Wednesday Feb 04, 2026

Wednesday Feb 04, 2026

Tuesday, 3 February 2026 03:32 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The weekly Treasury Bill auction scheduled for today will have on offer a total amount of Rs. 120 billion. The auction will be comprising of Rs. 30 billion in 91-day Bills, Rs. 55 billion in 182-day Bills, and Rs. 35 billion in 364-day Bills. The offered amount is below the maturing volume, which is estimated at around Rs. 137.17 billion.

For context, the previous weekly Treasury Bill auction held last Wednesday (28), registered a positive outcome as weighted average yields registered declines across all maturities for the second consecutive week.

The rate on 91-day Bill declined 9 basis points to 7.84%, while the rate on the 182-day Bill dropped 10 basis points to 8.26%. The 364-day Bill saw its yield ease by 11 basis points to 8.36%. The auction was fully subscribed, raising the full Rs. 125 billion on offer, highlighting strong investor demand. Demand spilled over to the second phase, where the maximum available amount of Rs. 12.50 billion was raised across all three tenors, out of a total market subscription of a staggering Rs. 54,162 million. Accordingly, the aggregate accepted amount for the issuance increased to Rs. 137.50 billion.

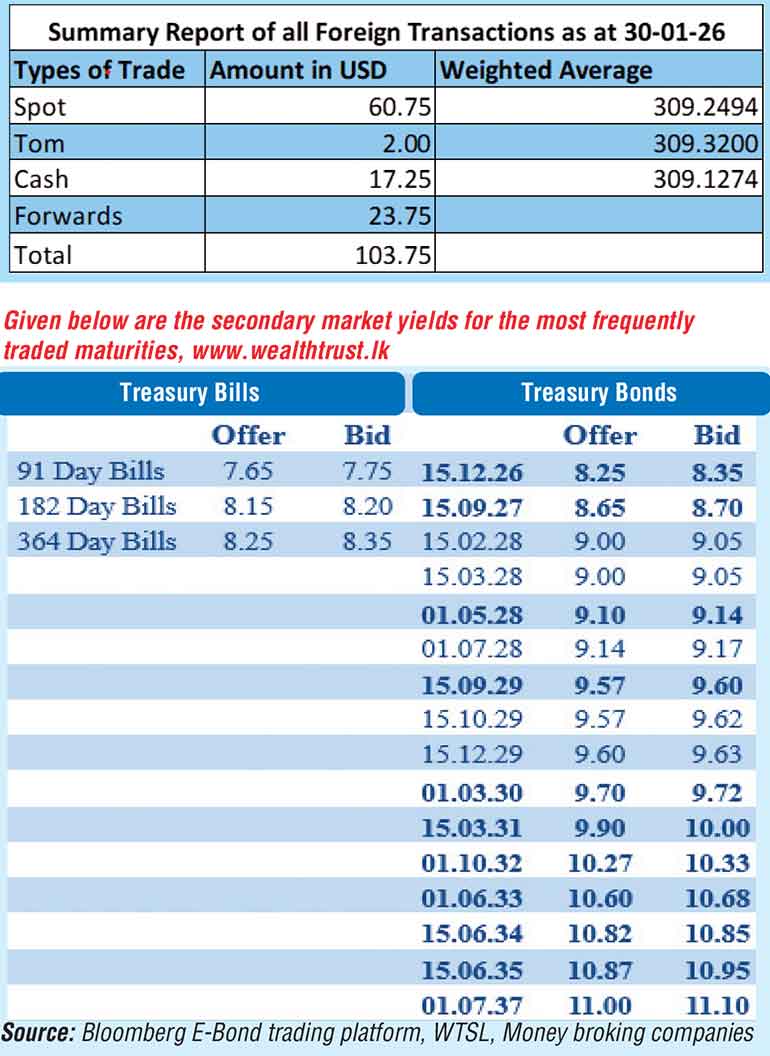

The secondary Bond market began the new trading week with yields seen declining on 2029 tenors on the back of concentrated demand, while the rest of the yield curve consolidated. Activity and transaction volumes were seen at healthy levels.

Accordingly, the 15.06.29, 15.09.29, 15.10.29 and 15.12.29 maturities were seen trading lower at the rates of 9.55%-9.53%, 9.60%-9.58%, 9.60% and 9.60% respectively on the back of sizeable volumes.

In-addition, trades were observed on the 15.12.26 maturity at the rate of 8.30% and 15.01.27 maturity at the rate of 8.41%. The 15.02.28 and 15.03.28 maturities were seen changing hands at the rates of 9.02% and 9.03%-9.04% respectively. The 01.05.28 maturity was seen trading at the rate of 9.12%-9.10% and the 01.09.28 and 15.12.28 maturities at the rates of 9.16% and 9.20% respectively. The 15.03.31 maturity traded at the rate of 9.95%.

Secondary Market Treasury Bill transactions saw a lot of action yesterday. March/April 2026 maturities were seen collected at the rate of 7.70% and similarly July 2026 maturities were seen trading at the rate of 8.20%, both on the back of sizeable volumes.

The total secondary market Treasury Bond/Bill transacted volume for 30 January was Rs. 52.51 billion.

In money markets, the net liquidity surplus remained elevated and was recorded at Rs. 212.54 billion yesterday. An amount of Rs. 214.09 billion was deposited at Central Bank’s SDFR (Standing Deposit Facility Rate) of 7.25% as against an amount of Rs 1.55 billion withdrawn from the Central Bank’s SDFR (Standing Deposit Facility Rate) of 8.25%.

While the weighted average rates on overnight call money and Repo stood at 7.70% and 7.75% respectively.

Forex market

In the Forex market, the USD/LKR rate on spot contracts were seen closing the day depreciating to

Rs. 309.55/309.63 as against its previous day’s closing level of Rs. 309.25/309.35.

The total USD/LKR traded volume for 30 January 2026 was $ 103.75 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)