Tuesday Feb 24, 2026

Tuesday Feb 24, 2026

Friday, 28 November 2025 04:25 - - {{hitsCtrl.values.hits}}

Gold prices began climbing sharply back in 2024 as central banks and investors alike turned to the precious metal as a safe haven amid mounting geopolitical tensions and global economic uncertainty.

While some countries accelerated their gold purchases to strengthen reserves, others seized the opportunity to cash in on elevated prices by selling significant volumes.

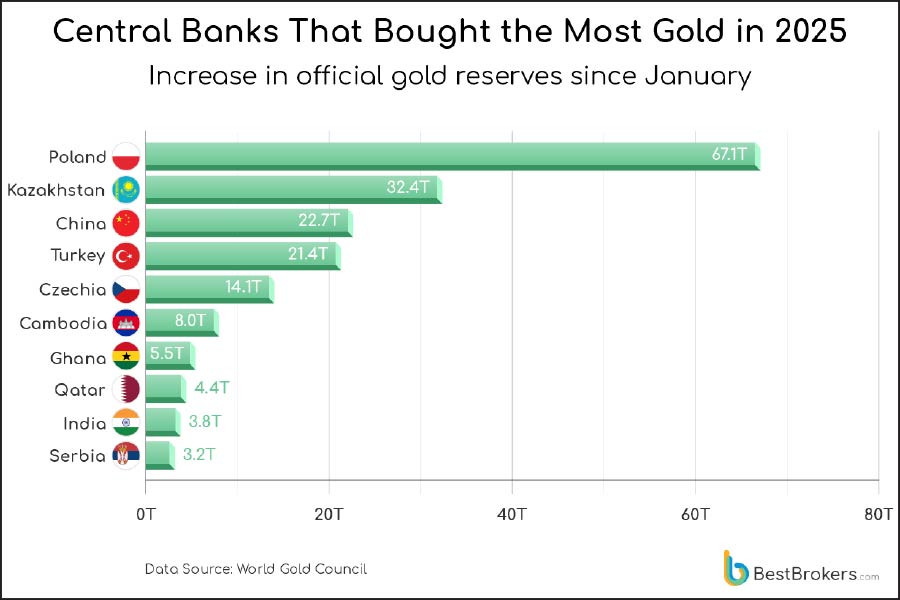

The team at BestBrokers has analysed the World Gold Council’s November 2025 release, covering all of the available data for 2025, to identify the world’s largest buyers and sellers of gold during this period.

As of 19 November, gold prices climbed to $ 4,135.80 per ounce, reversing nearly a month of lows. At this level, the combined value of global gold reserves stands at approximately $ 4.83 trillion, an increase of 44.66% since December 2024, when gold traded at $ 2,609.10 per ounce. While Poland and Kazakhstan have been the most active buyers so far in 2025, China’s renewed accumulation may shift the global picture, with reported purchases of 1.2 tons in September and 900 kilograms more in October.

Here are a few key takeaways from the report:

nAlthough Poland remains the largest buyer of gold in 2025 with 67.1 tons added year-to-date, its most recent confirmed purchase dates back to May, when the Narodowy Bank Polski (NBP) increased its holdings by 6.2 tons. Since then, no credible or official data has indicated further accumulation. Even without new purchases, the surge in global prices has lifted the value of Poland’s gold reserves to $ 68.52 billion, a 66.57% increase compared with 2024.

nKazakhstan was the largest net gold buyer in Q3, expanding its gold reserves by 18 tons to a total of 324 tons and positioning itself as the second-largest accumulator of 2025 so far. Up to August, the National Bank of Kazakhstan had already purchased 32.4 tons. With a reported additional 8 tons in September, its total net purchases for the first three quarters of the year rise to approximately 40.4 tons.

nChina’s gold purchases of 1.2 tons in September and 0.9 tons in October bring its total net acquisitions for 2025 to approximately 35.5 tons, including the 32.4 tons reported up to August. This signals a steady continuation of its accumulation strategy, although the year-to-date purchases remain well below those of Poland and Kazakhstan. In terms of total reserves, China ranks sixth globally, holding 2,303.5 tons of gold.

nThe United States continues to hold the title of the world’s largest gold reserve, with 8,133 tons valued at $ 1.08 trillion, while Switzerland leads on a per capita basis, with each citizen theoretically owning the equivalent of 37 gold coins.

BestBrokers lead data analyst Paul Hoffman said: “Global gold reserves reaching $ 4.83 trillion in November 2025 highlight the ongoing central-bank accumulation trend, with Poland and Kazakhstan dominating 2025 purchases while China’s measured additions in September and October suggest a potential ramp-up before year-end. If this pattern continues, central-bank buying could sustain elevated gold prices into 2026, particularly as top holders like China and mid-tier buyers recalibrate portfolios amid currency diversification strategies and cautious responses to evolving US monetary policy.” See full report at https://www.bestbrokers.com/gold-brokers/golds-2024-rally-mapping-central-banks-demand-for-the-precious-metal-in-2024/