Sunday Feb 22, 2026

Sunday Feb 22, 2026

Wednesday, 14 January 2026 05:28 - - {{hitsCtrl.values.hits}}

InsureMe, one of Sri Lanka’s leading insurance intermediary and InsurTech-enabled risk solutions provider, has further strengthened its market offering with the receipt of a Reinsurance Broking Licence from the Insurance Regulatory Commission of Sri Lanka (IRCSL).

InsureMe, one of Sri Lanka’s leading insurance intermediary and InsurTech-enabled risk solutions provider, has further strengthened its market offering with the receipt of a Reinsurance Broking Licence from the Insurance Regulatory Commission of Sri Lanka (IRCSL).

This positions InsureMe among a select group of intermediaries in the country authorised to provide both insurance and reinsurance broking services, reinforcing its role as a strategic risk partner to insurers and corporate clients navigating increasingly complex risk environments.

The reinsurance licence enables InsureMe to directly structure and place reinsurance programs for Sri Lankan insurers and large-scale corporate clients, facilitating access to global reinsurance markets, including specialist and Lloyd’s markets. This is particularly significant in the current operating landscape, where heightened exposure to large, complex, and catastrophic risks has increased the need for sophisticated risk transfer mechanisms beyond local insurer capacity.

InsureMe’s reinsurance capability is built on an integrated service model, combining insurance placement, reinsurance structuring, and risk advisory under one platform. The company has already arranged reinsurance placements for local insurers, enabling effective management of high-value risks while ensuring regulatory compliance, cost efficiency, and continuity of coverage.

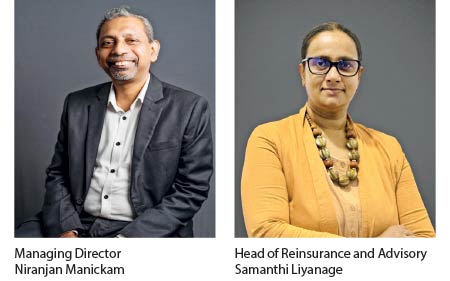

InsureMe Managing Director Niranjan Manickam said: “Reinsurance is no longer a back-end function, and is a strategic enabler of resilience. Being a licenced reinsurance intermediary InsureMe is positioned to support insurers and corporates with technically sound, globally benchmarked reinsurance solutions. Our focus is on designing structures that are not only compliant, but commercially optimised and responsive to today’s evolving risk landscape.”

The company’s reinsurance operations are supported by a technical team with combined experience of over 50 years in Insurance and Reinsurance with deep expertise across general insurance classes, including fire, engineering, marine, liability, Cyber and specialty risks. Central to this capability is InsureMe Insurance Broker Head of Reinsurance and Advisory Samanthi Liyanage, who brings over 20 years of experience in the general insurance industry, including a distinguished 17-year career in underwriting and management roles at leading insurance companies.

Liyanage said, “Direct engagement with a reinsurance broker gives insurers and corporates access to global capacity, technical structuring expertise, and stronger claims advocacy. Our role is to ensure risks are correctly assessed, programs are optimally designed, and clients are protected with certainty, particularly for large, complex, or capital-intensive projects.”

The ability to engage in reinsurance activities strengthens InsureMe’s value proposition to Sri Lankan corporates undertaking large infrastructure, manufacturing, or export-oriented projects, where local underwriting capacity alone may be insufficient. Through layered and structured reinsurance programs, InsureMe enables access to international capacity while maintaining competitive pricing and professional claims support.

This development follows InsureMe’s recent listing on the Colombo Stock Exchange, underscoring the company’s continued focus on governance, regulatory compliance, and long-term institutional growth. Together, the public listing and reinsurance licence marks a significant step in InsureMe’s evolution from a sole insurance intermediary to a comprehensive risk solutions partner serving both domestic and international markets.