Thursday Feb 19, 2026

Thursday Feb 19, 2026

Thursday, 11 December 2025 05:51 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

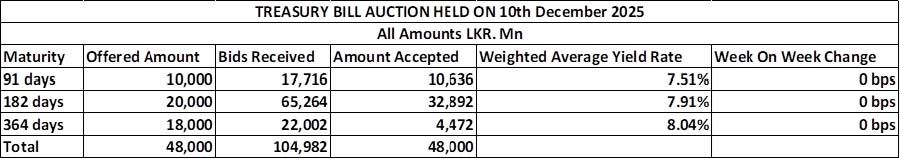

The weighted average rates at the weekly Treasury Bill auction conducted yesterday held steady. Accordingly, the yields on the 91-day, the 182-day and the 364-day tenors were recorded unchanged at 7.51%, 7.91% and 8.03%. This marks the 21st week where T-Bill rates have stayed broadly anchored around prevailing levels.

The weighted average rates at the weekly Treasury Bill auction conducted yesterday held steady. Accordingly, the yields on the 91-day, the 182-day and the 364-day tenors were recorded unchanged at 7.51%, 7.91% and 8.03%. This marks the 21st week where T-Bill rates have stayed broadly anchored around prevailing levels.

The auction was fully subscribed, raising the entire Rs. 48 billion offered. This marks the first instance in six consecutive auctions to be fully subscribed. The bids received-to-accepted amount ratio was 2.19 times.

The Phase II of subscription is now open across all the 91-day and 364-day ISINs until 3:00 p.m. of business day prior to settlement date (i.e., 03.12.2025) at the WAYRs determined for the said ISINs at the auction. (Please see table for the details of the auction Phase 1).

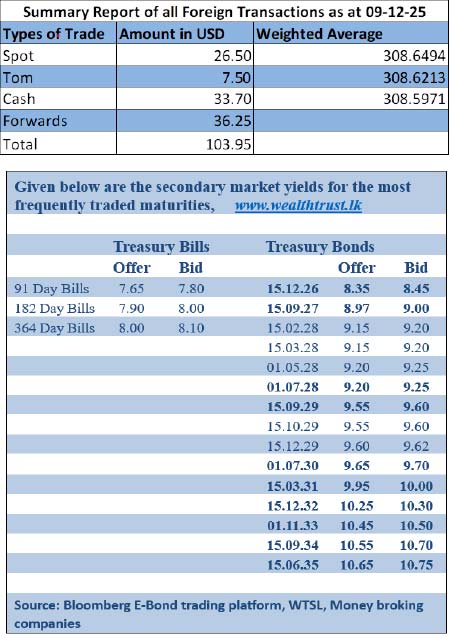

Activity in the secondary Bond market moderated as participants adopted a wait-and-see stance ahead of the upcoming Treasury Bond auction. Yields overall remained broadly steady, with sentiment staying positive following the rally observed the previous day.

In terms of the Secondary Bond market trade summary, the 01.05.27 and 15.09.27 maturities were seen trading at the rates of 8.94% and 9.01% respectively. The 15.12.32 maturity traded within the range of 10.32%-10.30%, marking a slight increase in its rate. The 01.11.33 maturity traded at the rate of 10.50%.

This comes ahead of the Treasury Bond auction scheduled to be conducted today (11). The round of auctions will have a total offered amount of Rs. 143 billion across three available maturities.

The auction will be comprised of: Rs. 43 billion from a 01 March 2030 Maturity bearing a coupon rate of 9.50%; Rs. 30 billion from a 01 October 2032 Maturity bearing a coupon rate of 9.00%; and, Rs. 70 billion from a 15 June 2035 Maturity bearing a coupon rate of 10.70%. The settlement will be on 15 December 2025.

For context, the immediately previous Treasury Bond auctions conducted on 27 November produced remarkable outcomes, registering weighted averages below prevailing secondary market yields at the time. The auction was comprised of two maturities with a total offered amount of Rs. 42 billion.

Maturity wise the results were as follows:

Firstly, the shorter tenor 01.03.2030 maturity recorded a weighted average rate of 9.53%, this was as against a pre-auction rate of 9.60/9.64 for a similar maturity (01.07.2030). However, the 01.03.30 maturity only raised 87.00% or Rs. 17.40 billion out of the Rs. 20 billion maturity wise offered amount across both 1st and 2nd phases.

Secondly, the 01.06.2033 maturity recorded a weighted average rate of 10.39%, also significantly below its pre-auction secondary market rate of 10.45/10.50. The 01.06.33 maturity raised the entire maturity wise offered amount of Rs. 22 billion, in competitive bidding at the 1st phase. The demand subsequently extended into the Direct Issuance Window, where the full Rs. 2.20 billion available was entirely taken up.

The total secondary market Treasury Bond/Bill transacted volume for 9 December was Rs. 8.41 billion.

In money markets, the weighted average rates on overnight call money and Repo stood at 7.95% and 8.00% respectively.

The net liquidity surplus was recorded at Rs. 97.83 billion yesterday as an amount of Rs. 97.92 billion was deposited at Central Bank’s SDFR (Standing Deposit Facility Rate) of 7.25%. An amount of Rs. 0.09 billion was withdrawn from the Central Bank’s SLFR (Standard Lending Facility Rate) of 8.25%.

Forex Market

In the Forex market, the USD/LKR rate on spot contracts depreciated to 308.80/308.90 as against the previous day’s closing level of Rs. 308.64/308.66.

The total USD/LKR traded volume for 09 December 2025 was $ 103.95 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)