Saturday Feb 21, 2026

Saturday Feb 21, 2026

Tuesday, 21 October 2025 03:22 - - {{hitsCtrl.values.hits}}

The International Federation of Accountants (IFAC), in collaboration with the Chartered Institute of Public Finance and Accountancy (CIPFA) and the International Public Sector Accounting Standards Board (IPSASB), has unveiled the 2025 Status Report of the International Public Sector Financial Accountability Index. This comprehensive report highlights significant advancements in public sector financial reporting, particularly focusing on the adoption of accrual accounting.

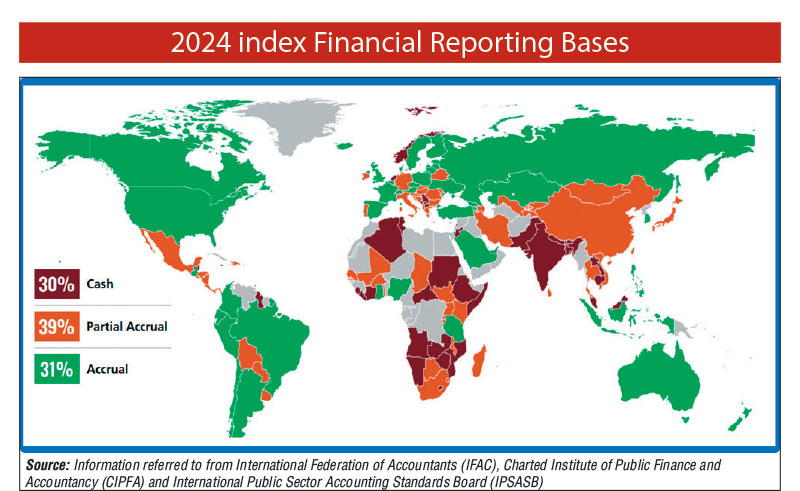

The report reveals that 30% of jurisdictions are on a cash basis, whilst 39% and 31% are on a partial accrual and accrual basis respectively. It is interesting to note the changing profile of countries using accrual. The report states that, although in 2024 the majority of countries using accrual accounting are High Income Jurisdictions, it is projected that by 2030 more middle- and low-income groups will advance to accrual-based accounting.

Ernst & Young Sri Lanka Head of Assurance Gayathri Manatunga said: “I believe it is an ideal time for the Government of Sri Lanka to revisit its plans for adopting accrual-based financial reporting.”

Transitioning to an accrual basis offers numerous benefits that enhance public financial management. Accrual accounting improves transparency by providing a clearer picture of a government’s financial position, recognising all financial transactions when they occur rather than when cash is exchanged. This approach supports better decision-making by policymakers and stakeholders, allowing for informed resource allocation based on a comprehensive understanding of financial obligations and assets.

Ernst & Young Sri Lanka Partner Assurance Hiranthi Fonseka said: “Accrual accounting strengthens accountability by ensuring all financial activities are accurately recorded and reported. It also supports inter-generational equity, making sure today’s decisions don’t unfairly impact future generations.”

The gradual shift towards accrual accounting reflects a growing commitment to better financial management in the public sector.

*Source: Information referred to from International Federation of Accountants (IFAC), Charted Institute of Public Finance and Accountancy (CIPFA) and International Public Sector Accounting Standards Board (IPSASB)