Thursday Feb 05, 2026

Thursday Feb 05, 2026

Thursday, 5 February 2026 03:46 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

In money markets, the net liquidity surplus surged to Rs. 266.13 billion on Tuesday, hitting the highest level in five years since 1 January 2021.

In money markets, the net liquidity surplus surged to Rs. 266.13 billion on Tuesday, hitting the highest level in five years since 1 January 2021.

Incidentally, this was also the largest surplus recorded since the economic crisis of 2022. An amount of Rs. 266.33 billion was deposited at Central Bank’s SDFR (Standing Deposit Facility Rate) of 7.25% as against an amount of Rs. 0.20 billion withdrawn from the Central Bank’s SDFR (Standing Deposit Facility Rate) of 8.25%.

The persistently elevated liquidity conditions have exerted a downward pressure on money market rates, accordingly the weighted average rates on overnight call money and Repo stood at 7.70% and 7.74% respectively.

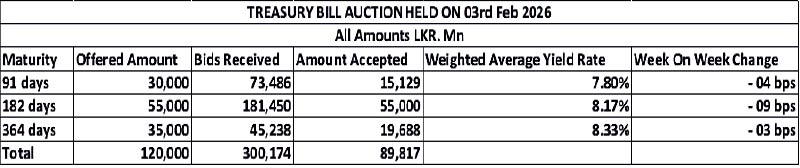

Against this backdrop the weekly Treasury Bill auction conducted on Tuesday registered a positive outcome and saw yields continue to trend downwards. Accordingly, weighted average rates registered declines across all maturities for the third consecutive week. The rate on 91-day Bill declined 4 basis points to 7.80%, while the rate on the 182-day Bill dropped 09 basis points to 8.17%. The 364-day Bill saw its yield ease by 03 basis points to 8.33%.

However, the auction was undersubscribed, raising only Rs. 89.82 billion or 74.85% out of the Rs. 120 billion offered. Total bids reached 2.50 times the offered amount.

The Phase II subscription across all three maturities is now open until 3.00 pm of business today at the WAYRs determined for the said ISINs at the auction.

The secondary Bond market also expressed positive sentiment. Traders were seen moving further along the yield curve, capitalising on the steepness. As a result, yields declined as investors targeted higher carry returns and roll-down potential on the belly end of the yield curve. Strong demand was observed on 2029-2033 tenors. This shift followed the persistently high liquidity surplus, which had already pushed short-end yields lower. Market activity and transaction volumes were seen at healthy levels.

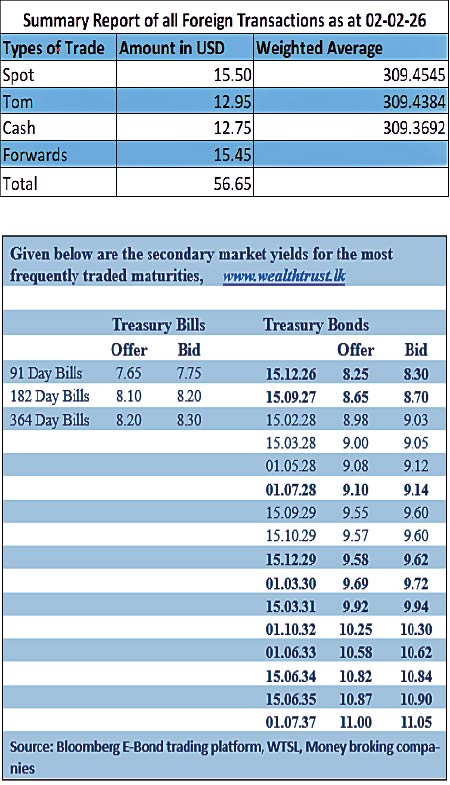

In terms of the Secondary Bond market trade summary, the 15.03.28 maturity was seen trading at the rates of 9.04%-9.02%. The 01.05.28 maturity traded at the rate of 9.10% and 01.09.28 maturity traded at the rate of 9.16%. The 15.06.29 maturity traded within the range of 9.53%-9.50% and the 15.09.29 maturity traded at the rate of 9.56% and the 15.10.29 was seen trading at the rate of 9.58%. The 01.03.30 maturity was seen trading at the rate of 9.70%. The 15.03.31 maturity traded within the range of 9.95%-9.92% and the 15.05.31 maturity traded at the rate of 10.04%. The 01.10.32 and 15.12.32 maturities were seen trading at the rates of 10.30% and 10.30%-10.29% respectively. The 01.06.33 maturity traded down the range of 10.65%-10.60%. The 15.06.34 maturity traded within the range of 10.85%-10.82%. The 15.06.35 maturity traded at the rate of 10.90%.

The total secondary market Treasury Bond/Bill transacted volume for 2 February was Rs. 13.40 billion.

Forex market

In the Forex market, the USD/LKR rate on spot contracts closed the day at 309.45/309.55, appreciating as against its previous day’s closing level of Rs. 309.55/309.65.

The total USD/LKR traded volume for 2 February was Rs. 56.65 million.

(References: Public Debt Management Office - Ministry of Finance, Central Bank of Sri Lanka, Bloomberg E-Bond Trading Platform, Money Broking Companies)