Tuesday Feb 24, 2026

Tuesday Feb 24, 2026

Wednesday, 1 October 2025 00:14 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The overnight net liquidity surplus in the inter-bank money market surged to Rs. 198.79 billion yesterday, reaching the highest level since 05 June. An amount of Rs. 203.36 billion was deposited at Central Banks SDFR (Standing Deposit Facility Rate) of 7.25%, while an amount of Rs. 4.57 billion was withdrawn from Central Banks SLFR (Standard Lending Facility Rate) of 8.25%.

The weighted average rates on call money and repo were registered at 7.87% and 7.88% respectively.

Meanwhile, the Treasury Bills auction scheduled to be conducted today will have a total offered amount of Rs. 43 billion, an increase of Rs. 5.00 billion over the previous week. The auction will consist of Rs. 8.00 billion on the 91-day, Rs. 25.00 billion on the 182-day and Rs. 10.00 billion on the 364-day maturities.

For context, at the previous weekly Treasury Bill auction (held on 24 September) the weighted average yields remained unchanged. Accordingly, the rate on the 91-day, 182-day and 364-day tenors remained at 7.57%, 7.89% and 8.02% respectively. This marks the 10th week where T-Bill weighted averages have stayed mostly unchanged at auctions. In terms of subscription, 90.41% of the total offered amount was raised, with successful bids amounting to Rs. 34.35 billion against the Rs. 38.00 billion on offer in the first phase of competitive bidding. This marked the fifth consecutive auction that fell short of fully raising the targeted amount. Subsequent to the T-Bill auction an additional amount of Rs. 275 million was raised at the second phase.

The secondary Bond market remained largely subdued for a second consecutive day. Market participants adopted a watchful stance, leaving conditions at a virtual standstill for much of the session. Yields, however, edged up marginally during trading, with two-way quotes closing the day slightly up.

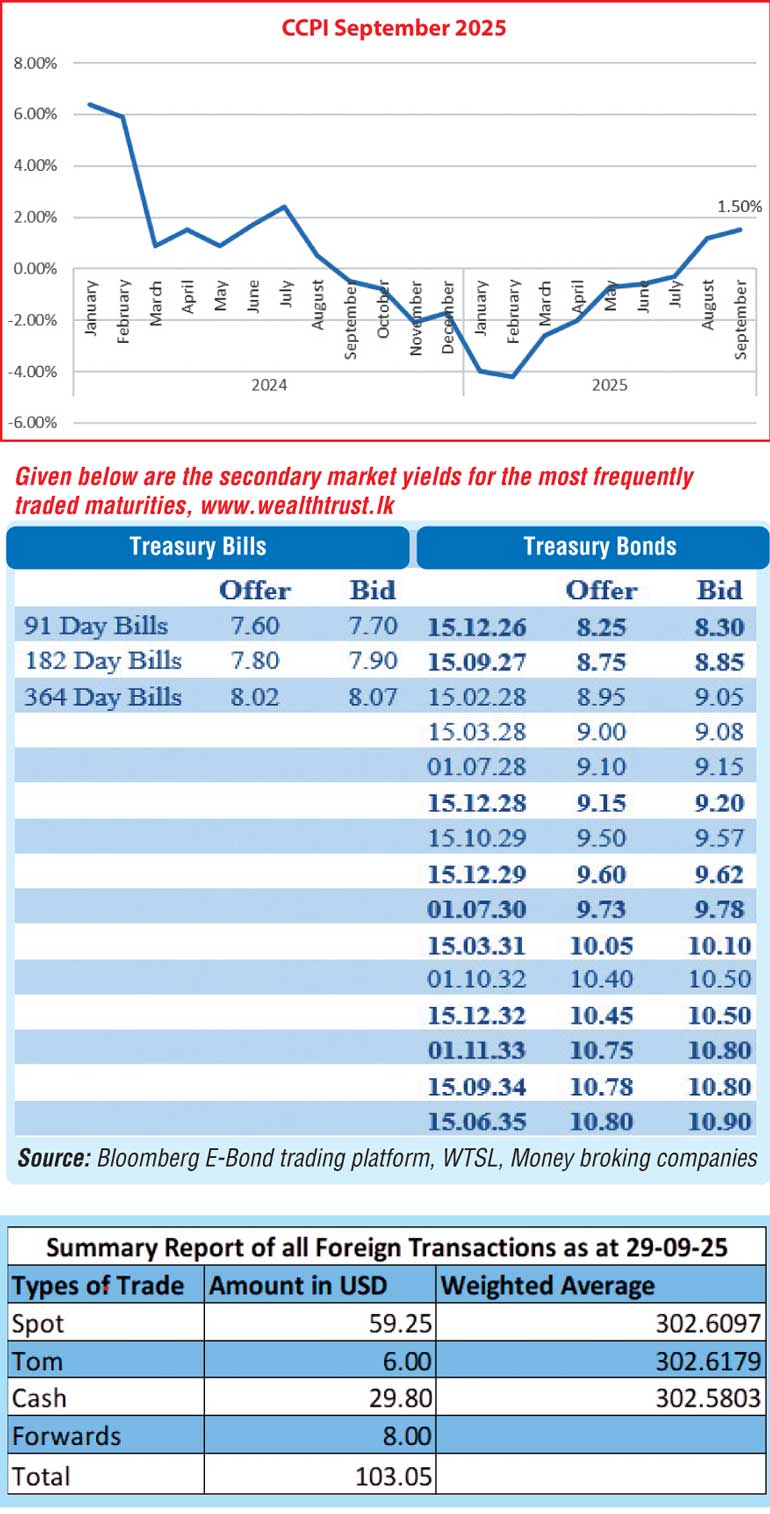

The 01.02.26 maturity traded at the rate of 8.00% and the 15.09.27 maturity was seen trading at the rate of 8.77%. The 15.03.28 and 01.05.28 maturities were seen trading at the rates of 9.05% and 9.10% respectively. The 15.06.29, 15.09.29 and 15.12.29 maturities were seen trading at the rates of 9.48%, 9.50% and 9.60% respectively. The 01.07.32 and 01.10.32 maturities were seen trading at the rates of 10.65% and 10.40% respectively. The 15.09.34 maturity traded between the rates of 10.82%-10.80%.

The Colombo Consumer Price Index (CCPI; Base 2021=100) for the month of September was recorded at a positive + 1.5% on its point to point. This is as against its previous month’s figure of + 1.20%, which was incidentally the first instance of positive inflation in 11 months up to that point. The annual average was registered at -1.4% as at September.

The total secondary market Treasury Bond/Bill transacted volume for 29 September was Rs. 2.30 billion.

Forex market

In the Forex market, the USD/LKR rate on spot contracts closed the day steady Rs. 302.55/302.60 unchanged against the previous day.

The total USD/LKR traded volume for 29 September was $ 103.05 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)