Wednesday Feb 04, 2026

Wednesday Feb 04, 2026

Friday, 30 January 2026 00:12 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

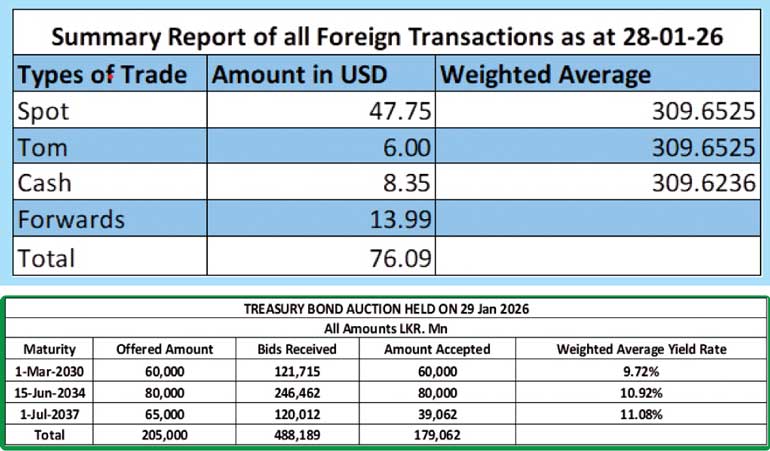

The Bond auctions conducted yesterday delivered a decisively positive outcome, with the Public Debt Management Office raising Rs. 179.06 billion, equivalent to 87.35% of the Rs. 205 billion on offer across three maturities.

This reflected the bullish momentum in the secondary Bond market fuelled by elevated liquidity levels, declining money market rates and mirroring the decline in yields at the T-Bill auction held the previous day.

For context, the money market net liquidity surplus remained elevated at Rs. 194.26 billion yesterday while the weighted average rates on overnight call money and Repo notched lower to 7.69% and 7.72% respectively.

At the Bond auction weighted average rates across the board were seen coming below or in-line with market levels. The bids received-to-accepted amount ratio stood at 2.38 times, an impressive result given the size of the auction. Maturity-wise the results were as follows:

The shorter tenor 01.03.30 maturity was issued at a weighted average yield of 9.72%, and the entire maturity-wise offered amount was fully raised at the 1st phase of competitive bidding. This was slightly below market expectations, as the maturity was quoted at a two-way price of 9.72%/9.80% pre-auction.

The 15.06.34 maturity -a new ISIN- was fully subscribed at the 1st and 2nd phases, and was issued at the weighted average yield of 10.92%. This was in line with market expectations as similar maturity of 15.09.34 was quoted at a two-rate of 10.85/95 pre-auction.

The 01.07.37 maturity was undersubscribed across both the first and second phases and was issued at the weighted average rate of 11.08%. This displayed a very narrow term premium over the 15.06.34 tenor.

An issuance window for the 2030 tenor is now open until 3.00 pm of 30.01.2026 at the Weighted Average Yield Rates (WAYR) determined for the said ISIN at the auction, up to 10% of the respective amount offered. Given in the table are the details of the auction.

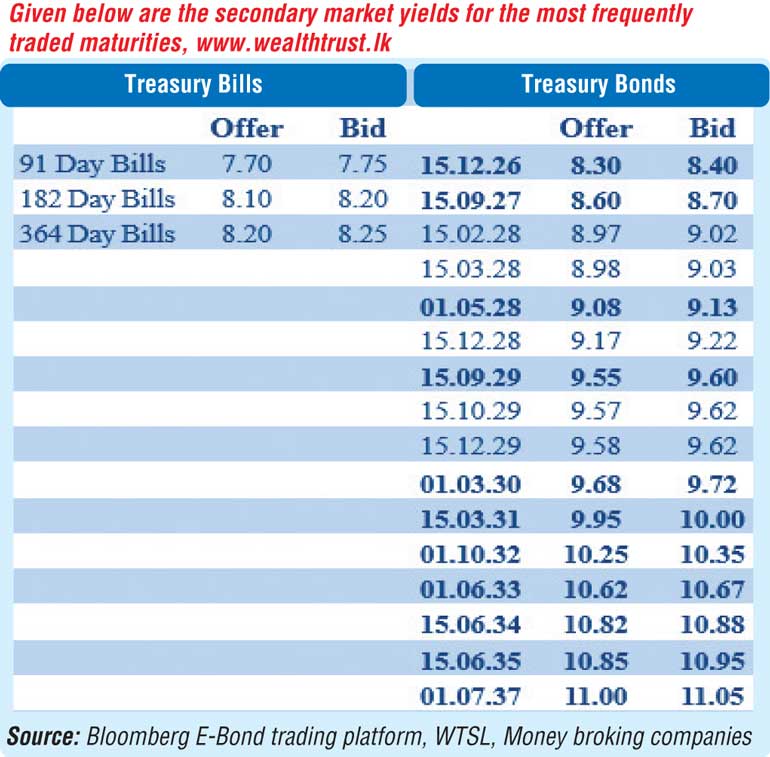

The secondary Bond market yesterday saw activity pick up notably following the release of the auction results. Yields declined as the market underwent a bullish re-pricing along the belly-to-long end of the curve. Buying interest was centred around 2029-2037 tenors as traders looked to capitalise on the curve’s steepness, shifting attention into higher relative value opportunities further along the curve, to lock in attractive carry and roll-down potential.

Accordingly, the 15.10.29 maturity traded at the rate of 9.60% and the 15.12.29 maturity down the range of 9.65% to 9.60%. The 01.03.30 maturity traded at the rate of 9.68% whiles the 01.07.30 maturity traded down the range of 9.75%-9.72%.

The 01.06.33 maturity traded down to a low of 10.65%. The 15.06.35 maturity saw a very bullish drop in rates from an intraday high of 10.95% to a low of 10.85%. Similarly, the 15.06.34 and 01.07.37 maturities were seen trading at the rate of 10.85% and 11.00% respectively post auction down from the weighted average issuance rate of 10.92% and 11.08%.

In addition, trades were observed on the 15.12.26 maturity at the rate of 8.35%. The 01.05.27 and 15.09.27 maturities at the rates of 8.60% and 8.70% respectively. The 15.02.28 and 15.03.28 maturities were seen trading at the rate of 9.00% each.

The total secondary market Treasury Bond/Bill transacted volume for 9 January was Rs. 60.69 billion.

Forex market

In the Forex market, the USD/LKR rate on spot contracts were seen closing the day at Rs.309.35/309.45 as against its previous day’s closing level of Rs. 309.60/309.67. The total USD/LKR traded volume for 28th January 2026 was $ 76.09 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)