Sunday Feb 22, 2026

Sunday Feb 22, 2026

Wednesday, 18 February 2026 00:00 - - {{hitsCtrl.values.hits}}

Chairman Aravinda Perera (left) and Director/CEO Naleen Edirisinghe

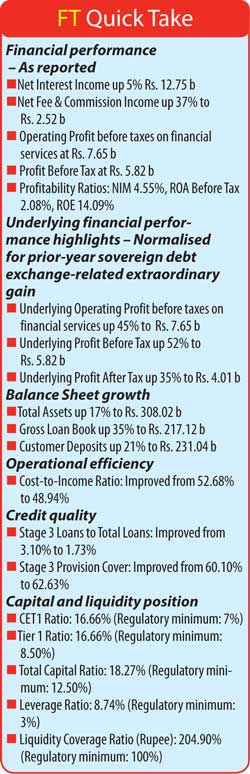

Pan Asia Banking Corporation PLC said yesterday it has reported a strong financial performance for 2025, marking a year in which the Bank reinforced its position among Sri Lanka’s steadily expanding financial institutions.

The Bank’s overall asset base surpassed Rs. 300 billion, reaching Rs. 308.02 billion its largest balance sheet to date while Profit After Tax amounted to Rs. 4.01 billion. Earnings Per Share stood at Rs. 9.05, reflecting a solid core earnings base and disciplined balance sheet execution during a year of gradually easing macroeconomic pressures.

Its statement said total operating income grew to Rs. 16 billion, supported by resilient net interest generation and sharp growth in non-interest revenue. Even though benchmark interest rates trended downward for much of the year reducing gross interest income at the market level, the Bank protected its core income through proactive liability repricing, careful funding management, and the retirement of high-cost borrowings. A healthier deposit mix supported by CASA growth helped reduce interest expenses by 4%, allowing the Bank to maintain profitability despite softer yields on loans and government securities.

Its statement said total operating income grew to Rs. 16 billion, supported by resilient net interest generation and sharp growth in non-interest revenue. Even though benchmark interest rates trended downward for much of the year reducing gross interest income at the market level, the Bank protected its core income through proactive liability repricing, careful funding management, and the retirement of high-cost borrowings. A healthier deposit mix supported by CASA growth helped reduce interest expenses by 4%, allowing the Bank to maintain profitability despite softer yields on loans and government securities.

A clearer picture of Pan Asia Bank’s true performance emerges once the non-recurring sovereign debt gain recorded in 2024 is set aside. On this normalised basis, 2025 stands out as the Bank’s strongest year of underlying profitability in its 30-year history. Underlying Profit After Tax surged 35% to Rs. 4.01 billion, while underlying Profit Before Tax climbed an impressive 52%, highlighting the Bank’s accelerating earnings momentum. Underlying EPS rose 35% to Rs. 9.05, supported by improved returns, with underlying ROE and ROA rising by 169 and 52 basis points, respectively. Together, these gains reflect the depth of the Bank’s core business strengths, broad based revenue growth, and disciplined margin management during a year shaped by declining interest rate conditions.

Income diversification also played a pivotal role. Net fee and commission income expanded by 37%, supported by heightened lending activity, improved trade flows, stronger card-related transactions, and remarkable growth in remittance-related business. These developments helped offset the moderation in trading gains, which were affected by lower capital gains on unit trusts and government securities. A de-recognition gain of Rs. 278.63 million on FVOCI assets and reduced mark to market losses helped stabilise non-interest income, allowing the Bank to sustain earnings despite a more subdued trading environment.

Credit quality improved significantly. The Stage 3 loan ratio declined to 1.73% from 3.10% a year earlier, one of the greatest improvements within the sector—reflecting the Bank’s continued emphasis on high quality underwriting, better borrower monitoring, and an effective early warning framework. Impairment expenses normalised following the unusually large reversal seen in 2024.

The Bank recognised Rs. 520.81 million in Expected Credit Loss provisions in 2025, reflecting strong loan growth, updated macroeconomic parameters, refinements to impairment models, and additional adjustments to factor in climate-related risks following Cyclone Ditwah. Stage-wise movements also highlighted prudent credit management, with higher Stage 1 provisions driven by portfolio expansion, moderate Stage 2 charges that reflected selective borrower vulnerability, and a Stage 3 reversal supported by improved recoveries. The Stage 3 provision coverage ratio strengthened to 62.63%, reinforcing the Bank’s capacity to absorb credit shocks.

Operational efficiency continued to improve, with the Cost to Income ratio declining to 48.94% from 52.68% the previous year. This improvement occurred despite investments in branch expansion, digital capability, and staff development. Enhanced process optimisation, expanding use of digital channels, and automation across key operational areas contributed significantly to the Bank’s ability to handle higher business volumes at lower incremental cost, supporting overall profitability.

The Bank also recorded one of its strongest periods of balance sheet expansion. Total assets grew by 17% to Rs. 308.02 billion, while the gross loan book rose 35% to Rs. 217.12 billion, reflecting increased credit demand across retail, SME, and corporate clients and the Bank’s ability to underwrite growth responsibly. Customer deposits increased 21% to Rs. 231.04 billion, demonstrating deepening customer trust and broad relevance across markets. Strengthened liquidity buffers, higher balances with the Central Bank, and the continued expansion of foreign currency deposits ensured a stable funding structure to support lending momentum.

Liquidity remained exceptionally strong throughout the year, consistently staying well above regulatory thresholds and reflecting the Bank’s disciplined approach to balance sheet management. With a Rupee Liquidity Coverage Ratio of 204.90% and an All Currency LCR of 154.97%, Pan Asia Bank demonstrated its ability to maintain deep liquidity buffers through careful planning, strong deposit mobilisation, and a deliberately constructed liquid asset portfolio. These indicators reflect a banking institution that has embedded resilience into its funding strategy—capable of navigating shifting interest rate cycles and rapid credit expansion without compromising safety or stability.

Capital adequacy remained equally robust. The Bank’s Common Equity Tier 1 and Tier 1 ratios both stood at 16.66%, with the Total Capital Ratio reaching 18.27%, comfortably surpassing regulatory minimums by a wide margin. This conservative yet strategic capital position provides ample capacity for sustainable future growth while shielding the Bank and its stakeholders from market volatility. The leverage ratio of 8.74% further underscores the strength of the Bank’s capital structure and its commitment to maintaining a secure and well-fortified balance sheet.

Chairman Aravinda Perera said: “2025 was a landmark year for Pan Asia Bank, marked by our strongest underlying performance to date and a meaningful strengthening of the Bank’s financial foundation. As we celebrate three decades of progress, the priorities of the Board remain clear: ensuring disciplined governance, safeguarding resilience, and guiding the institution toward sustainable, long-term value creation. The trust placed in us by customers and investors has enabled the Bank to navigate a rapidly evolving operating environment with confidence, and we are committed to ensuring that the strategic momentum achieved in 2025 translates into durable returns and continued support for Sri Lanka’s broader economic advancement.”

Director/CEO Naleen Edirisinghe said: “2025 marked a transformative year for Pan Asia Bank, with the Bank delivering the strongest balance sheet expansion in its 30 year history. Total assets grew by 17 % to Rs. 308 billion, our loan portfolio expanded by 35 % to Rs. 217.12 billion, our highest annual credit growth to date and customer deposits exceeded Rs. 231 billion. This exceptional growth reflects our enhanced scale, strengthened competitiveness, and the deep trust placed in us by our customers.”

He added that the Bank’s ability to maintain asset quality leadership while expanding across SME, retail, and corporate portfolios demonstrates the resilience of its franchise, noting, “We have significantly scaled our earning asset base, improved capital efficiency, and deepened customer engagement. As we move forward, our focus remains firmly on responsible growth, maintaining asset quality leadership, optimising margins, and accelerating digital and analytics-enabled transformation. Pan Asia Bank enters its next phase with the confidence, resilience, and strategic clarity required to convert scale into sustained value for all stakeholders.”

Pan Asia Bank said as steps confidently into its fourth decade, it does so with a strengthened balance sheet, a broadening customer base, and a clear strategic direction anchored in sustainable growth. With a proven ability to adapt, innovate, and maintain disciplined risk management, the Bank appears well positioned to support Sri Lanka’s economic progress while delivering enduring value to customers, employees, and shareholders in the years ahead.