Wednesday Feb 25, 2026

Wednesday Feb 25, 2026

Monday, 22 September 2025 03:31 - - {{hitsCtrl.values.hits}}

By WealthTrust Securities

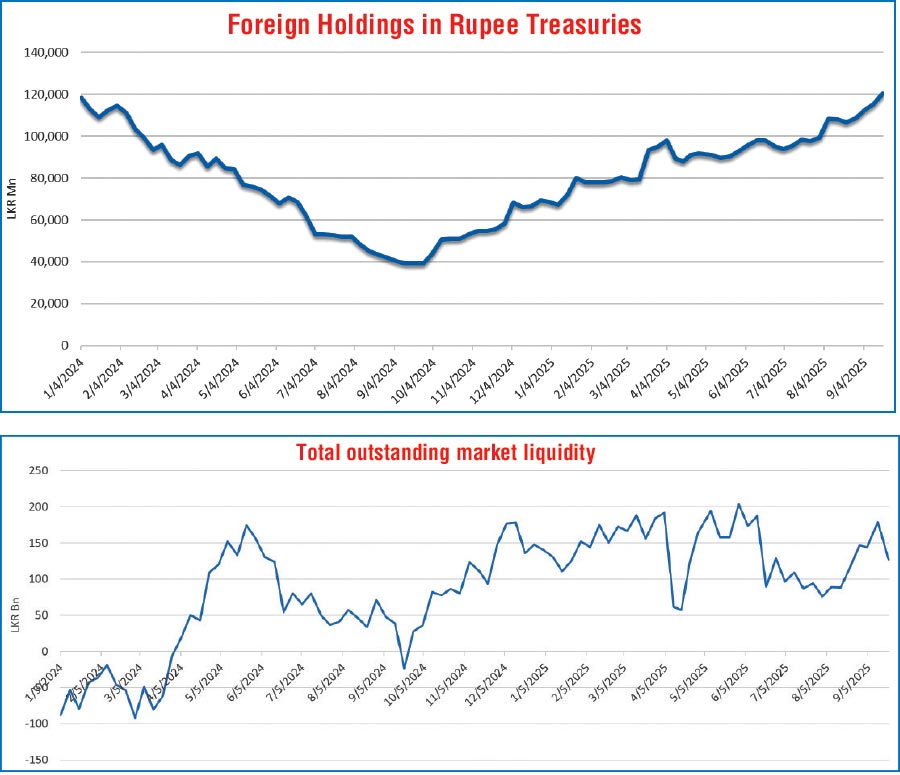

The U-shaped recovery in foreign holdings of Rupee-denominated Government securities continued last week, supported by strong demand. A net inflow of Rs. 4.99 billion — a 4% week-on-week increase — was recorded during the week ending 18 September, marking the fourth consecutive week of foreign inflows. As a result, total foreign holdings rose to Rs. 120.28 billion, the highest level in nearly two years (around 21 months), since early December 2023. This trend underscores a robust rebound in foreign investor appetite for domestic Treasury Bills and Bonds, from a low of Rs. 39.38 billion recorded in September 2024.

The U-shaped recovery in foreign holdings of Rupee-denominated Government securities continued last week, supported by strong demand. A net inflow of Rs. 4.99 billion — a 4% week-on-week increase — was recorded during the week ending 18 September, marking the fourth consecutive week of foreign inflows. As a result, total foreign holdings rose to Rs. 120.28 billion, the highest level in nearly two years (around 21 months), since early December 2023. This trend underscores a robust rebound in foreign investor appetite for domestic Treasury Bills and Bonds, from a low of Rs. 39.38 billion recorded in September 2024.

On Friday (19), S&P Global Ratings upgraded Sri Lanka’s long-term foreign currency debt rating to ”CCC+” from “Selective Default (SD),” while affirming the long-term local currency rating at CCC+, with a stable outlook. The upgrade reflects a steady recovery from Sri Lanka’s 2022 crisis: S&P points to improvements in GDP growth, the external sector, and foreign exchange reserves, alongside progress on debt restructuring.

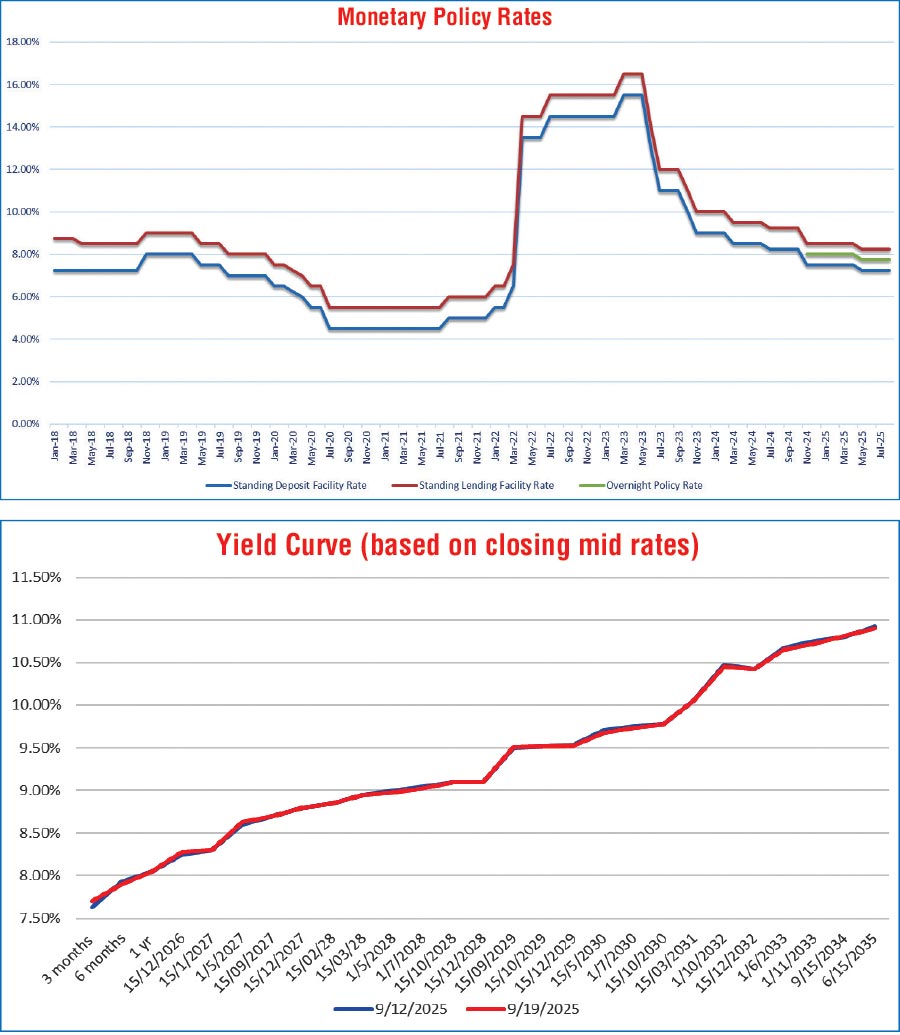

Meanwhile, the secondary Bond market remained subdued through the early part of last week, with activity and volumes muted as investors stayed cautious ahead of the US Federal Reserve’s policy decision. Limited trades were observed, with yields broadly steady apart from minor declines on selected maturities such as the 01.07.30 and 15.06.35. The Fed’s 25 basis point rate cut midweek sparked a recovery in sentiment, driving renewed buying interest, particularly in the 2029-2033 maturities. This lifted activity levels and saw yields edge lower marginally. However, conditions quietened again by Friday, as momentum faded. Overall, the week saw subdued activity and was characterised by a brief rebound in demand, but ultimately closed with secondary market yields broadly steady on a week-on-week basis.

In the secondary Bond market, the 01.05.28 maturity was seen trading at 8.97%. In the 2029 space, the 15.06.29 maturity changed hands within a range of 9.45%-9.43%, while the 15.09.29 maturity was seen trading from 9.52% down to 9.50%. The 15.12.29 maturity was active between 9.55%-9.50%. Moving into 2030, the 15.05.30 maturity traded at 9.68%, while the 01.07.30 maturity was seen within a narrow range of 9.72%-9.71%. The 15.03.31 maturity changed hands between 10.05% and 10.02%. In the longer end, the 15.12.32 maturity traded at 10.40%, while the 01.06.33 and 01.11.33 maturities were seen within 10.70%-10.75% and 10.72%-10.70%, respectively. The 15.06.35 maturity recorded trades across 10.93%-10.90%.

This quiet, reserved market behaviour, with yields seen trading sideways in a narrow band and consolidating, comes ahead of the upcoming Sri Lanka monetary policy decision, which is due to be announced this week on Wednesday (24). Market participants were seen gravitating towards the sidelines and adopting a wait-and-see stance. This will be Monetary Policy Review No. 5 for 2025, the penultimate announcement for the year.

At the weekly Treasury Bill auction held last Wednesday (17), the weighted average yields remained broadly steady, with the rate on the 182-day and 364-day tenors remaining unchanged at 7.89% and 8.02%, respectively. The 91-day maturity registered a marginal dip of one basis point to 7.57%. This marks the ninth week where T-Bill rates have stayed mostly unchanged at auctions. However, only 72% of the total offered amount was raised, with successful bids amounting to Rs. 54 billion against the Rs. 75 billion on offer in the first phase of competitive bidding. This marked the fourth consecutive auction that fell short of fully raising the targeted amount. An additional amount of Rs. 3.26 million was raised in the second phase.

Meanwhile, in the money market, the total outstanding liquidity surplus in the inter-bank money market dropped to Rs. 126.81 billion as at the week ending 12 September, from Rs. 178.58 billion recorded the previous week. The weighted average interest rates on call money and repo were recorded within the ranges of 7.86% and 7.87%-7.88%, respectively, while the Central Bank of Sri Lanka’s (CBSL) holding of Government securities was registered at Rs. 2,508.92 billion as at 19 September, unchanged against the previous week’s closing level.

The daily secondary market Treasury Bond/Bill transacted volumes for the first four days of the week averaged at Rs. 15.61 billion.

Forex market

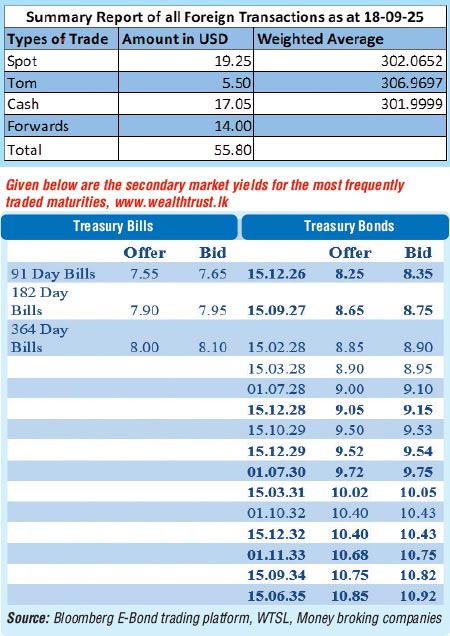

In the Forex market, the USD/LKR rate on spot contracts was seen closing the week depreciating to Rs. 302.45/302.50 as against the previous week’s closing level of Rs. 301.90/301.95. However, this was subsequent to trading at a high of Rs. 301.95 and a low of Rs. 302.60.

The daily USD/LKR average traded volume for the first four trading days of the week stood at $ 60.49 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)