Friday Feb 20, 2026

Friday Feb 20, 2026

Friday, 12 September 2025 00:20 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The Treasury Bond auctions conducted yesterday, where a total amount of Rs. 155 billion was on offer comprising three maturities, saw only the longer tenure maturities of 01.10.32 and 15.06.35 being fully subscribed at weighted average rates of 10.45% and 10.96%, respectively. The averages were within its pre-auction rates of 10.40/45 and 10.90/95. The two maturities will see a further amount of 10% on offer through its direct issuance window, until close of business of the day prior to settlement (i.e., 3 p.m. today).

However, the mid-term maturity of 01.07.2030 saw only an amount of Rs. 46.16 billion being taken up successfully in both phases (I and II) against an offered amount of Rs. 85 billion at a weighted average rate of 9.76%, also within the pre-auction rate of 9.70/80.

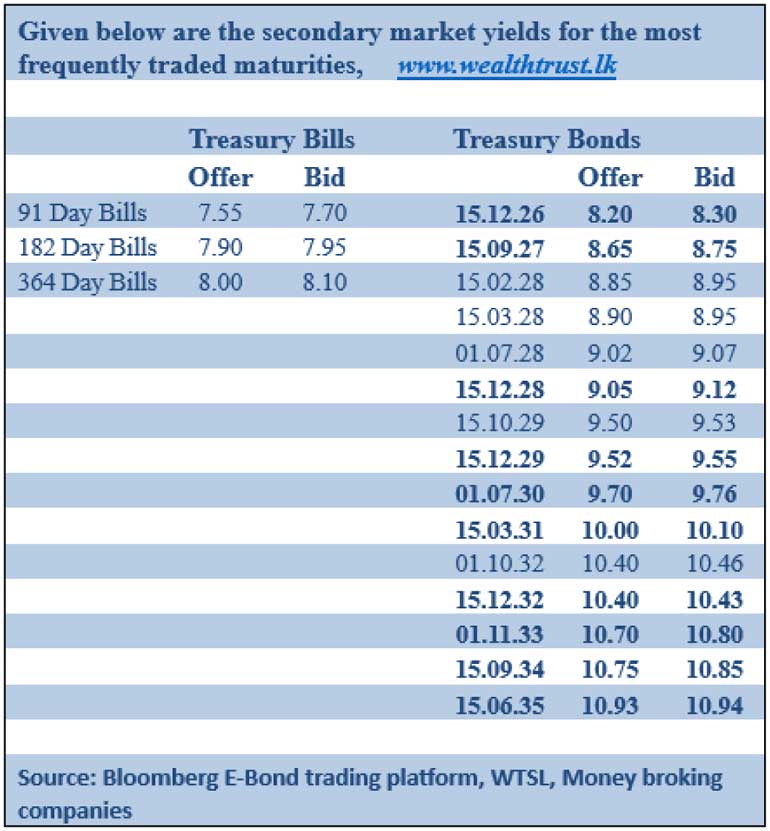

Meanwhile, the secondary Bond market was relatively quiet yesterday during the early trading hours, with two-way quotes in the secondary market holding broadly steady around pre-existing levels. The notable exception was the 15.12.32 maturity, which saw buying interest push its rates lower. However, following the release of auction results, the market witnessed a shift in momentum, with renewed buying interest driving rates lower across the board. This was accompanied by a notable pickup in activity and transaction volumes.

Earlier in the day, the 15.12.28 maturity was seen trading at the rate of 9.11% and the 15.12.32 traded at the rate of 10.40%. After the announcement of the results, the 15.09.29 and the 15.12.29 maturities were seen trading at the rates of 9.53%-9.50% and 9.55%-9.52%, respectively, on the back of a marked improvement in demand. The 15.05.30 maturity traded at the rate of 9.70% and the 01.07.30 maturity at 9.76%. The 15.06.35 maturity was seen changing hands at a level of 10.94%-10.95%.

The total secondary market Treasury Bond/Bill transacted volume for 10 August was Rs. 68.74 billion.

In money markets, the net liquidity surplus increased to Rs. 169.57 billion yesterday.

The weighted average rates on overnight call money and repo stood at 7.86% and 7.87%, respectively.

Forex market

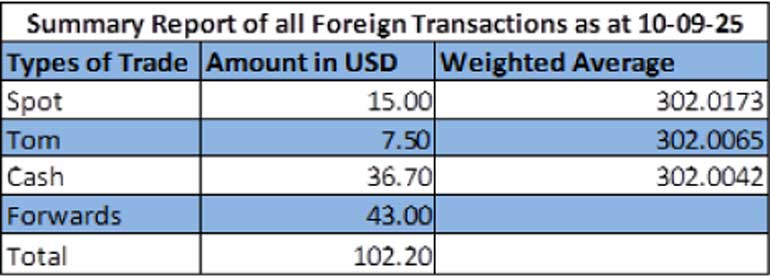

In the Forex market, the USD/LKR rate on spot contracts closed the day appreciating to Rs. 301.85/301.95, as against Rs. 301.98/302.02 the previous day.

The total USD/LKR traded volume for 10 August was $ 102.20 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)