Wednesday Feb 25, 2026

Wednesday Feb 25, 2026

Friday, 16 February 2024 00:25 - - {{hitsCtrl.values.hits}}

By Insurance Regulatory Commission of Sri Lanka

Gross Written Premium

The Gross Written Premium (GWP) growth of the insurance industry was 7.70% during the 3rd Quarter of 2023, recording an increase of Rs. 14,734 million when compared to the same period in the year 2022.

The GWP for Long Term Insurance and General Insurance Businesses was Rs. 206,091 million compared to the 3rd Quarter of 2022 amounting to Rs. 191,357 million.

As depicted in chart 1 a, the GWP of Long-Term Insurance Business amounted to Rs. 109,931 million (Q3, 2022: Rs. 98,308 million) recording a growth of 11.82%. The GWP of General Insurance Business amounted to Rs. 96,160 million (Q3, 2022: Rs. 93,049 million) recording a growth of 3.34%.

The Chart 1 b depicts the performance of the insurance industry over the last five years from 2018 to 2022. The GWP of the industry increased to Rs. 258,100 million in the year 2022 compared to Rs. 180,880 million recorded in 2018, showing a growth of 42.69%.

The growth in GWP of long-term insurance business was steady until 2021, representing over 10% growth each year. Furthermore, the long-term insurance business displayed a significant growth momentum in years 2020 and 2021 and increased by 16.0% and 21.0% respectively as the outbreak of the pandemic heightened the risk awareness of the public and enhanced the need for life protection. However, in the year 2022, the long-term insurance industry recorded a moderate growth of 9.4%. The depleted real income of households due to soaring inflation resulted in a significant drop in new long term insurance policies issued in 2022, resulting in subdued premium growth.

The GWP of general insurance business witnessed premium growth of 7.7% and 7.1% in 2018 and 2019 respectively. However, the general insurance business exhibited a negative premium growth of 2.3% in 2020 and rebounded in 2021, achieving a moderate growth of 3.5%. The general insurance business demonstrated a significant improvement in 2022 by recording an 11.9% growth rate compared to the growth reported in 2021.

Total assets

The value of the total assets of insurance companies surpassed Rs. 1 trillion, recording Rs. 1,089,456 million as at end of 3rd Quarter of 2023, when compared to Rs. 925,379 million recorded as at end of 3rd Quarter of 2022, reflecting a growth of 17.73%. As illustrated in chart 2 a, the assets of the Long-Term Insurance Business amounted to Rs. 789,819 million (Q3, 2022: Rs. 656,631 million) depicting a growth rate of 20.28%, mainly due to increase in business volume, which is represented by investments in government debt securities, deposits and equities. The assets of the General Insurance Business amounted to Rs. 299,637 million (Q3, 2022: Rs. 268,748 million), indicating a growth of 11.49%.

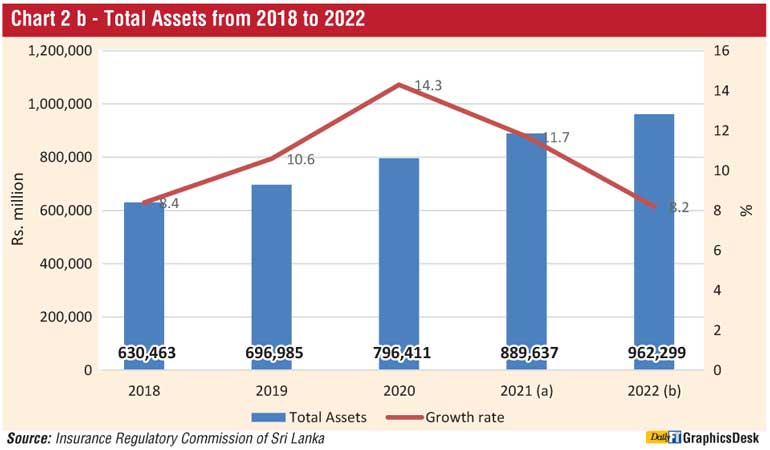

The Chart 2b illustrates the total asset portfolio of the insurance industry over the last five years from 2018 to 2022.

The total asset portfolio of the insurance industry reached Rs 962,299 million by the end of 2022, displaying growth of 52.63% over the last five years. However, the rate of growth slowed in 2021 due to increased dividend distributions by insurers during the year, after restrictions on dividend payments being removed and the resultant usage of assets to fund such distributions made a notable impact on the asset growth of the industry. In the year 2022, total assets grew by 8.2%, but at comparatively reduced rate compared to the preceding years. This was largely due to the effect of depleted asset values of insures in the face of high interest rate environment prevailed in the year

Claims incurred by insurance companies

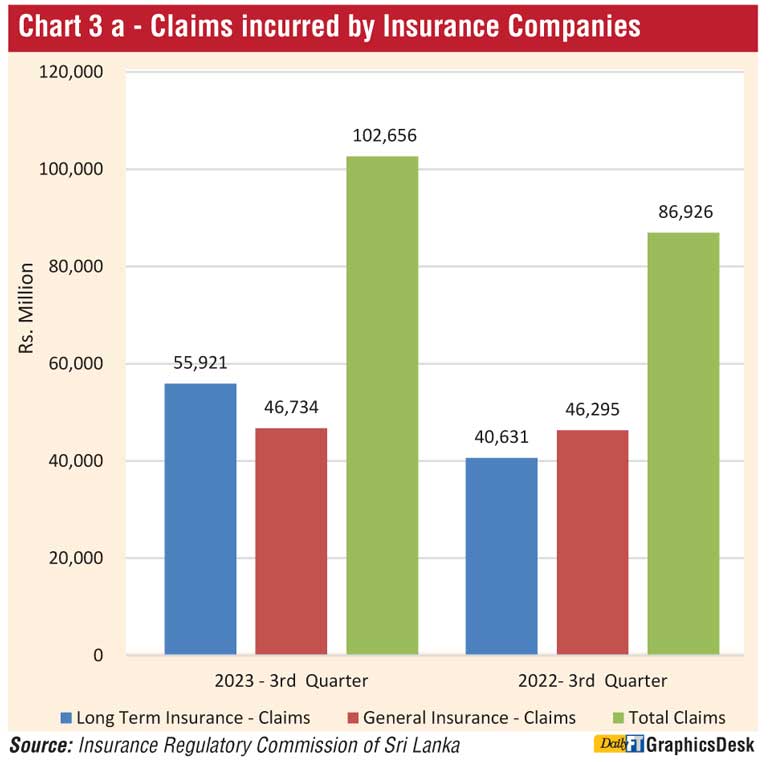

The chart 3a depicts the claims incurred by insurance companies during the 3rd Quarter of 2023. The claims incurred by insurance companies in both the Long-Term Insurance Business and the General Insurance Business were Rs. 102,656 million during the 3rd Quarter of 2023 (Q3, 2022: Rs. 86,926 million) showing an increase in total claims value by 18.09% year-on-year. The Long-Term Insurance claims, including maturity and death benefits, amounted to Rs. 55,921 million (Q3, 2022: Rs. 40,631 million) with a growth rate of 37.63%. The claims incurred in the General Insurance Business, including Motor, Fire, Marine and other categories, amounted to Rs. 46,734 million (Q3, 2022: Rs. 46,295 million) with a slight growth of 0.95%.

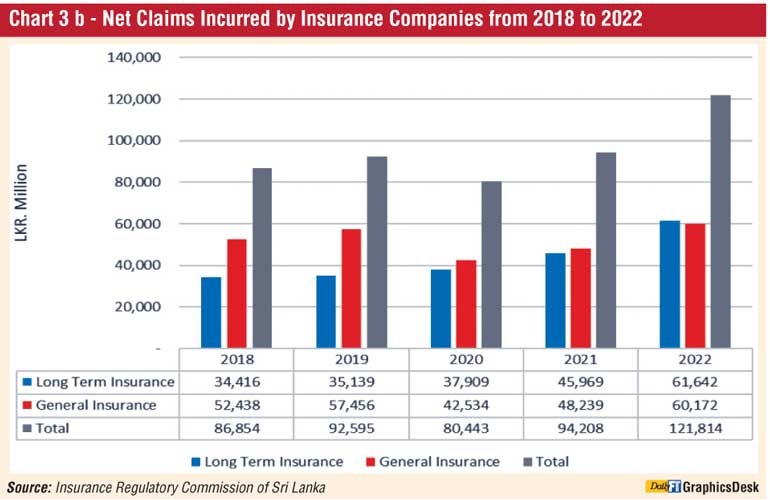

Net Claims incurred by Insurance companies over the last five years from 2018 to 2022 for long term and general insurance business is illustrated in Chart 3 b.

The total net claims incurred by the long-term insurance sector amounted to Rs. 121,814 million in 2022 when compared to Rs. 86,854 million recorded in 2018. The total claims incurred by life insurers continued to grow over the last five years. Claims incurred by the long-term insurers can be categorised into Disability Benefits, Death, Surrenders, Maturity Benefits and Other benefits. The net claims incurred in the long-term insurance business increased by 34.1% in 2022, reflecting the highest growth rate recorded for the past five years. The increase was primarily due to maturity benefits, surrenders, and other benefits.

The net claims incurred by the general insurance sector amounted to Rs. 60,170 million and increased by 14.75% in 2022 when compared to Rs. 52,438 million recorded in 2018. However, the year 2020 recorded the lowest claims incurred value for the past five years with a drop of 25.97%. Major factors behind this noticeable slump were mobility restrictions imposed during the first and second waves of COVID-19, which directly reduced the motor claims and sharp decline in travel and tourism industries in the wake of the pandemic.

However, total net claims incurred by the general insurance sector increased by 13.41% to Rs. 48,239 million (excluding SRCC & T) in 2021 and 24.74% to Rs. 60,172 million (excluding SRCC & T) in 2022. The significant increase in general insurance claims in 2022 has resulted from several factors, including increase in costs for repairs and replacements as a result of the country’s high inflationary conditions, unforeseen riot claims arising from protests, and the lifting of pandemic restrictions, which has resulted in an increase in accidents and subsequent insurance claims.

Profit (Before Tax) of insurance companies

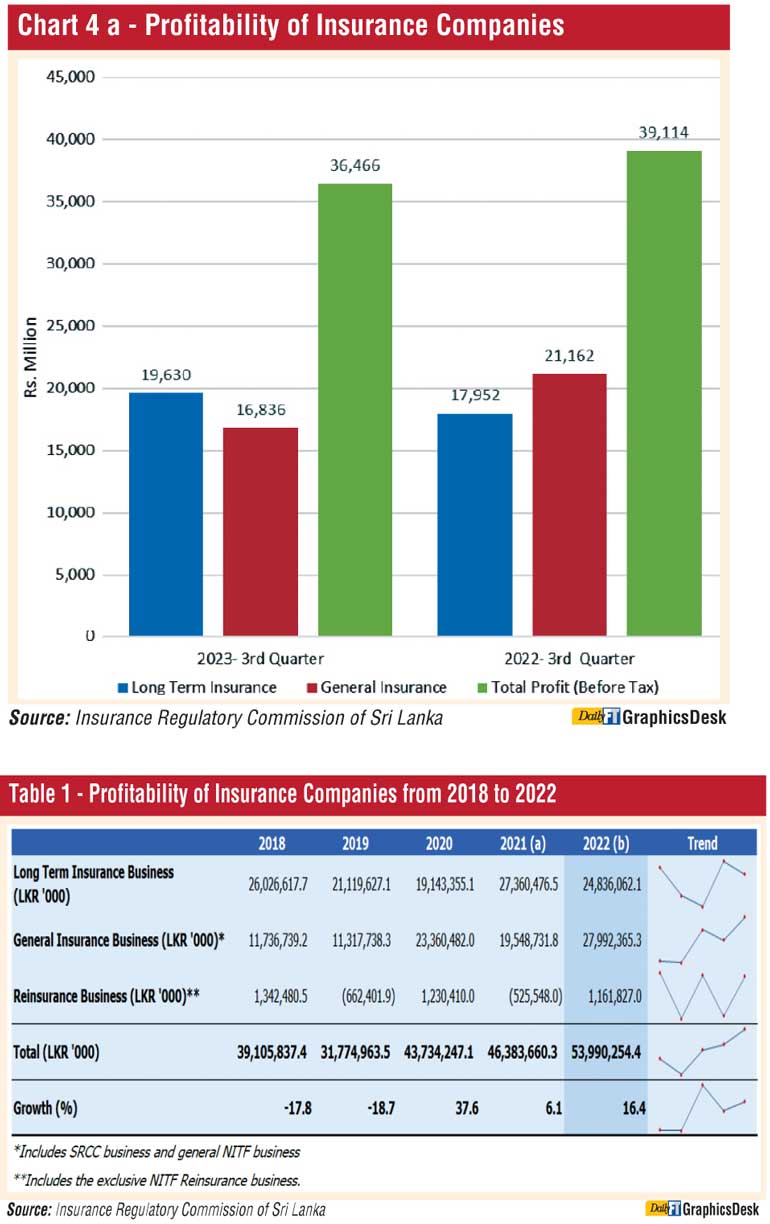

The chart 4 illustrates the profit (before tax) of insurance companies as of the end of the 3rd Quarter of 2023 in both Long-Term Insurance Business and General Insurance Business which amounted to Rs. 36,465 million (Q3, 2022: Rs. 39,114 million) showing a decrease in total profit of 6.77%. The profit (before tax) of Long-Term Insurance Business amounted to Rs. 19,630 million (Q3, 2022: Rs. 17,952 million), while the profit (before tax) of General Insurance Business amounted to Rs. 16,836 million (Q3, 2022: Rs. 21,162 million). Thus, profit (before tax) of Long-Term Insurance Business has increased by 9.34% and General Insurance Business has decreased by 20.44%.

The profitability of the insurance industry over the last five years, from 2018 to 2022 is illustrated in table 1. The highest recorded profitability was in 2022, while the lowest was in 2019. Unfavourable economic conditions prevailed in the country, coupled with the negative effects created by the Easter Sunday attacks, challenged the performance of the insurance industry in 2019. In 2020, the insurance industry displayed a significant financial performance by posting a year-over-year profit growth of 37.6%.

The long-term insurance business rebounded strongly in 2021 in terms of performance and achieved a profitability growth of 20.82%, as a result of the strong growth in GWP, favourable net investment income, stringent cost optimisation and containment measures adopted by many long-term insurers. However, in 2021, general insurance business exhibited reduced profits, resulting in the overall profitability of general insurance business dropping by 18.48% on year-over-year basis due to increase in general insurance claims, reflecting the normalisation of economic activity and mobility.

The contribution of general insurers to overall profitability exceeded the long-term insurers in 2022 and recorded Rs. 27,992 million. The general insurance business demonstrated a remarkable year-over-year profit growth of 43.2% in 2022, which was largely influenced by promising expansion in overall premium income and noteworthy foreign exchange gains reported by several general insurers, which emerged from foreign currency-denominated investments.

Insurers

Out of 28 Insurance Companies (Insurers) in operation as at 30 September 2023, 14 companies are engaged in Long-Term (Life) Insurance Business, 12 companies are engaged in General Insurance Business and two companies function as composite companies (dealing in both Long Term and General Insurance Businesses).

Insurance brokers

Seventy-eight Insurance Broking Companies, were in operation as at 30 September 2023. Total Assets of insurance broking companies have increased to Rs. 12,378 million as at the end of 3rd Quarter of 2023 when compared to Rs. 9,202 million recorded as at 3rd Quarter of 2022, indicating a growth of 34.51%.

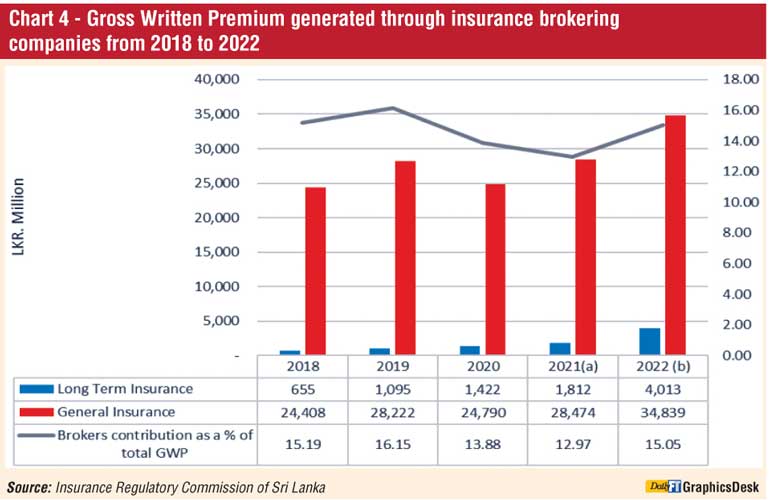

Chart 4 depicts the Gross Written Premium generated through insurance broking companies over the last five years from 2018 to 2022.

Gross Written Premium generated through insurance broking companies from 2018 to 2022

The GWP generated through insurance brokering companies has increased over the last five years, displaying over 12% contribution each year from 2018 to 2022.