Monday Feb 23, 2026

Monday Feb 23, 2026

Wednesday, 10 September 2025 04:38 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

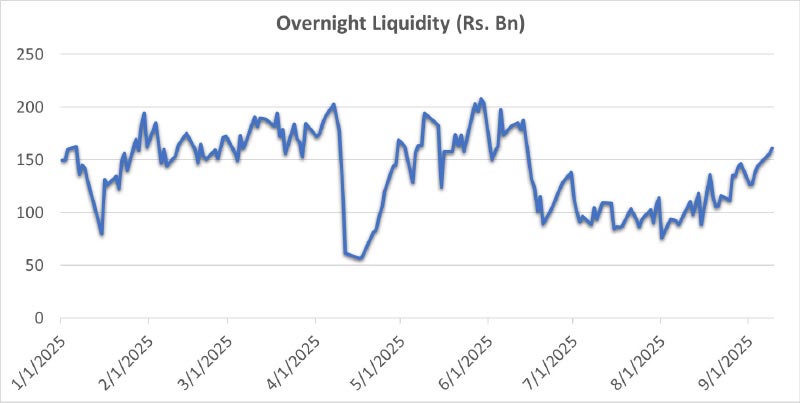

The net liquidity surplus in money market was recorded at Rs. 160.88 billion yesterday, surging to hit the highest level in almost three months (since 13 June) with an amount of Rs. 161.26 billion was deposited at Central Bank’s SDFR (Standard Deposit Facility Rate) of 7.25%. The weighted average rates on call money and repo were registered at 7.86% and 7.87% respectively.

The net liquidity surplus in money market was recorded at Rs. 160.88 billion yesterday, surging to hit the highest level in almost three months (since 13 June) with an amount of Rs. 161.26 billion was deposited at Central Bank’s SDFR (Standard Deposit Facility Rate) of 7.25%. The weighted average rates on call money and repo were registered at 7.86% and 7.87% respectively.

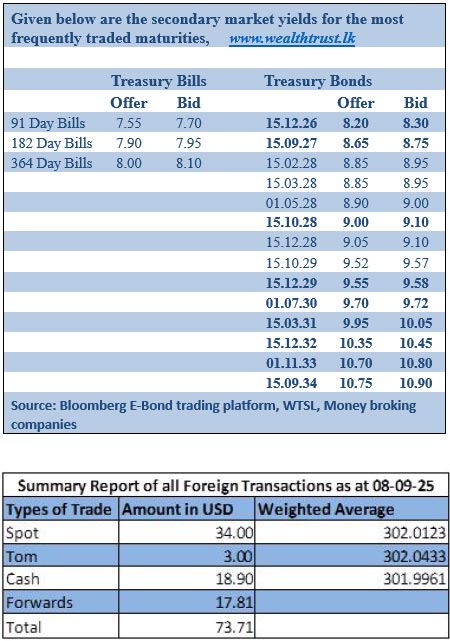

Meanwhile, the Treasury Bills auction scheduled to be conducted today will have a total offered amount of Rs. 77 billion, a marginal increase of Rs. 3.00 billion over the previous week. The auction will be consisting of Rs. 12.00 billion on the 91-day, Rs. 40.00 billion on the 182-day, and Rs. 25.00 billion on the 364-day maturities.

For context, at the weekly Treasury Bill auction held on Wednesday, 03 September, the Weighted average yields remained unchanged across all three maturities, with the 91-day, 182-day, and 364-day bills holding steady at 7.58%, 7.89%, and 8.03%, respectively. However, only an amount of Rs. 49.66 billion was successfully raised against the total offered amount of Rs. 74.00 billion.

The Secondary Bond market yesterday experienced a marginal pick-up in yields. However, the market continued to remain subdued for a second consecutive day, with activity and transaction volumes persisting at muted levels. Trading was limited to sparse deals concentrated on a few selected maturities.

The 01.07.28 traded at the rate of 9.00%. The 15.09.29 and 15.12.29 maturities were seen trading at the rates of 9.50%-9.55% collectively. The 15.05.30 and 01.07.30 maturities traded at the rates of 9.63%-9.64% and 9.70% respectively.

Nevertheless, the secondary market Bill which has experienced a pick-up in activity in recent times, remained active. The January 2026 maturities were seen trading at the rates of 7.85%-7.90% and the March 2026 at the rates of 7.93%.

The total secondary market Treasury Bond/Bill transacted volume for 8 September was Rs. 9.17 billion.

Forex Market

In the Forex market, the USD/LKR rate on spot contracts closed the day steady Rs. 301.97/302.05 as against

Rs. 301.97/302.05 the previous day.

The total USD/LKR traded volume for 08 September was $ 73.71 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)