Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Monday, 12 January 2026 00:49 - - {{hitsCtrl.values.hits}}

|

Deputy General Manager – SME, Development and Microfinance Wickrama Narayana |

How is People’s Bank ready to support the rebuilding of the MSME sector in Sri Lanka, not only in the post-crisis context but in general?

Micro, Small and Medium Enterprises (MSMEs) are the backbone of the Sri Lankan economy, playing a vital role in employment generation, regional development, and income distribution. At People’s Bank, supporting MSMEs is a long-term strategic priority aligned with our mandate as the country’s premier State-owned commercial bank.

Our approach extends beyond post-crisis recovery to support the full MSME life cycle, from start-ups and micro entrepreneurs to growing and established businesses, through tailored financing, advisory support, and sector-specific solutions. With our island-wide branch network and strong understanding of local economies, People’s Bank is well positioned to serve entrepreneurs across urban, rural, and underserved communities.

What Government-funded facilities are currently available through People’s Bank?

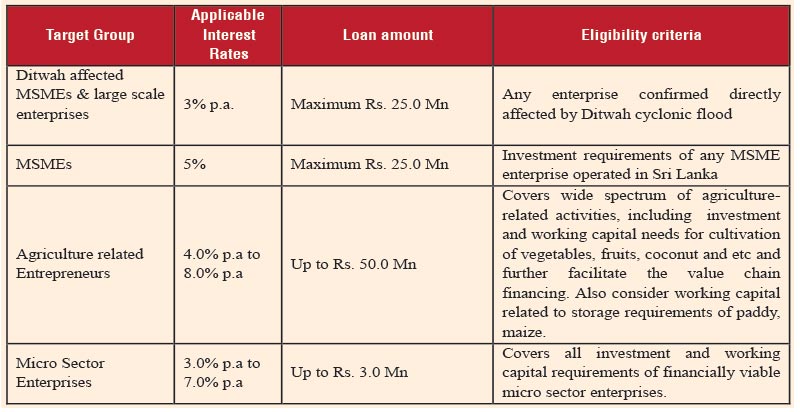

People’s Bank actively participates in several Government-funded and concessionary loan schemes, offering lower interest rates compared to market rates, medium to long-term tenures, loan amounts based on project viability and eligibility criteria defined by sector, purpose, and enterprise size.

Government funded loan products are made available at People’s Bank branches for the following sectors (see table) in line with Government policy directives in MSME sector.

Can you briefly summarise the MSME loan products offered by People’s Bank?

People’s Bank offers a wide range of bank-funded MSME loan products, including working capital loans to support day-to-day business operations, term loans for machinery, equipment, expansion, and modernisation, trade finance facilities including import, export, and local trade support, overdrafts and revolving credit to manage cash flow fluctuations and sector-specific loans tailored for agriculture, manufacturing, tourism, construction, logistics, and services.

Loan amounts, interest rates, and tenures vary depending on the business profile, purpose of the loan, and credit evaluation, with repayment periods extending up to several years for long-term investments whereas the MSME definition introduced by Ministry of Industries for categorisation of concerned businesses.

People’s Bank offers a range of bank-funded loan schemes in MSME sector as follows and the interest rates are varies from 7.0% p.a to 12.0% p.a.

How should customers approach People’s Bank to access these facilities?

Customers are encouraged to visit their nearest People’s Bank branch, which serves as the primary access point for MSME financing. Branch Managers and Credit Officers will assess customer needs, recommend suitable bank-funded or Government-funded facilities, and provide guidance on eligibility and documentation, ensuring personalised support throughout the process.

This branch-based approach ensures transparency, sound advisory support, and efficient decision-making. People’s Bank remains committed to empowering Sri Lanka’s MSME sector as a long-term national responsibility, delivering inclusive and sustainable financial solutions through both its own resources and Government-backed initiatives.

(This article is based on an interview with People’s Bank Deputy General Manager (SME, Development and Micro Finance), Wickrama Narayana.)