Wednesday Feb 25, 2026

Wednesday Feb 25, 2026

Tuesday, 21 October 2025 03:25 - - {{hitsCtrl.values.hits}}

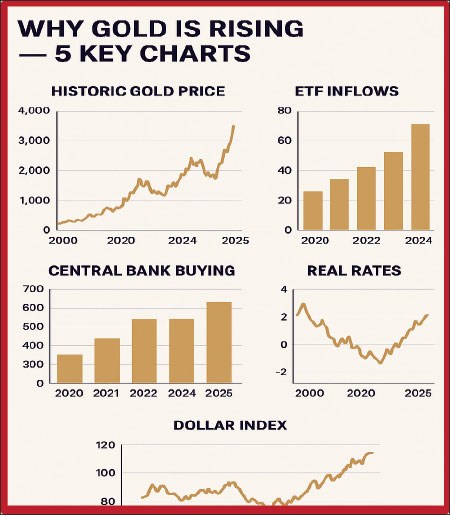

Gold has entered a historic rally in 2025, driven by a mix of geopolitics, expectations of lower policy rates, record central-bank buying, ETF inflows and de-dollarisation. Analysts offer scenario ranges (many now price gold well above $4,000/oz and some see $4,400–4,600/oz by mid-2026), but outcomes depend on real interest rates, Fed policy, and geopolitical shocks. For gold merchants the immediate priorities are liquidity, risk controls, and trusted sourcing. For the general public—especially in gold-centric cultures like Sri Lanka and India—the prudent moves are to protect purchasing power through staged purchases, diversify savings, and be very careful with leverage. Below is a detailed, publication-ready article with data-backed drivers, scenarios and practical strategies.

Gold has entered a historic rally in 2025, driven by a mix of geopolitics, expectations of lower policy rates, record central-bank buying, ETF inflows and de-dollarisation. Analysts offer scenario ranges (many now price gold well above $4,000/oz and some see $4,400–4,600/oz by mid-2026), but outcomes depend on real interest rates, Fed policy, and geopolitical shocks. For gold merchants the immediate priorities are liquidity, risk controls, and trusted sourcing. For the general public—especially in gold-centric cultures like Sri Lanka and India—the prudent moves are to protect purchasing power through staged purchases, diversify savings, and be very careful with leverage. Below is a detailed, publication-ready article with data-backed drivers, scenarios and practical strategies.

1. The current picture — what’s happening now

In 2025, gold has shattered previous ceilings and surged to record highs, rapidly crossing the $4,000 per ounce mark. This move is not a one-off spike but the result of several concurrent forces: geopolitical tensions (notably US–China and other global flashpoints), broad expectations of future interest-rate cuts in the US (which reduce real yields), sustained central-bank purchases and strong investor (ETF) inflows. These combined factors have created both a demand surge and a scarcity mindset among buyers.

2. Why gold is rising — the key drivers explained

2. Why gold is rising — the key drivers explained

2.1 Falling real interest rates and rate-cut expectations

Gold does not pay interest; its relative attractiveness rises when real yields (nominal rates minus inflation) fall or move negative. As markets price in Fed rate cuts, the opportunity cost of holding bullion declines — supporting higher gold prices.

2.2 Geopolitical risk and safe-haven demand

Escalating geopolitical tensions (trade frictions, sanctions, supply-chain weaponisation) push investors toward non-counterparty assets. Gold is a classic safe haven and benefits disproportionately during such risk episodes.

2.3 Central-bank accumulation (structural demand)

Central banks have been net buyers for several years; 2025 saw record or near-record official purchases. Central-bank buying is different from speculative flows — it reduces available market supply and establishes a long-term base under prices.

2.4 ETF and retail investor inflows

Exchange-traded funds and private investors have poured into gold as a hedge, amplifying moves. Large ETF inflows are visible and temporarily remove metal from the tradable pool.

2.5 De-dollarisation and reserve diversification narratives

Some countries are diversifying away from reliance on dollar-denominated assets and increasing allocations to gold. The narrative of “gold as an alternative reserve” adds a strategic, non-cyclical source of demand.

3. How far can gold go? — scenario view and “settlement price” thinking

Forecasting a single number is hazardous, but we can map plausible scenarios:

• Base (consensus) scenario: gold consolidates with higher volatility but averages in the $3,500–$4,200/oz range through late 2025 as markets balance rate-cut expectations against inflation data. (Some major houses already put mid-2026 averages near $4,000/oz.)

• Bull case: sustained central-bank buying, faster de-dollarisation, and earlier Fed rate cuts, push prices toward $4,400–$4,600/oz (ANZ and several market strategists have published targets in that area). In an extreme risk-off episode (global crisis), prices could overshoot further.

• Bear case: a surprise resurgence in real yields (if inflation falls rapidly and central banks hold rates high), or sharply stronger US dollar, could pause or reverse the rally — bringing prices back toward $2,800–$3,400/oz ranges seen before the 2025 acceleration.

Settlement price level (practical definition for business use): for dealers and exchanges, “settlement price” refers to the accepted closing price used for margining and accounting. In the present regime, settlement levels will track spot markets influenced by futures liquidity; if the $4,000+/oz zone becomes the new trading norm, margin models, lending limits and inventory valuations must be reset accordingly. Given current analyst ranges, businesses should stress-test operations at $3,000, $4,200 and $5,000 per ounce scenarios.

4. Practical implications for the Sri Lankan and Indian markets

Gold in South Asia is not just investment — it is cultural savings, dowries, religious spending and a liquidity buffer. Rapid price rises have concrete effects:

• Affordability: higher prices reduce the quantity of gold that households can buy for ceremonies and savings, shifting spending to lower carat items or alternative assets.

• Substitution pressure: families may substitute to financial instruments (bank deposits, government securities) or smaller jewellery pieces. But trust and liquidity considerations mean gold remains preferred for many.

• Inflation perception: in economies with weak currencies or inflation risks, gold rising amplifies perception of currency weakness and accelerates gold purchases as a hedge.

• Smuggling and quality risks: higher price differentials encourage informal channels and counterfeit risk — regulatory vigilance and hallmarking become more critical.

• Jewellery sector: manufacturing margins can be squeezed unless price indexing or forward contracts are used; customer demand may shift toward lower margins but higher volumes of cheaper pieces.

These dynamics make it essential for policymakers, banks and merchants to monitor both physical flows and informal market activity.

5. Strategies for gold merchants (dealers, jewellers, wholesalers)

1. Tighten liquidity and margin controls. High price volatility increases margin calls on futures and loans. Maintain cash buffers and conservative leverage.

2. Hedge inventory using approved derivatives. Use a mix of short-dated forwards, options collars and futures to protect gross margins. Avoid unhedged exposures.

3. Transparent pricing and indexing. Introduce clear mechanisms (daily price lists, transparent making-charge policies) so customers trust you and disputes fall. Consider offering “price-locked” pre-orders with deposits for large purchases.

4. Supply chain diligence. Verify sourcing and hallmarking; due to higher smuggling incentives, strengthen KYC and documentation.

5. Product re-mixing. Offer lower-weight items, alloys and designs that preserve karat but reduce absolute grams per item to keep affordable options for customers.

6.Insurance and security upgrades. As inventory value rises, re-assess insurance limits and physical security (vaults, transport).

7.Digital and financial services tie-ins. Offer buy-back guarantees, instalment plans, or fractional ownership/ETP access to capture customers who prefer not to hold physical metal.

8.Educate customers. Proactively explain why prices move and provide simple hedging/buying options — this builds trust and loyalty.

6. Strategies for the general public — savers and retail investors

Short answer: you can buy, but do it deliberately and with risk controls.

Guidelines:

• Avoid lump-sum timing gambles. Price may rise further — or correct. Use rupee-cost averaging (regular small purchases) to reduce timing risk.

• Set an allocation target. Decide what share of net financial assets you want in gold (e.g., 5–15% depending on risk tolerance and local context) and buy toward that target rather than chase headlines.

• Prefer physical for liquidity and cultural reasons, but be mindful of cost. Jewellery and coins carry making charges and taxes; recognize the difference between price of gold and effective cost to you.

• Consider financial gold for lower costs. Gold ETFs, digital gold products or sovereign gold bonds (where available) often have lower transaction/holding costs, no making charges and better auditability. But check counterparty risk and local availability.

• Avoid leverage. Margin buying or loans collateralised with gold can be extremely risky in volatile markets.

• Store and insure properly. For physical holdings, use bank lockers or insured vaults; document purchases carefully for future resale or inheritance.

• Tax and reporting. Check local tax rules on capital gains, VAT and import duties. (In Sri Lanka and India tax treatments differ; consult a tax advisor before large purchases.)

7. Should “ordinary people” buy now if prices may go higher?

Buying depends on the objective:

• If the objective is a long-term store of value or intergenerational savings — gradual accumulation through averaging makes sense. Gold as insurance against systemic risk still has merit.

• If the objective is short-term profit (speculation) — higher volatility increases the chance of losses; only experienced traders using risk capital should trade futures or leveraged products.

• If required for cultural reasons (weddings, rituals) — consider contractual arrangements (advance bookings, price locks) or buy smaller quantities earlier to avoid last-minute premium spikes.

No universal “yes/no” rule exists — but the safest retail approach is disciplined, small, regular purchases and avoiding leverage.

8. How businesses and banks should prepare

• Banks and NBFCs should re-assess lending against gold collateral (LTV ratios, haircuts), given elevated price volatility. Stress-test portfolios at multiple gold price scenarios.

• Payment and fintech firms offering digital gold must disclose product mechanics, custodial arrangements, and counterparty risk.

• Regulators should monitor physical imports, hallmarking compliance and cross-border flows to contain illicit channels.

• Exchanges and clearing houses must revisit margin methodologies and circuit breakers for metals futures.

9. Risks and warning signs to monitor

• Sudden rise in real yields (stronger growth or unexpected disinflation) can puncture the rally.

• Policy surprises: central banks reversing purchases or major policy coordination that restores dollar strength.

• Liquidity shocks: if ETF inflows reverse abruptly, temporary price dislocations can occur.

• Regulatory moves: export/import controls, changes in duty or tax on jewellery or bullion can distort local price relationships.

10. Practical checklist for a Sri Lankan reader (Actionable)

For households:

• Decide target allocation (e.g., 5–10% of investable assets).

• Implement monthly or quarterly small purchases (rupee-cost averaging).

• Use bank lockers/vaults and insure holdings.

• Keep receipts and hallmarks for future resale/tax purposes.

For merchants:

• Reprice inventory daily; publish making charges separately.

• Hedge a portion of inventory; keep cash reserves.

• Strengthen sourcing and anti-smuggling checks.

For policymakers and banks:

• Monitor central-bank flows and informal market signals.

• Recalibrate loan-to-value on gold loans; tighten where necessary.

11. Conclusion — what this means for Sri Lanka

Gold’s rally is a structural-plus-cyclical event: structural because of central-bank accumulation and reserve diversification; cyclical because of rate expectations and geopolitics. For Sri Lanka — where gold is deeply embedded in personal finance — the rally raises the cost of traditional savings but also offers an opportunity to re-assess how households preserve wealth. The best path is pragmatic: educate consumers, enable lower-cost access (digital/ETFs/savings plans), ensure strong consumer protections, and for merchants, focus on liquidity and hedging.

Forecast note (transparent): market houses differ — some project $4,000/oz as a mid-term norm, others expect $4,400–$4,600/oz by mid-2026 if current drivers persist. But price outcomes hinge on future Fed moves, real yields and geopolitical shocks; stress testing and caution remain essential.