Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Monday, 18 August 2025 00:18 - - {{hitsCtrl.values.hits}}

The Insurance Regulatory Commission of Sri Lanka (IRCSL) says the insurance industry has demonstrated resilience from 2020 through early 2025, successfully navigating the economic challenges caused by the COVID-19 pandemic and the severe economic crisis of 2022.

Despite these hurdles, the sector remained stable, reaffirming its commitment to protecting policyholders and ensuring business continuity, the IRCSL said in a performance review of the insurance sector from 2020 to the first quarter of 2025. The review is reproduced as follows:

In 2024, both life and general insurance sectors recorded improvements supported by proactive regulatory measures from the IRCSL. Over the past five years, the industry has made significant progress toward sustainability, with the positive momentum continuing into the first quarter of 2025, marked by a steady increase in Gross Written Premiums (GWP).

These developments highlight the insurance sector’s vital contribution to Sri Lanka’s economic recovery and emphasise the ongoing need for innovation and regulatory support to expand insurance coverage across all communities.

As of 31 March 2025, 15 companies were operating in the Long-Term (Life) Insurance sector, while 14 companies were engaged in the General Insurance sector.

Gross Written Premium (GWP)

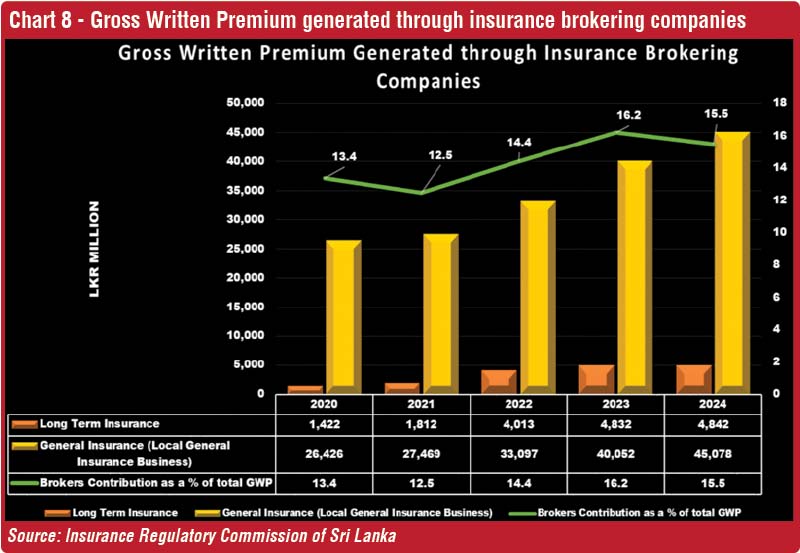

Chart 1 highlights the performance of the insurance industry from 2020 to 2024. Total GWP increased significantly, reaching Rs. 322,037 million in 2024 compared to Rs. 208,265 million in 2020, representing an impressive growth of 54.6%.

The Long-Term (Life) Insurance sector saw a notable rise in GWP, growing from Rs. 103,000 million in 2020 to Rs. 183,875 million in 2024. This steady increase reflects the sector’s growing appeal and the rising demand for long-term financial security among policyholders.

Similarly, the General Insurance sector experienced growth during this period, with GWP increasing from Rs. 105,265 million in 2020 to Rs. 138,162 million in 2024. This upward trend signifies enhanced public awareness and a wider acceptance of insurance products throughout Sri Lanka.

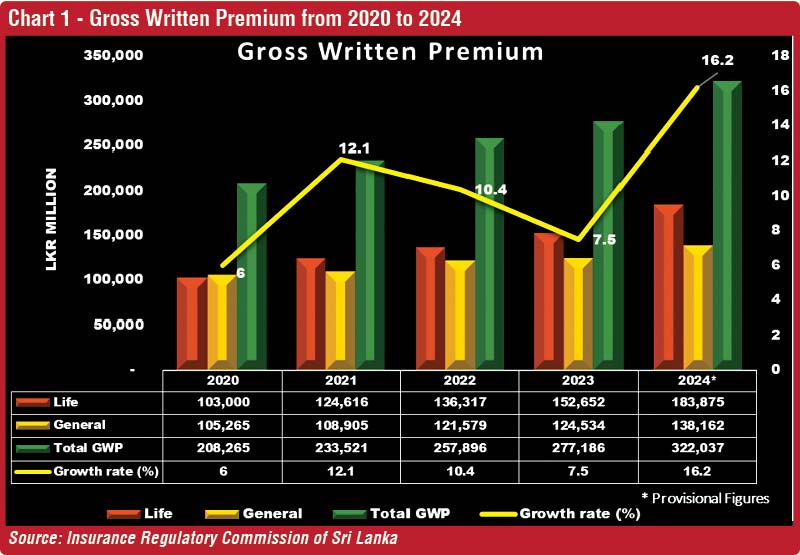

As shown in Chart 2, the Gross Written Premium for the first quarter of 2025 stood at Rs. 92,229 million, marking a 10.61% increase compared to Rs. 83,384 million recorded in the first quarter of 2024. This reflects a year-on-year growth of Rs. 8,845 million.

The Long-Term Insurance Business contributed significantly to this increase, registering a GWP of Rs. 51,056 million in Q1 2025, a substantial growth of 21.40% from Rs. 42,058 million in the corresponding quarter of 2024.

Conversely, the General Insurance Business recorded a marginal decline, with GWP at Rs. 41,172 million in the first quarter of 2025, representing a slight decrease of 0.37% compared to Rs. 41,326 million during the same period in 2024.

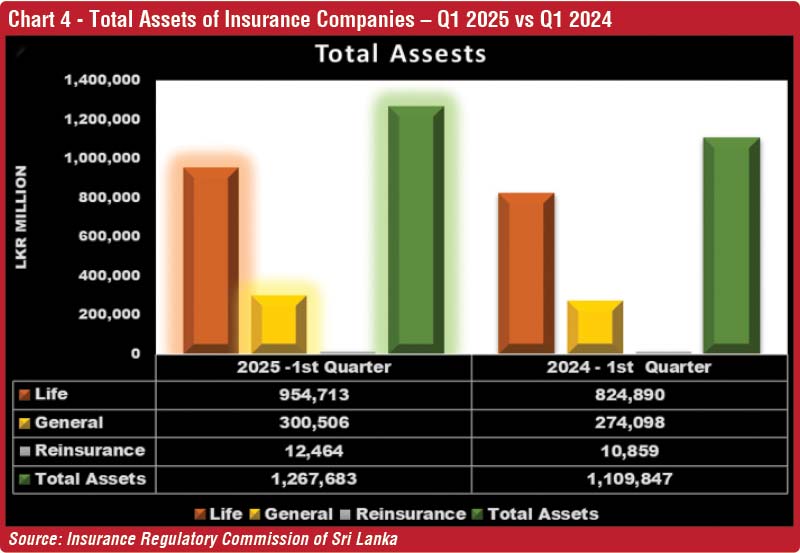

Total assets

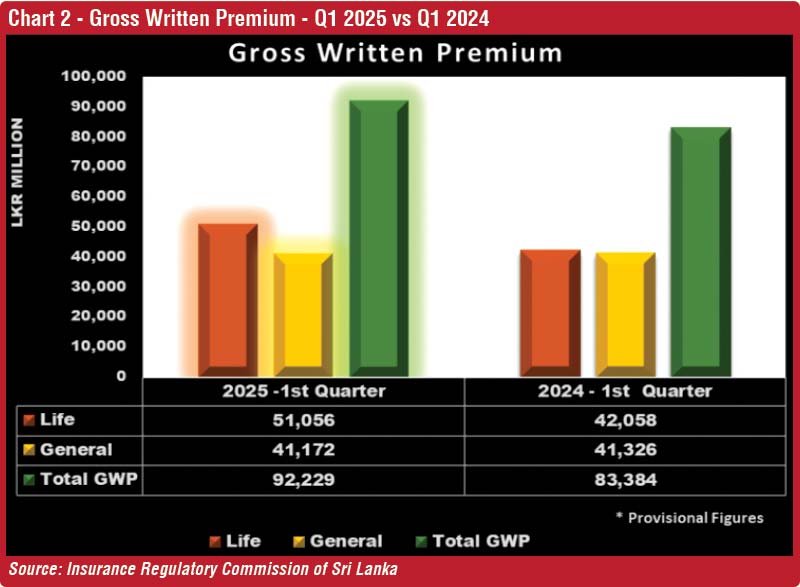

Chart 3 illustrates the total assets of insurance companies in Sri Lanka from 2020 to 2024. The industry’s total assets grew significantly, rising from Rs. 796,411 million in 2020 to Rs. 1,219,269 million by the end of 2024.

The Long-Term (Life) Insurance sector experienced substantial asset growth, increasing from Rs. 562,706 million in 2020 to Rs. 921,171 million in 2024. Meanwhile, the General Insurance sector saw a moderate increase, with assets growing from Rs. 227,640 million in 2020 to Rs. 286,355 million in 2024.

Year-on-year asset growth rates reflect a consistently positive upward trend, highlighted by a notable increase of 19.3% in 2023. Although growth was more moderate in 2022 and 2024, steady asset accumulation was maintained across the sector with annual growth rates of 14.3% in 2020, 11.7% in 2021, 6.8% in 2022, and 7.6% in 2024, supporting sustained overall growth.

As presented in Chart 4, total assets further increased to Rs. 1,267,683 million in the first quarter of 2025, representing a robust 14.22% growth compared to Rs. 1,109,847 million in Q1 2024. Assets in the Long-Term Insurance Business grew by 15.74%, reaching Rs. 954,713 million, up from Rs. 824,890 million in the same period last year. The General Insurance Business also recorded asset growth of 9.63%, with assets totalling Rs. 300,506 million compared to Rs. 274,098 million in Q1 2024.

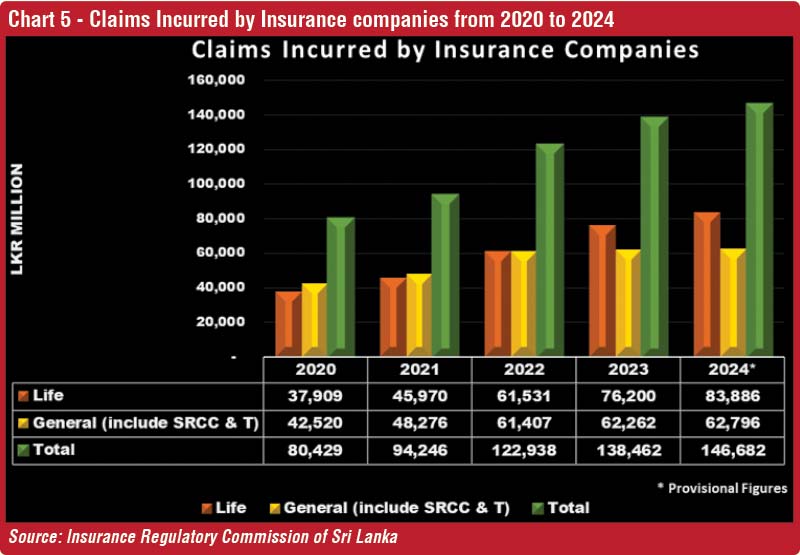

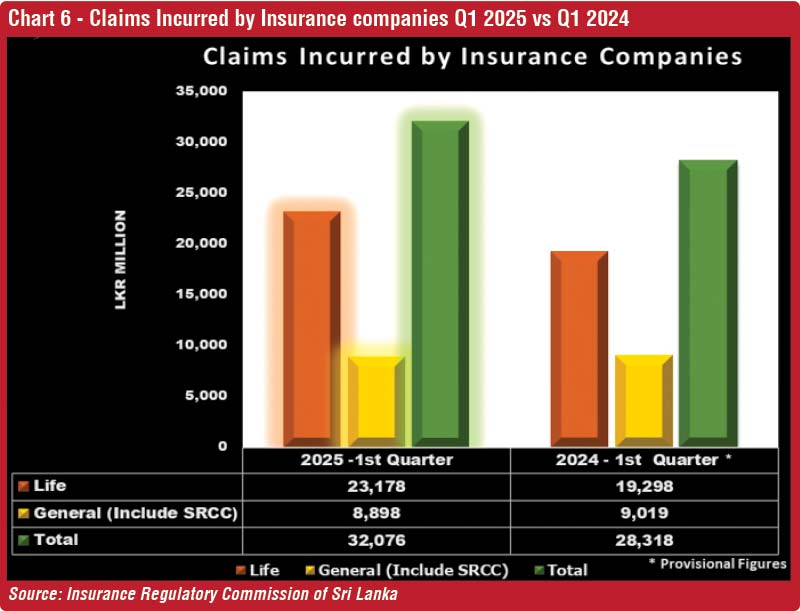

Claims incurred by insurance companies

Chart 5 presents an analysis of claims incurred by insurance companies in Sri Lanka from 2020 to 2024. The Life Insurance segment experienced steady and significant growth in claims, rising from Rs. 37,909 million in 2020 to Rs. 83,886 million in 2024. This represents a substantial increase of 121.3% over five years, reflecting heightened reliance on life insurance products and a corresponding rise in policyholder benefit payments.

Claims incurred in the General Insurance sector showed notable fluctuations during this period. Starting at Rs. 42,520 million in 2020, claims increased to Rs. 48,276 million in 2021, followed by a sharp rise to Rs. 61,407 million in 2022. The upward trend continued more moderately in 2023 and 2024, with claims reaching Rs. 62,262 million and Rs. 62,796 million, respectively. Overall, total claims grew by approximately 82.4%, from Rs. 80,429 million in 2020 to Rs. 146,682 million in 2024.

As detailed in Chart 6, total claims incurred by both Long-Term and General Insurance businesses in the first quarter of 2025 amounted to Rs. 32,076 million, marking a 13.27% increase compared to Rs. 28,318 million in Q1 2024. Claims from the Long-Term Insurance Business, including maturity and death benefits, rose by 20.11% to Rs. 23,178 million, up from Rs. 19,298 million in the same period last year. Conversely, claims from the General Insurance Business, covering Motor, Fire, Marine, and other lines, recorded a slight decrease of 1.34%, totalling Rs. 8,898 million compared to Rs. 9,019 million in Q1 2024.

These figures highlight the growing financial responsibilities borne by the insurance sector in meeting policyholder needs and underscore the importance of sustained operational resilience within the industry.

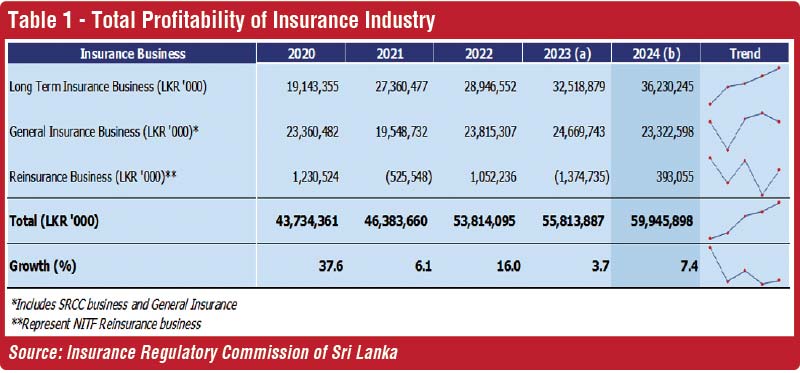

Profit (Before Tax) of insurance companies

The industry posted a robust profit before tax growth of 37.06% in 2020, reflecting strong performance despite challenging conditions. In 2021, profit growth slowed to 6.1% and the year 2022 marked a solid rebound, with profit before tax increasing by 16.0%. Growth moderated in 2023 to 3.7%, largely supported by the Long-Term Insurance segment, while 2024 saw a gradual improvement with profits rising by 7.4%.

It is noteworthy that the reinsurance segment, recovering from previous losses, reported a profit of Rs. 393 million in 2024, improving significantly from a loss of Rs. 1,375 million in 2023.

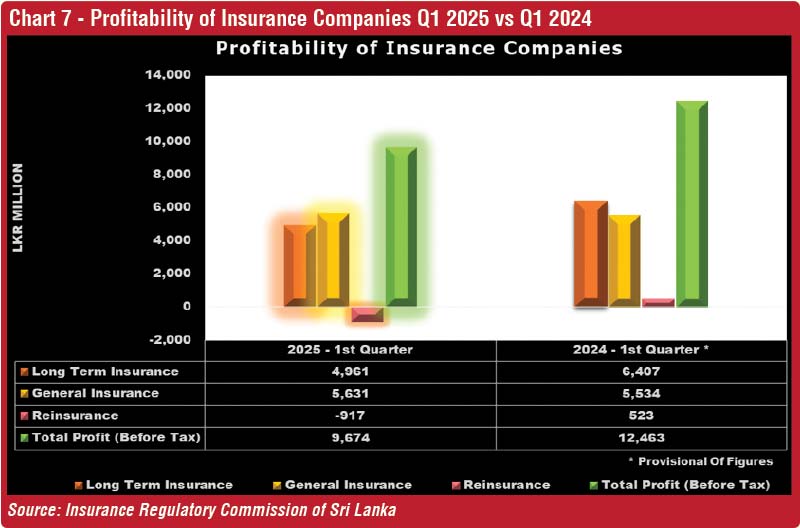

As shown in Chart 7, the insurance industry recorded a noticeable decline in total Profit Before Tax (PBT) in the first quarter of 2025 compared to the same period in 2024.

The Long-Term Insurance Business experienced a decrease in PBT, falling from Rs. 6,407 million in Q1 2024 to Rs. 4,961 million in Q1 2025, representing a decline of 22.57%. Meanwhile, the General Insurance Business saw a modest increase, with PBT rising from Rs. 5,534 million in Q1 2024 to Rs. 5,631 million in Q1 2025, an increase of 1.75%.

Insurance brokering companies and Gross Written Premiums

As of 31 March 2025, a total of eighty-two (82) insurance brokering companies were registered with the Insurance Regulatory Commission of Sri Lanka (IRCSL).

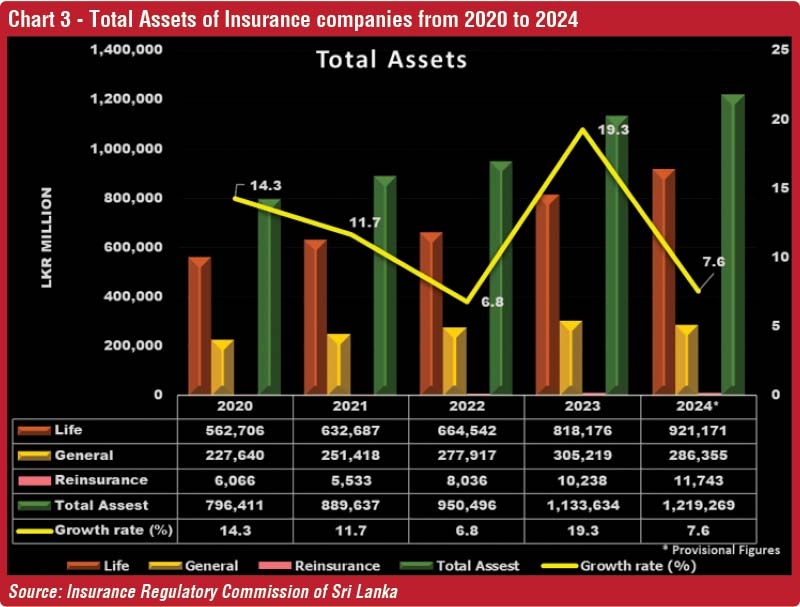

Chart 8 outlines the Gross Written Premium generated through insurance brokering companies over the last five years from 2020 to 2024.

The GWP generated through insurance brokers has shown a steady and robust increase, underscoring their growing significance within Sri Lanka’s insurance market. In 2024, brokers facilitated a total GWP of Rs. 49,920 million across both General and Long-Term Insurance businesses, representing a substantial increase of Rs. 22,072 million compared to Rs. 27,848 million in 2020. This marks an impressive growth of 79.3% over the five-year period.

This strong upward trend highlights brokers’ expanding market share, particularly in the General Insurance sector, reflecting their vital role in enhancing insurance accessibility and penetration across the country.