Thursday Feb 19, 2026

Thursday Feb 19, 2026

Tuesday, 28 October 2025 00:23 - - {{hitsCtrl.values.hits}}

Chairman Aravinda Perera, and Director and CEO Naleen Edirisinghe

Pan Asia Banking Corporation PLC said yesterday it has reported a stellar financial performance for the nine months ended 30th September 2025, reaffirming its resilience and strategic agility amid a gradually recovering yet challenging macroeconomic environment.

Pan Asia Banking Corporation PLC said yesterday it has reported a stellar financial performance for the nine months ended 30th September 2025, reaffirming its resilience and strategic agility amid a gradually recovering yet challenging macroeconomic environment.

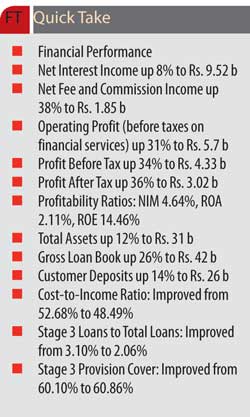

The Bank recorded a 36% increase in Profit After Tax (PAT), reaching Rs. 3.02 billion, and an Earnings Per Share (EPS) of Rs. 6.83, reflecting strong portfolio and cost management, coupled with a steadfast commitment to sustainable profitability.

In a statement PABC said the Bank’s unwavering commitment to maintaining superior asset quality was demonstrated by sustaining one of the lowest Stage 3 Loan Ratios in the industry at 2.06% as of 30th September 2025-reflecting the strength of its prudent credit risk management and robust underwriting practices.

The Bank achieved a remarkable 38% growth in net fee and commission income during the period under review, underpinned by strong demand for loans and advances in a low-interest rate environment and favourable macroeconomic conditions. Additionally, fee income from trade and remittance services recorded substantial growth, further demonstrating the Bank’s diversified revenue capabilities and operational strength.

The investments in people development reinforce the Bank’s focus on attracting, retaining, and developing high-calibre professionals who are essential for delivering superior customer experiences, fostering innovation, and sustaining long-term shareholder value.

The Bank reported a Net Interest Margin (NIM) of 4.64% for the period under review. Return on Equity (ROE) stood at 14.46%, while Pre-Tax Return on Assets (ROA) reached 2.11%, reflecting the Bank’s capacity to deliver strong returns to shareholders

Total assets grew by 12%, driven primarily by an expansion in loans and advances, which increased by 26% across the SME Banking, Corporate Banking, and Retail Banking segments due to heightened credit demand. The Bank’s customer deposits rose by Rs. 26 billion, or 14%, surpassing the Rs. 217 billion by the end of the nine months of September 2025. The Current and Savings Account (CASA) ratio remained steady at 21.27%, reflecting a stable low-cost deposit base.

Throughout the nine-month period, the Bank maintained a strong capital and liquidity position, reinforcing its resilience in a dynamic economic environment. Capital buffers remained well above regulatory minimums, demonstrating prudent management. The Common Equity Tier 1 (CET1) Capital Ratio and Tier 1 Capital Ratio were 15.43%, comfortably above the regulatory thresholds of 7.00% and 8.50%, respectively. The Total Capital Ratio stood at 17.07% versus the statutory minimum of 12.50%, while the Leverage Ratio remained robust at 7.96%, well above the 3% regulatory benchmark.

Liquidity levels remained strong despite significant growth in the loan book. The Bank’s All-Currency Liquidity Coverage Ratio (LCR) was 166.27%, and the Rupee LCR stood at 180.89%, both exceeding regulatory requirements. The Net Stable Funding Ratio (NSFR) of 127.90% underscores the Bank’s capacity to maintain stable funding in a gradually recovering economic environment. These metrics collectively highlight the Bank’s commitment to financial stability, sustainable growth, and long-term shareholder value.

As the Bank commemorates its 30th anniversary, the Bank celebrates three decades of prudent growth, financial stability, and strategic evolution. Since its establishment in 1995, Pan Asia Bank has developed into a leading mid-tier bank in Sri Lanka, recognized for its strong governance framework, disciplined risk management, and consistent delivery of shareholder value.

The Bank’s 2025 financial results reflect solid performance across key indicators, underscoring resilience in a dynamic economic environment. Sustained growth in the Corporate, Retail and SME segments, combined with robust capital adequacy and liquidity positions, has reinforced the Bank’s financial foundation. The Bank continues to demonstrate strong cost discipline and asset quality, positioning it well for long-term profitability and sustainable expansion.

Chairman Aravinda Perera said: “For three decades, the Bank has consistently evolved to meet the demands of a dynamic financial landscape. Guided by a resilient balance sheet, a culture of innovation, and a commitment to excellence, we have delivered sustainable value to our shareholders and earned the trust of our stakeholders. As we look to the future, we are strategically positioned to lead the next era of banking - driving innovation, expanding our footprint, and creating long-term, enduring growth for all our stakeholders.”

Director and CEO Naleen Edirisinghe said: “Pan Asia Bank’s strong performance during the first nine months of 2025 reflects our disciplined execution and unwavering focus on value creation. Despite a dynamic operating environment, we achieved steady growth and improved profitability, underscoring the strength of our core banking strategy and the trust our customers continue to place in us. As we enter the next phase of our growth trajectory, we are investing in digital transformation, advanced risk management, and trade finance capabilities. These strategic initiatives are designed to enhance operational efficiency, deepen market penetration, and align with global best practices in banking and sustainability-enabling us to unlock long-term value and deliver sustainable growth for all stakeholders.”

With a renewed strategic focus on technology-driven banking, ESG integration, and prudent capital management, Pan Asia Bank aims to strengthen its position as a trusted financial partner within Sri Lanka and beyond. The Bank’s 30-year legacy stands as a testament to its commitment to transparency, innovation, and long-term value creation for its investors.