Tuesday Feb 24, 2026

Tuesday Feb 24, 2026

Tuesday, 20 January 2026 04:42 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The Secondary Bond market yesterday opened the new week on a positive note and extended its recovery, carrying over the momentum from last week.

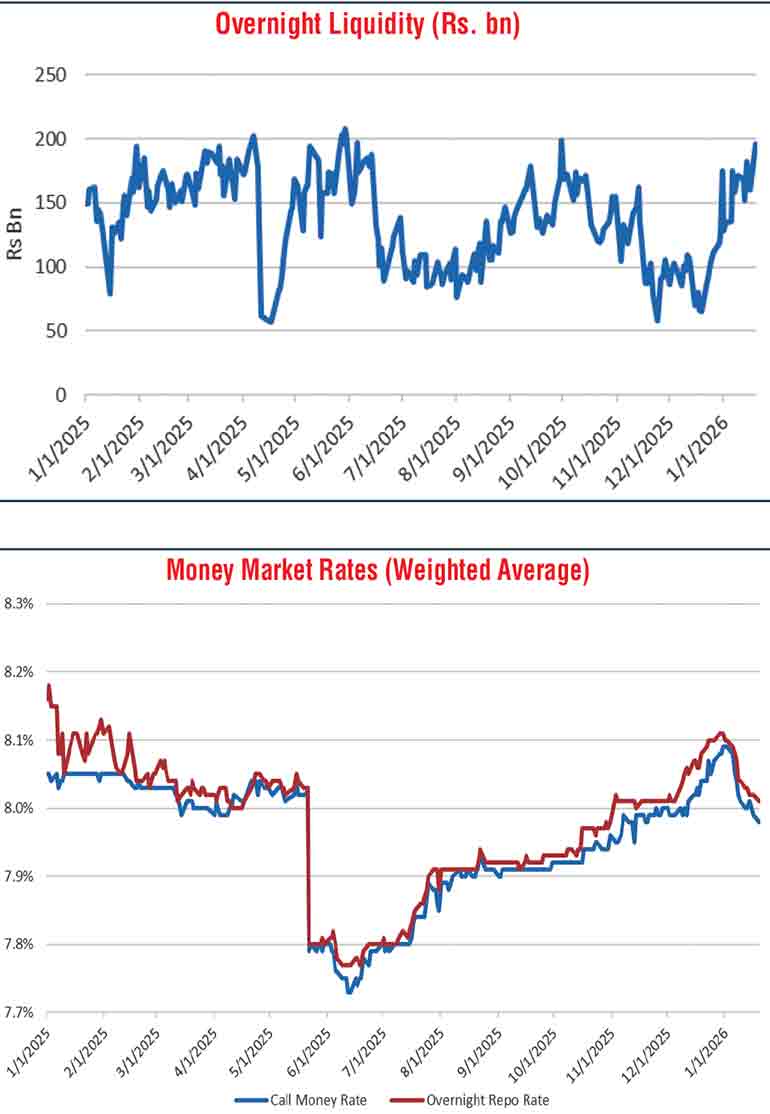

This was spurred by an increased overnight money market liquidity surplus, recorded at Rs. 196.08 billion, up from Rs. 160.19 billion at the close of the previous week. The entire amount was parked at the Central Bank’s Standing Deposit Facility Rate (SDFR) of 7.25%. This marks a trend of steady improvement from the prior month, which saw overnight liquidity touch lows of Rs. 65.92 billion, and represents the highest level observed since end-September 2025.

The rise in liquidity has been matched by a corresponding drop in money market rates, with both Repo and Call Money rates registering weighted averages of 7.93% and 7.96% yesterday, down from highs of 8.06% and 8.04% recorded at the tail end of December 2025. This moderation in money market rates was also reflected in lending rates, as the Average Weighted Prime Lending Rate, as at 16 January, recorded a drop of 21 basis points to 8.98% from the previous week.

The said dynamic drove Bond yields lower, with concentrated buying focused on the 2028, 2029, 2030, 2031, and 2035 tenors. Market activity and transaction volumes were observed at healthy levels, partly driven by book-building interest from institutional players.

Accordingly, trades were observed on 15.03.28 maturity at 9.10% and the 01.05.28 maturity at the rate of 9.15%. The 15.06.29, 15.09.29, 15.10.29 and 15.12.29 maturities were seen trading at the rates of 9.60%, 9.68%-9.65%, 9.65% and 9.68%-9.67% respectively. The 01.03.30 maturity traded within the range of 9.76%-9.75%. The 01.06.33 maturity traded down the range of 10.75%-10.73%. The 15.06.35 maturity dropped down the range of 11.15% to 11.10% on the back of block buying interest.

The total secondary market Treasury Bond/Bill transacted volume for 16 January was Rs. 17.83 billion.

Forex market

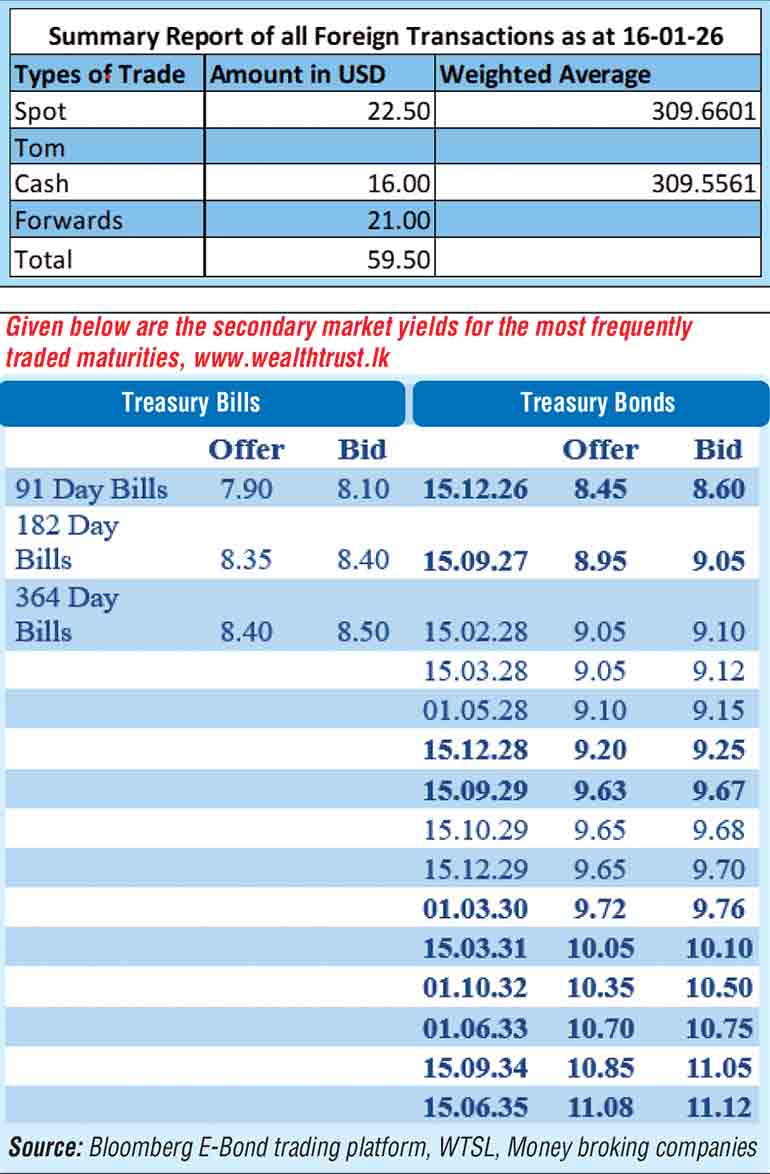

In the Forex market, the USD/LKR rate on spot contracts were seen closing the day at Rs. 309.72/309.77 as against its previous day’s closing level of Rs. 309.70/309.80.

The total USD/LKR traded volume for 16 January 2026 was $ 59.50 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)