on spot contracts were seen closing the day at Rs.309.30/309.37 as against its previous day’s closing level of Rs. 309.35/309.40.

The total USD/LKR traded volume for 11 February 2026 was $ 121.25 million.

(References: Public Debt Management Office- Ministry of Finance, Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)