Sunday Feb 15, 2026

Sunday Feb 15, 2026

Thursday, 8 January 2026 00:02 - - {{hitsCtrl.values.hits}}

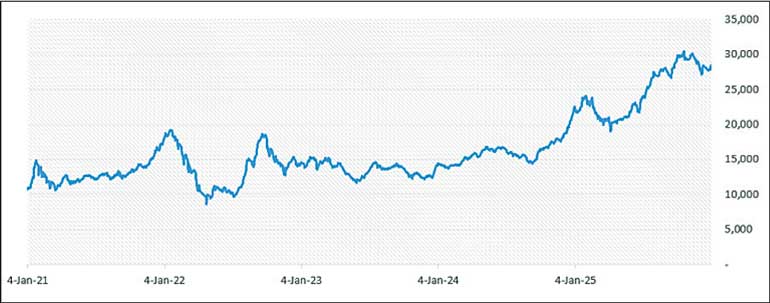

Movement of the MBSL Midcap Index

MBSL Midcap Index has been recalibrated for 2026 to aid investors who prefer growth but are prepared to withstand only conservative levels of volatility in their equity investments.

In a pioneering move, Merchant Bank of Sri Lanka and Finance PLC (MBSL) constructed a Stock market Index: the “MBSL MIDCAP Index”, which measures the aggregate price level and price movements of medium size companies listed on the Colombo Stock Exchange (CSE).

The index which came into operation in 1999 is revised annually and focus at the Middle Range Market Capitalisation, Liquidity and the Profitability of the firms to be included in the MBSL MIDCAP Index.

MBSL Midcap Index generates valuable signals for portfolio managers for switching from larger-cap more sensitive stocks to midcap less sensitive stocks with more growth potential in response to changing capital market conditions. The MBSL Midcap Index focus in profitability, helps to screen stocks with better future prospects that will cross to higher market capitalisation in the coming year.

MBSL MIDCAP Index which is in effect from 1 January 2026 and the criteria for selecting the twenty-five stocks of the index remained unchanged.

They are:

A. Middle Range Market Capitalisation as at 30 November 2025.

B. Liquidity based on number of trades during the year.

C. Profitability within the last two years.

When calculating the midcap index for the previous year (2025), stocks were selected from the market capitalization range of Rs. 4.9 billion to 49.07 billion and with the changes of ASPI the midcap range for the year 2026 as Rs. 8.45 billion to Rs. 84.5 billion.

Based on the above criteria the MBSL Midcap Index 2026 includes the following stocks representing nine sectors classified according to GICS industry group.

The banking sector is represented by Hatton National Bank PLC (X), Seylan Bank PLC, Seylan Bank PLC (X), DFCC Bank PLC, and National Development Bank PLC. In the Capital Goods sector, the constituents comprise ACL Cables PLC, Access Engineering PLC, Sierra Cables PLC, Royal Ceramics Lanka PLC, and Aitken Spence PLC. Ambeon Capital PLC represents the Consumer Durables and Apparel segment.

The Diversified Financials category includes Commercial Credit and Finance PLC, Central Finance Company PLC, Vallibel Finance PLC, First Capital Holdings PLC, and People’s Leasing & Finance PLC. Energy sector representation is through Lanka IOC PLC.

The Food, Beverage and Tobacco sector includes Lanka Milk Foods (CWE) PLC and Sunshine Holdings PLC. Insurance sector exposure is provided by Janashakthi Insurance PLC. The Materials sector consists of Chevron Lubricants Lanka PLC, Dipped Products PLC, and JAT Holdings PLC.

Real Estate Management and Development is represented by Prime Lands Residencies PLC and Overseas Realty (Ceylon) PLC.

Separately, changes to the list show a set of exclusions and new inclusions. The companies excluded are Citizens Development Business Finance PLC, CIC Holdings PLC, Ceylon Grain Elevators PLC, John Keells Holdings PLC, Hayleys Fabric PLC, TeeJay Lanka PLC, and Watawala Plantations PLC.

The new inclusions are Sierra Cables PLC, Aitken Spence PLC, Vallibel Finance PLC, Lanka IOC PLC, Janashakthi Insurance PLC, JAT Holdings PLC, and Prime Lands Residencies PLC.