Friday Feb 20, 2026

Friday Feb 20, 2026

Monday, 19 January 2026 04:42 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The secondary Bond market began last week on a cautious and subdued note, as participants largely stayed on the side-lines ahead of the Treasury Bond auction, reflecting a wait-and-see approach. Following the Bond auction, yields moved higher as initial market positioning adjusted to the outcome. Post-auction, yields re-priced higher as the newly issued Bonds cleared at levels above market expectations, specifically on the medium tenors offered. This prompted an initial bearish adjustment in the secondary curve as participants reassessed fair value. However, this uptick proved short-lived, with renewed and increasingly aggressive buying interest emerging quickly, effectively containing further upward pressure on yields, setting the stage for a broader recovery.

The secondary Bond market began last week on a cautious and subdued note, as participants largely stayed on the side-lines ahead of the Treasury Bond auction, reflecting a wait-and-see approach. Following the Bond auction, yields moved higher as initial market positioning adjusted to the outcome. Post-auction, yields re-priced higher as the newly issued Bonds cleared at levels above market expectations, specifically on the medium tenors offered. This prompted an initial bearish adjustment in the secondary curve as participants reassessed fair value. However, this uptick proved short-lived, with renewed and increasingly aggressive buying interest emerging quickly, effectively containing further upward pressure on yields, setting the stage for a broader recovery.

The recovery gathered momentum on Tuesday. Although yields edged higher during initial trading hours, the tone shifted decisively after the Treasury Bill auction results, which provided a supportive signal to the broader rates market. As the increase in rates at the auction expressed a notable deceleration in the pace of increases, suggesting emerging signs of yield stabilisation. As a result, buying interest resurfaced strongly on Bonds at the recently elevated yield levels, triggering a reversal in yields and reinforcing the market’s recovery.

By Wednesday, the recovery was firmly entrenched. The market opened on a markedly stronger footing, with yields continuing to drop from their intraday highs amid sustained demand. Trading activity and transaction volumes increased significantly, accompanied by a noticeable improvement in market depth. Multiple sizeable block trades were executed, pointing to balance-sheet driven demand and strategic accumulation by market participants locking in higher yield thresholds. This flow dynamic reinforced the downward bias in yields and consolidated the recovery as the week progressed. On Friday, yields were seen consolidating on the back of slim trade amidst the holiday shortened week across most of the curve, but the 15.06.35 maturity continued to see concentrated interest and rates dropped further on that maturity.

Despite the intra-week recovery and improved market tone, yields ultimately closed higher on a week-on-week basis, reflecting the residual impact of the post-auction re-pricing.

In terms of the secondary Bond market trade summary:

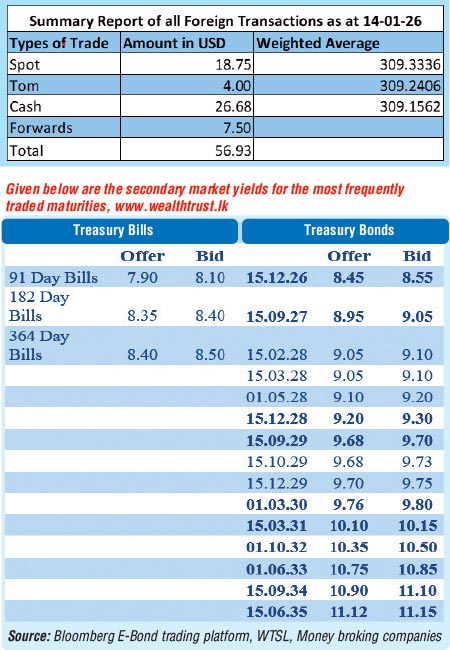

During the week, the 15.05.26 and 01.06.26 maturities traded within the range of 8.42%–8.40%. The 01.05.27 maturity traded at 9.05%, while the 15.09.27 maturity traded at 9.00%.

Moving into the 2028 tenors, the 15.03.28 maturity initially traded up from 9.09% to a post-auction high of 9.18%, before easing to trade down the range of 9.15%–9.10% as buying interest re-emerged. The 01.05.28 maturity traded at 9.20%, while the 01.07.28 maturity traded down the range of 9.40%–9.22%. The 15.10.28 maturity traded down the range of 9.35%–9.25%, and the 15.12.28 maturity traded down from 9.35% to 9.30%. The 01.09.28 maturity traded at 9.22%.

Further along the curve, the 15.06.29 maturity traded within 9.65%–9.60%. The 15.09.29 maturity traded within 9.70%–9.61%, while the 15.10.29 maturity traded within 9.72%–9.63%. The 15.12.29 maturity traded up from 9.62% to 9.70% post-auction before trading down from intraday highs to lows of 9.85%–9.71% as the recovery gained traction.

On the medium-to-long end, the 01.03.30 maturity traded at 9.75%, while the 15.05.30 maturity traded up the range of 9.75%–9.80%. The 15.03.31 maturity traded within 10.22%–10.15%. At the long end, the 15.06.35 maturity traded down the range of 11.25%–11.10%, supported by strong concentrated demand and sizeable transaction volumes

The Bond auctions conducted last Monday (12 January) successfully raised 90.14% or Rs. 184.79 billion out of the Rs. 205 billion total offered amount across four available maturities. Maturity wise, the short end and the long end of the offered maturities saw rates anchored at market levels and in line with pre-auction rates. However, the middle tenors offered, exhibited an uptick compared to market levels.

The shorter tenor 01.03.30 maturity was issued at a weighted average of 9.74% and the maturity wise offered amount was fully raised at the first phase in competitive bidding. This was in line with market expectations as yields settled neatly between comparable maturities.

The 01.06.33 maturity was also fully subscribed at the 1st phase and was issued at the weighted average rate of 10.65%. This was above market expectations.

The 15.06.35 maturity went undersubscribed at the first and second phases; maturity and was issued at the weighted average of 11.08%. This was well above market levels as the maturity was quoted at the rate of 10.73%/10.77% pre-auction.

The 15.08.39 maturity again was fully subscribed and was issued at the weighted average rate of 11.09%. This not only displayed a very narrow term premium over the 15.06.35 tenor but also came in line with pre-auction market levels.

At the weekly Treasury Bill auction held last Wednesday (13 January), weighted average yields recorded an upwards movement for a fourth consecutive week, albeit witnessing a moderation in the increasing momentum. Accordingly, the weighted average yield on the 91-day bill rose by 7 basis points to 7.95% and the 364-day increased by 1 basis point to 8.48% respectively. The weighted average on the 182-day remained steady at 8.44%. The auction was marginally undersubscribed, raising 96.43% or Rs. 96.43 billion out of the Rs. 100 billion offered, reflecting a relatively increased take up from the recent past.

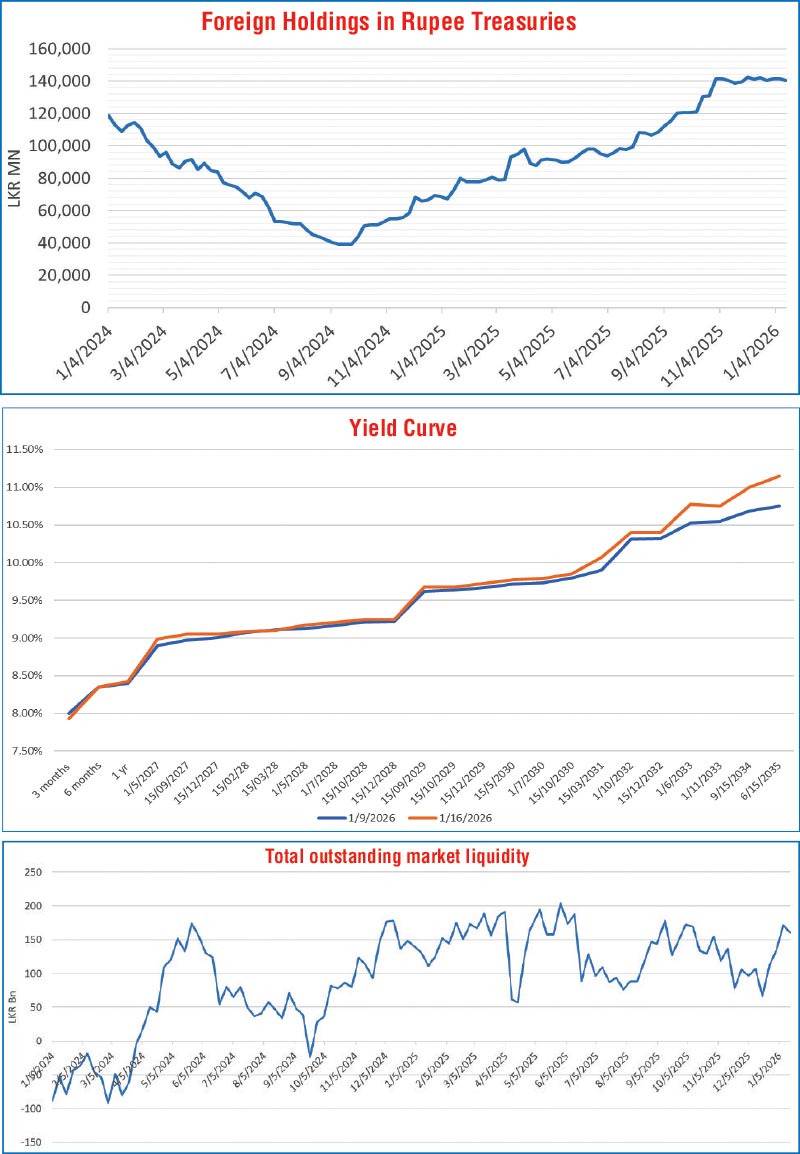

Meanwhile, the foreign holdings of rupee-denominated Government securities recorded a net outflow, amounting to Rs. 948 million. Consequently, the total holdings reduced to Rs. 140.475 billion during the week ending 14 January.

The daily secondary market Treasury Bond/Bill transacted volumes for the first three days of the week averaged at Rs. 41.33 billion.

In the money market, the total outstanding liquidity surplus in the inter-bank money market stood at Rs. 160.19 billion as at the week ending 16 January 2026, from Rs. 171.03 billion recorded the previous week. The weighted average interest rates on call money and repo were recorded within the ranges of 7.94%-7.96% and 7.97%-7.99% respectively while the Central Bank of Sri Lanka’s (CBSL) holding of Government Securities was registered at Rs. 2,508.92 billion as at 16 January, unchanged against the previous week’s closing level.

Forex market

In the forex market, the USD/LKR rate on spot contracts was seen closing the week depreciating to Rs. 309.70/309.80 as against the previous week’s closing level of Rs. 309.00/309.30. This was subsequent to trading at a high of Rs. 308.95 and a low of Rs. 309.86.

The daily USD/LKR average traded volume for the first three trading days of the week stood at $ 81.25 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)