Thursday Feb 19, 2026

Thursday Feb 19, 2026

Sunday, 7 April 2024 00:10 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

Activity in the secondary bond market remained moderate during the week ending 5 April 2024 as the weekly Treasury bill auction rates were seen increasing after rates dropped the previous week, following a knee-jerk reaction to a monetary policy rate cut of 50 basis points. This coupled with a wait-and-see approach by most market participants ahead of Rs.85 billion in Treasury bond auctions scheduled for today (8 April) saw momentum turn dull in the secondary bond market during the week.

Activity in the secondary bond market remained moderate during the week ending 5 April 2024 as the weekly Treasury bill auction rates were seen increasing after rates dropped the previous week, following a knee-jerk reaction to a monetary policy rate cut of 50 basis points. This coupled with a wait-and-see approach by most market participants ahead of Rs.85 billion in Treasury bond auctions scheduled for today (8 April) saw momentum turn dull in the secondary bond market during the week.

This was despite the backdrop of the news that “JPMorgan Juices Bets on the Red-Hot Debt Market in Sri Lanka” as reported by Bloomberg. The article states that global money managers are increasingly turning to Sri Lanka’s local-currency Government bonds, anticipating a lucrative restructuring deal and buoyed by positive economic developments. Recent positive indicators, including IMF approval for a pay-out, normalisation of inflation and stabilisation of foreign reserves and improved domestic economic growth, have contributed to the favourable sentiment. Investors are attracted by relatively higher yields and potential currency gains.

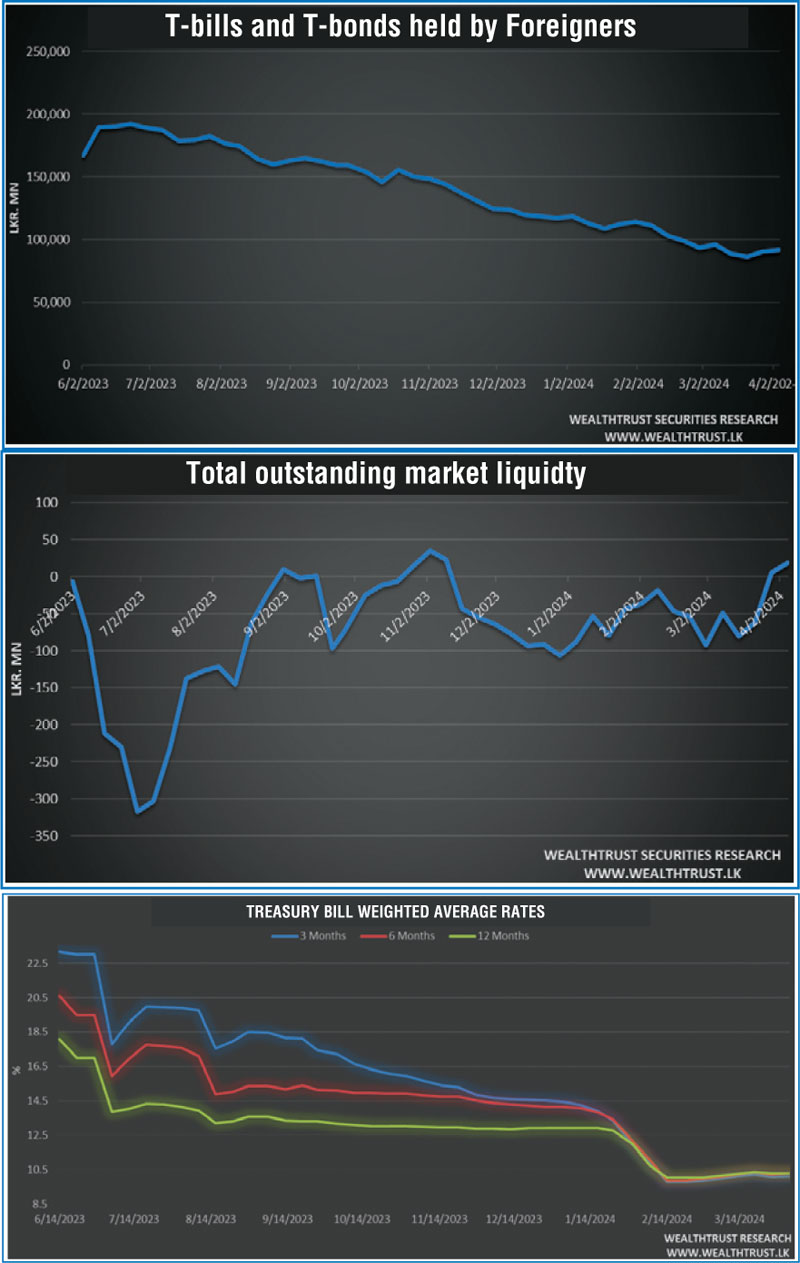

At the weekly Treasury bill auction conducted last Wednesday (3 April 2024), the weighted average yields were seen increasing marginally on the shorter tenors. The 91-day maturity increased by 04 basis points to 10.11%, while the 182-day maturity increased by 07 basis points to 10.30%. However, the 364-day maturity remained unchanged at 10.28%. The auction went undersubscribed, with only 98.02% or Rs. 132.33 billion out of the Rs. 135.00 billion offered raised at the 1st phase of the auction. An additional amount of Rs. 6.48 billion was raised at the 2nd phase of the auction.

The Treasury bond auctions due today (8 April), will have on offer a total of Rs. 85.00 billion. Which will comprise of Rs. 25.00 billion from a maturity of 15 December 2026 with a coupon rate of 11.25%, Rs. 25.00 billion from a maturity of 15 September 2029 with a coupon of 11.00% and Rs. 35.00 billion from a maturity of 1 October 2031 with a coupon rate of 09.00%. For context, at the previous round of auctions held on 12 March 2024, the weighted average yields were seen increasing on the 2026 and 2028 maturities as compared to the previous round of bond auctions conducted on 13 February where both maturities were previously offered. The 15.12.26 maturity recorded a weighted average rate of 11.33% as against 10.81% at the previous auction. While the 15.12.28 maturity average was recorded at 12.25% as against 11.90% at the previous auction. However, 15.03.31 maturity was issued at a weighted average of 12.42% as against its pre-auction rate of 12.35/65. The entire offered amount of Rs. 270 billion was fully subscribed. Which was incidentally the largest in Sri Lanka’s history.

In limited secondary market trade, the popular liquid 2026 tenors of (01.06.26, 01.08.26, 15.05.26 and 15.12.26) were seen changing hands within the range of 11.25% to 11.40% during the week. In addition, the 2027 tenors (01.05.27 and 15.09.27) were seen trading at levels of 11.75% to 12.00%, whereas the relatively shorter tenor of 15.01.27 transacted at 11.45%. While the liquid 2028 tenors of (15.03.28, 01.07.28 and 15.12.28) were seen trading at an intraweek low of 12.15% to a high of 12.17%. Trades were also observed on the medium tenor bonds of 15.07.29 and 15.03.31 at the levels of 12.40% and 12.30%.

The foreign holding in Rupee bonds and bills for the week ending 5 April 2024 recorded a net inflow for a second consecutive week, amounting to Rs. 1.052 billion. As a result, the total holding increased to Rs. 91.649 billion.

The daily secondary market Treasury bond/bill transacted volumes for the first four days of the week averaged at Rs. 25.64 billion.

In money markets, the total outstanding liquidity surplus increased to Rs. 19.205 billion by the week ending 5 April from its previous week’s deficit of Rs. 5.283 billion. The Domestic Operations Department (DOD) of the Central Bank continued to inject liquidity during the week by way of overnight and term reverse repo auctions at weighted average yields ranging from 8.59% to 8.99%.

The Central Bank of Sri Lanka (CBSL) holding of Government Securities was registered at Rs. 2,675.62 billion as at 5 April 2024, down from its previous week’s level of Rs. 2,691.27 billion.

In the Forex market, the USD/LKR rate on spot contracts was seen appreciating during the week to close at Rs. 299.20/299.30. This is as against its previous week’s closing level of Rs. 300.40/300.50 and subsequent to trading at a high of Rs. 299.25 and a low of Rs. 300.20.

The daily USD/LKR average traded volume for the first four trading days of the week stood at $ 128.31 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)