Tuesday Feb 24, 2026

Tuesday Feb 24, 2026

Tuesday, 13 January 2026 03:12 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

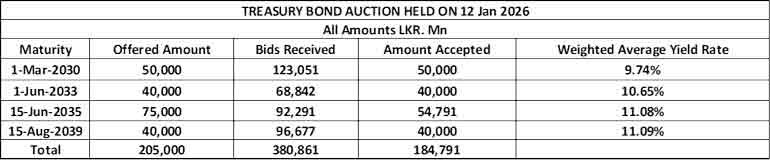

The Bond auctions conducted yesterday successfully raised 90.14% or Rs. 184.79 billion out of the Rs. 205 billion total offered amount across four available maturities. Maturity wise the short end and the long end of the offered maturities saw rates anchored at market levels and in line with pre-auction rates. However, the middle tenors offered, exhibited an uptick compared to market levels. The bid received to accepted amount ratio stood at 1.86 times.

The shorter tenor 01.03.30 maturity was issued at a weighted average of 9.74% and the maturity wise offered amount was fully raised at the 1st phase in competitive bidding. This was in line with market expectations as yields settled neatly between comparable maturities with the pre-auction rates of 9.65%/9.70% quoted on the 15.12.29 maturity and the 01.07.30 maturity quoted at 9.70%/9.75%.

The 01.06.33 maturity was also fully subscribed at the first phase and was issued at the weighted average rate of 10.65%. This was above market expectations as the maturity was quoted at the rate of 10.45/10.55% pre-auction and came in even above the slightly longer tenor 01.11.33 tenor which was quoted at the rate of 10.50%/10.60%.

The 15.06.35 maturity went undersubscribed at the first and second phases maturity and was issued at the weighted average of 11.08%. This was well above market levels as the maturity was quoted at the rate of 10.73%/10.77% pre-auction.

The 15.08.39 maturity again was fully subscribed and was issued at the weighted average rate of 11.09%. This not only displayed a very narrow term premium over the 15.06.35 tenor but also came in line with pre-auction market levels. For context the most recent longer tenor issuance at auction, held on the 30th of December saw a 01.07.37 tenor raised at the weighted average rate of 10.90% (immediately previous auction).

An issuance window for only the 2030, 2033 and 2039 tenors are now open until 3.00 pm of 13.01.2026 at the Weighted Average Yield Rates (WAYR) determined for the said ISINs at the auction, up to 10% of the respective amount offered. Given in the table are the details of the auction.

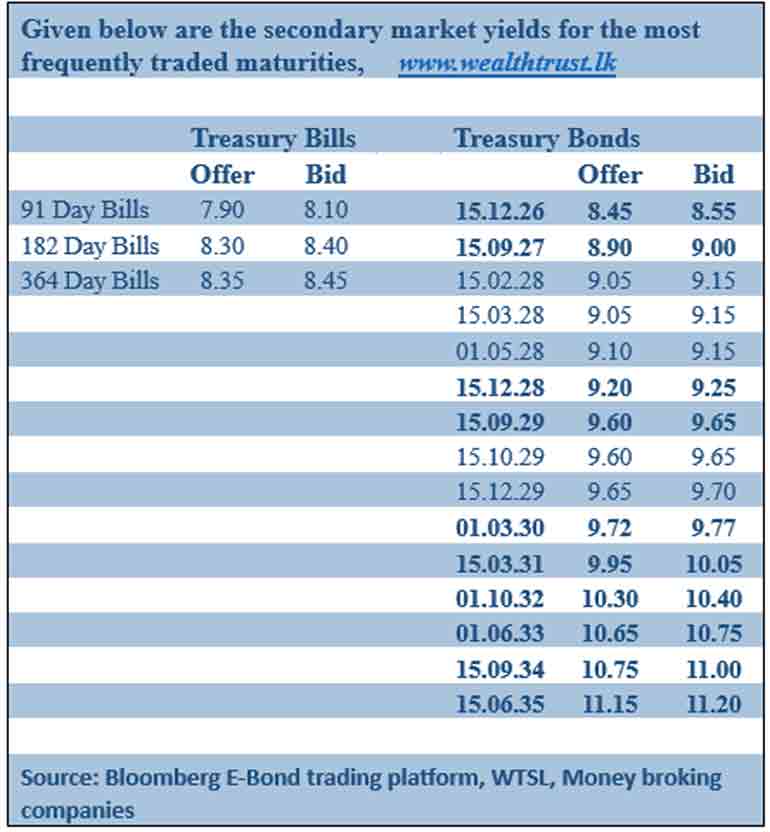

This comes ahead of today’s scheduled weekly Treasury Bill auction. The auction will have on offer a total amount of Rs. 100.00 billion. The auction will be comprising of Rs. 32.00 billion in 91-day Bills, Rs. 48.00 billion in 182-day Bills, and Rs. 20.00 billion in 364-day Bills. The offered amount is in line with the maturing volume, which is estimated at around Rs. 104.68 billion.

For context, at the weekly Treasury Bill auction held last Tuesday (7 January) weighted average yields recorded an upwards movement across the board for a third consecutive week. Accordingly, the weighted average yield on the 91-day Bill rose by 14 basis points to 7.88%, the 182-day by 17 basis points to 8.44%, and the 364-day by 02 basis points to 8.47% respectively. The auction was fully subscribed for the first time in 4 weeks raising the entire Rs. 100 billion on offer as the 182-day Bill dominated the auction, reflecting 80.46% of the total accepted amount or Rs.80.46 billion.

The Secondary Bond Market was mostly quiet amidst the conducting of the Treasury Bond auction. Limited trades were observed on selected maturities. However, following the auction, rates were seen picking up on selected tenors. This subsequently followed by renewed buying interest kicking in aggressively, which kept a cap on rates.

Accordingly, trades were observed on the 15.09.29 and 15.10.29 maturities at the rates of 9.61% and 9.63% prior to the auction. The 01.09.28 maturity traded at the rate of 9.22% also pre-auction.

The 15.03.28 maturity traded up the range of 9.09% to a high of 9.18% post auction. The 15.12.29 maturity traded up from a low of 9.62% to a high of 9.70% post auction. The 15.05.30 maturity traded up the range of 9.75%-9.80%. The 15.06.35 maturity traded down the range of 11.25%-11.15% post auction.

The total secondary market Treasury Bond/Bill transacted volume for 9 January was Rs. 4.81 billion.

In the money market, a net liquidity surplus of Rs. 168.89 billion was recorded yesterday, which was deposited at the Central Bank’s Standing Deposit Facility Rate (SDFR) of 7.25%. The weighted average rates on overnight call money and Repo stood at 7.95% and 7.98% respectively.

Forex market

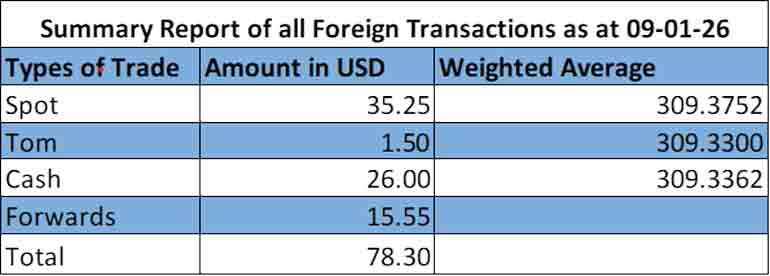

In the forex market, the USD/LKR rate on spot contracts were seen closing the day at Rs.309.00/309.10 as against its previous day’s closing level of Rs. 309.00/309.30.

The total USD/LKR traded volume for 9 January 2026 was $ 78.30 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)