Sunday Feb 22, 2026

Sunday Feb 22, 2026

Wednesday, 7 January 2026 00:05 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

Quarterly highlights

Q1 2025

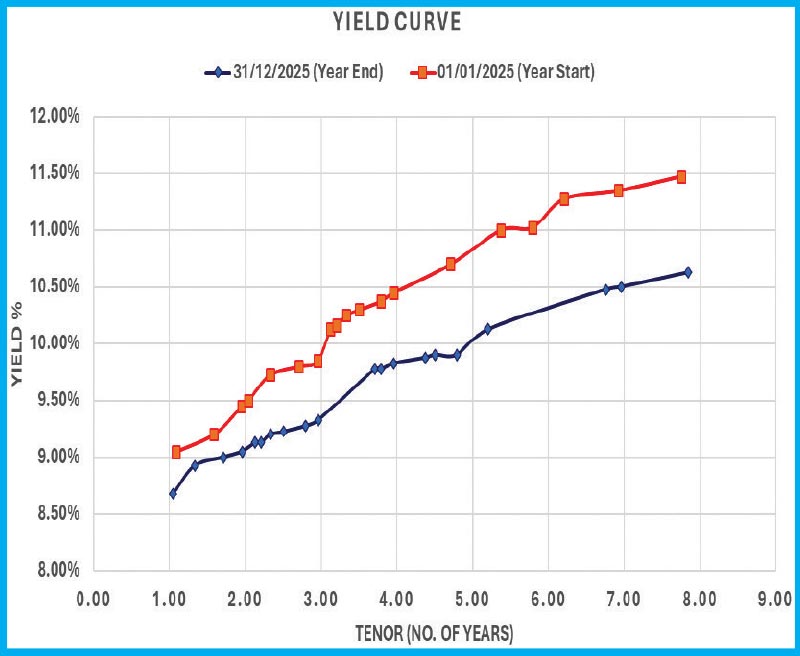

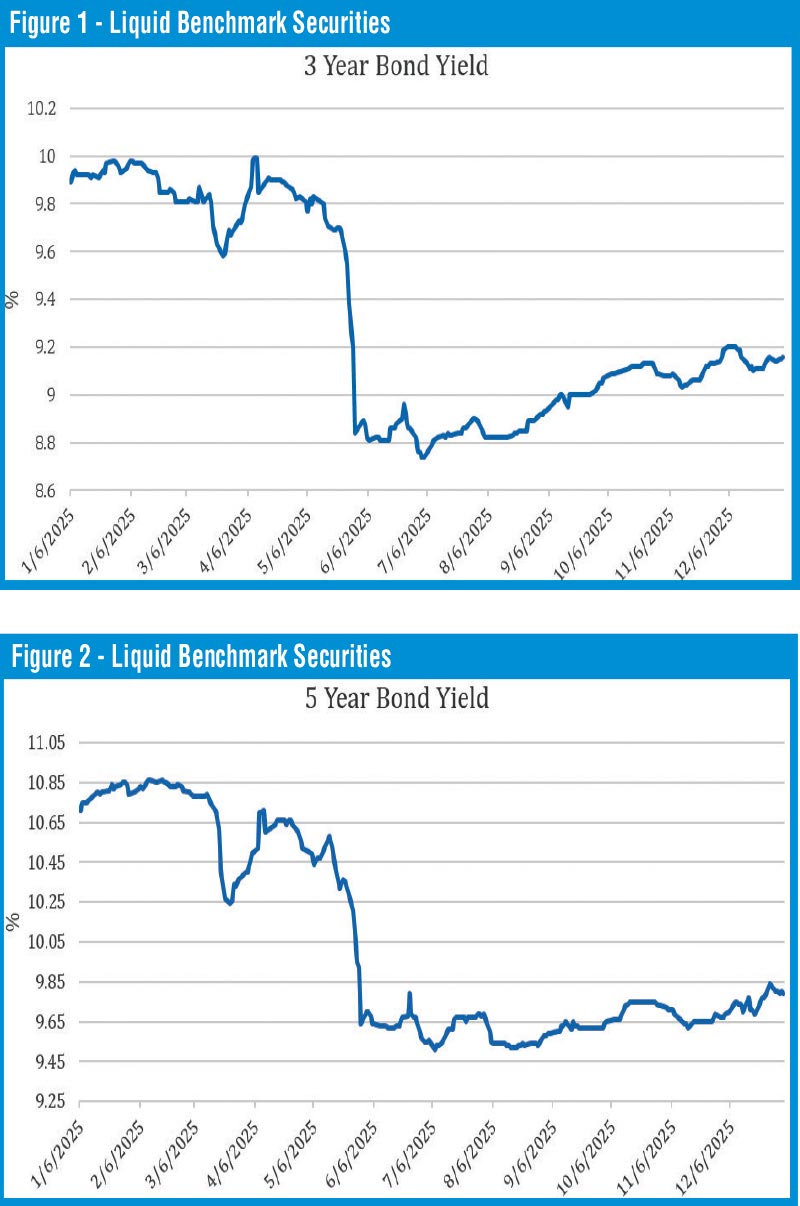

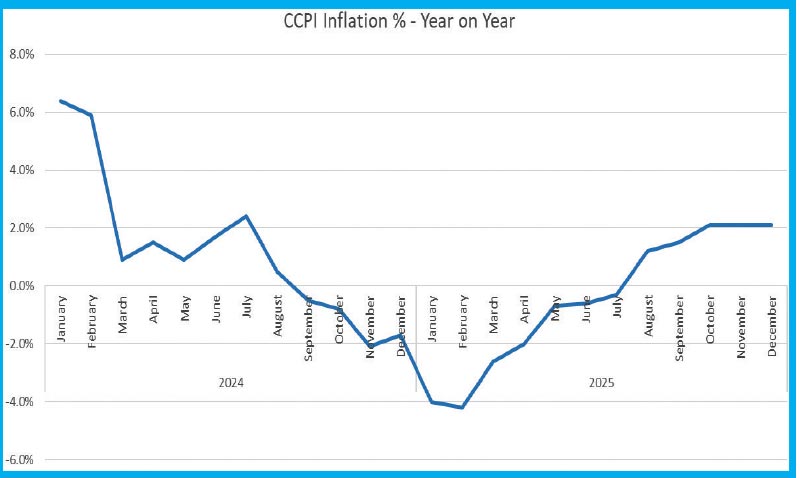

The Government Securities market commenced 2025 on a positive note, extending the momentum from late 2024, during which yields trended downward amid improving macroeconomic conditions. This was further supported by policy continuity and clarity following the completion of the 2024 electoral cycle, which helped alleviate uncertainty-related risk premiums and strengthen investor confidence. The T-Bill and T-Bond markets continued to mostly rally throughout Q1 of 2025 with yields overall trending lower at auctions and dropping in the secondary market as well. This was supported by CCPI inflation starting off the year in deflation at -4% YoY as at January and continuing to be in deflation throughout the quarter, reinforcing an attractive real rate environment. In addition, a robust fiscal consolidation contributed towards reduced Budget deficits and healthy Treasury cash buffers which further supported the rally. The Q1 table, gives the quarter opening and closing yields for the most liquid/benchmark durations.

Q2 2025

However, the start of Q2 saw a major shock with the announcement of the US imposing ‘Reciprocal Tariffs’ on its trading partners including Sri Lanka which was announced on 2 April in what was dubbed Liberation Day. This external shock prompted a reversal in market sentiment, with the Government Securities market repricing higher to reflect elevated external sector risks, while also triggering profit-taking after the prolonged rally observed during Q1. Consequently, yields picked up across both the primary and secondary markets. The upward adjustment was more pronounced in the secondary Bond market, where yields increased sharply, while T-Bill auction rates reflected a comparatively more modest increase. Subsequently, in May a Monetary Policy rate cut of 25 basis points was delivered dropping the Overnight Policy Rate to 7.75% by the Central Bank of Sri Lanka at the 03rd out of 6 Monetary Policy reviews for 2025, marking the only rate revision for the year. This drove the market into a buying frenzy and resulted in yields nosediving and an extended rally was observed. This was also supported by the suspension of the enforcement of the country-specific higher rates of the US reciprocal tariffs as per an executive order. This bullish momentum continued, until this rally was interrupted by the 12-day Iran-Israel war which began in mid-June of 2025. The conflict brought with it global risk-off sentiment stemming from the uncertainty as well as fears of a potential oil price spike raising domestic inflation risk. This again caused secondary Bond market yields to increase. However, once the conflict de-escalated in late June a relief rally saw rates drop down and recover to previous lows once again. The Q2 table, gives the quarter opening and closing yields for the most liquid/benchmark durations.

Q3 2025

In Q3, rates increased once again following renewed fears surrounding the imposition of the US Reciprocal Tariffs and the finalised details. Speculation was rife with some quarters of the market expecting significantly higher tariffs. However, come August, the market witnessed a change of direction once again following the official announcement that the US had reduced Reciprocal Tariffs for Sri Lanka to 20%, triggering a rally in the secondary Bond market. This announcement triggered a decisive change in sentiment as it was below expectations and considered a favourable development. As a result, yields dropped to fresh lows and continued the downward trend. Subsequently, as profit taking pressures kicked in during the early part of September, and as the market saw activity moderate considerably, in the absence of fresh directional cues, yields were seen drifting upwards. There was a brief relief rally spurred by S&P Global Ratings upgrading Sri Lanka’s long-term foreign currency debt rating to “CCC+” from “Selective Default (SD)”, while affirming the long-term local currency rating at CCC+, with a stable outlook on 19 September which was also supported by a US FED rate cut of 25 basis points during the latter part September as well (the first for the year 2025). The Q3 table gives the quarter opening and closing yields for the most liquid/benchmark durations.

Q4 2025

In October, at the start of Q4, rates started to rise on the back of profit taking amidst the absence of strong directional cues. However, following the release of news highlighting an impressive fiscal outperformance for January–September 2025, exceeding several IMF benchmarks and translating into lower funding pressures, the market rallied from mid-October through mid-November. Subsequently, in late November and early December, yields edged higher following the 6th and final Monetary Policy Review of 2025, which delivered a ‘no change’ outcome. This was compounded by profit-taking after the rally, as well as heightened uncertainty stemming from Cyclone Ditwah and its devastating impact. A brief relief rally and recovery was observed following the knee-jerk reaction to the Cyclone in Mid-December but rates again began to climb as the preliminary cost estimates following the cyclone started to surface. The damage culminated in a Rs. 500 billion Supplementary Estimate to the 2026 Budget. The tail end of the year also marked a significant shift in the outcome of the weekly T-Bill auction results, after an extended period of rate stability at primary T-Bill auctions, which had lasted over 22 weeks and kept rates broadly anchored. This stability gave way as yields began to rise materially. The period was also notable for a change in supply dynamics, with the last two Treasury Bill auctions of the year marking the first instances where the offered amounts materially exceeded, or broadly aligned with, estimated maturity volumes. This signaled a clear departure from the undersupply conditions that had characterised the earlier period. As a result, rates picked up once again at the close of the year, curtailed by renewed buying interest kicking in at the higher technical support levels. The Q4 table gives the quarter opening and closing yields for the most liquid/benchmark durations.

Conclusion

In conclusion, 2025 was shaped by strong macroeconomic fundamentals. These included fiscal consolidation and overperformance, low and stable inflation, a return to primary account surpluses, renewed foreign investment in Rupee-denominated Government Securities, a stable political environment, and solid GDP growth. The external sector also remained resilient, supported by current account surpluses and stable foreign reserves. Against this backdrop, Government Securities yields trended lower through 2025, reflecting a broad-based parallel downward shift in the yield curve. While intermittent volatility emerged, it was largely driven by transient external shocks.

Looking ahead to 2026, higher borrowing requirements linked to Cyclone Ditwah relief and reconstruction, alongside potential global shocks, introduce greater uncertainty around the interest rate trajectory, despite an otherwise supportive macroeconomic foundation.

Liquid Benchmark Securities:

A snapshot of strong macro-fundamentals for 2025

Fiscal consolidation outperformance

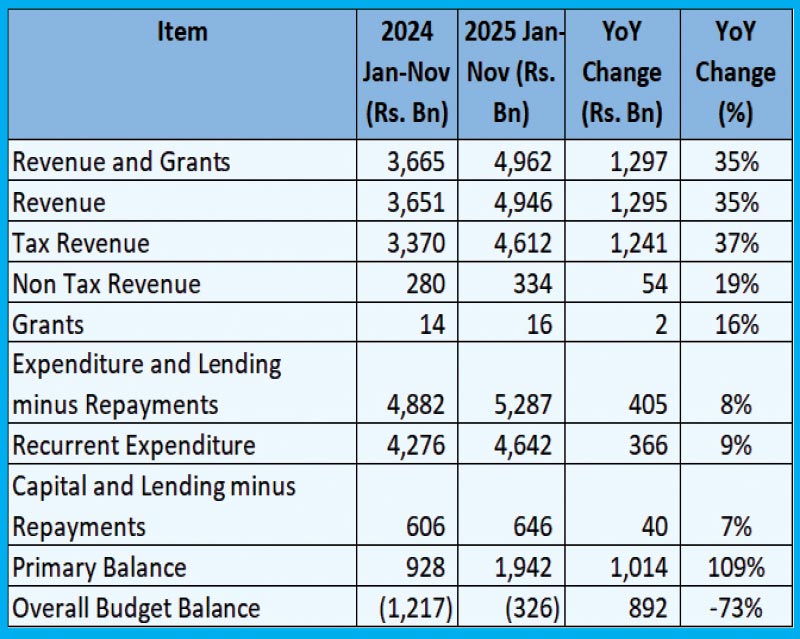

Sri Lanka’s Jan–Nov 2025 (latest data available) fiscal performance reflected a revenue-led, structurally anchored consolidation, with Revenue and Grants rising by Rs. 1.3 trillion (+35% YoY), driven mainly by tax revenue growth of 36.8% following VAT and income tax reforms. Expenditure growth was contained at 8.3%, enabling the primary surplus to more than double to Rs. 1.94 trillion (+109%) and the overall Budget deficit to narrow sharply from Rs. 1.22 trillion to Rs. 326 bn, strengthening fiscal discipline and debt sustainability. This was clear overperformance contributing to healthy Treasury cash buffers and exceeding several IMF benchmarks.

Stabe and low inflation

The year 2025 experienced low and stable inflation, recording deflation through January to July in terms of CCPI index. This carried on a streak of 11 months of deflation from September of 2024. In August the trend was broken and inflation edged back up into positive territory, however the figures came in well below the Central Banks target of 5% and even below the lower band of 3 of the target band.

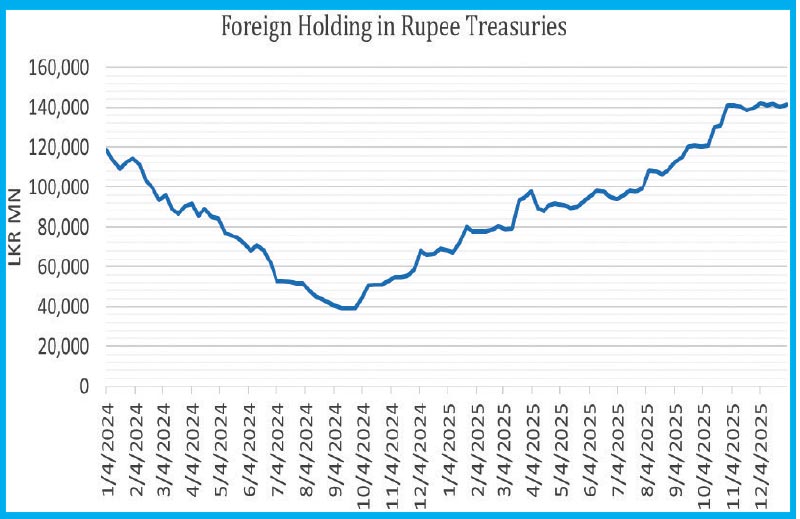

Foreign holdings in rupee treasuries surge

For context, these developments come against the backdrop of a U-shaped recovery in foreign holdings of rupee-denominated Government securities during 2025. As of the last week of 2025, total foreign holdings in Government Securities had risen to Rs. 141.37 billion, the highest level in over two years since mid-November 2023. This trend underscores a robust rebound in foreign investor appetite for domestic Treasury Bills and Bonds, up 259% after touching a low of Rs. 39.38 billion recorded in September 2024. This came against the backdrop of Sri Lankan Credit Rating upgrades and successive US Fed Rate cuts.

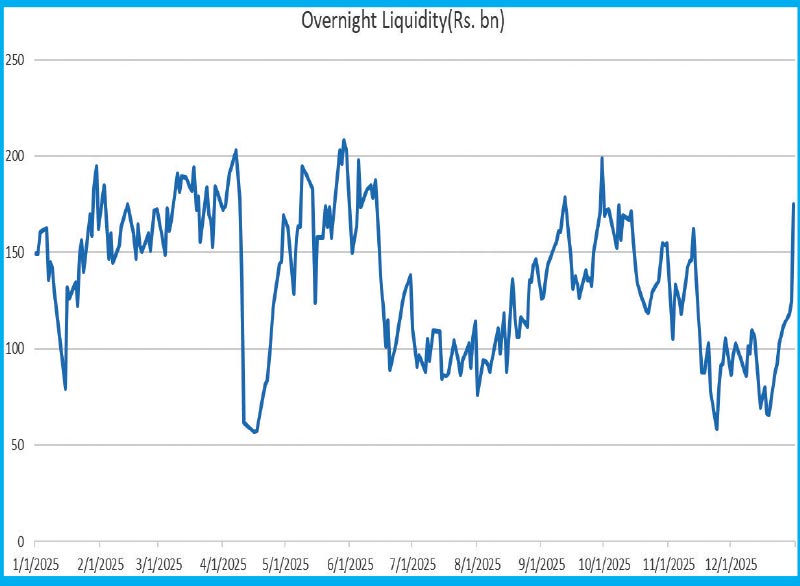

Liquidity in surplus throughout 2025

Overnight Money Market Liquidity remained in a surplus throughout the entirety of 2025 and despite fluctuations, the metric was seen above Rs 100 billion for 80% of the year. This too contributed towards demand for Government Securities.

External sector current account surpluses

The cumulative current account surplus from Jan-Nov 2025 was registered at $ 1.68 billion this was boosted by 21% increase in foreign worker remittances. This resulted in stable foreign exchange reserves which was recorded at $ 6 billion as at end November, providing an import cover of 3.4 months. This was particularly impressive as Sri Lanka had made foreign debt service of approximately $ 2.44 billion during the year.