Sunday Feb 22, 2026

Sunday Feb 22, 2026

Monday, 15 September 2025 03:08 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

By Wealth Trust Securities

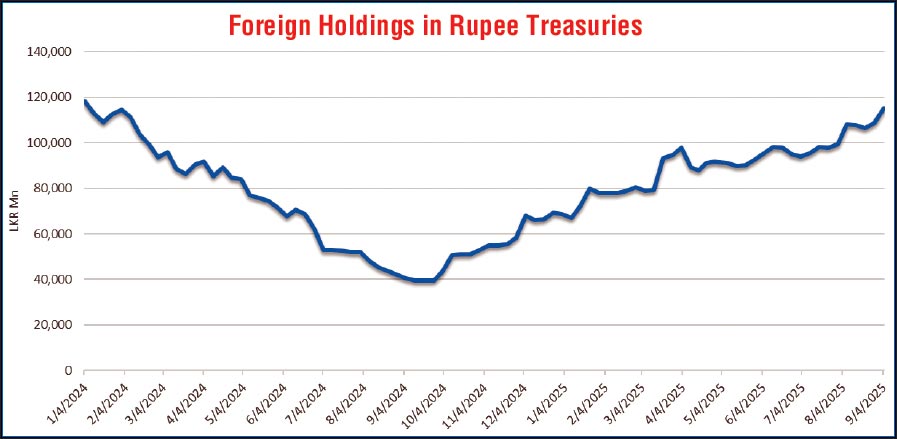

The recovery story in the foreign holdings of Rupee Treasuries continued last week, supported by robust demand. A sizeable net inflow of Rs. 2.78 billion — equivalent to a 2.0% week-on-week increase — was recorded during the week ending 12 September. This marked the third consecutive week of foreign inflows. As a result, foreign holdings rose to Rs. 115.29 billion, reaching the highest level in well over 1 ½ years (since early January 2024).

In the money market, the total outstanding liquidity surplus in the inter-bank money market surged to Rs. 178.58 billion as at the week ending 12 September, from Rs. 144.37 billion recorded the previous week. This marks the highest weekly closing liquidity surplus in 13 weeks (since 13 June). The weighted average interest rates on call money and repo were recorded within the ranges of 7.86% and 7.86%-7.87% respectively while the Central Bank of Sri Lanka’s (CBSL) holding of Government Securities was registered at Rs. 2,508.92 billion as at 12 September, unchanged against the previous week’s closing level.

In an article titled “Sri Lanka Preview: GDP Growth Likely Picked Up in 2Q25,” Bloomberg Economics opined that Sri Lanka’s growth likely accelerated to 5.7% year on year in the second quarter of 2025 (2Q25), from 4.8% in the previous quarter (1Q25) — driven by the industrial and services sectors. The report forecasted a full year GDP growth rate 4.7% for the year 2025, after a 5% expansion in 2024. The report noted that this would be a significant turnaround from the hardship in 2022 and 2023, when the country defaulted on its foreign debt and its output shrank 9.5%. The official data is due today, 15 September.

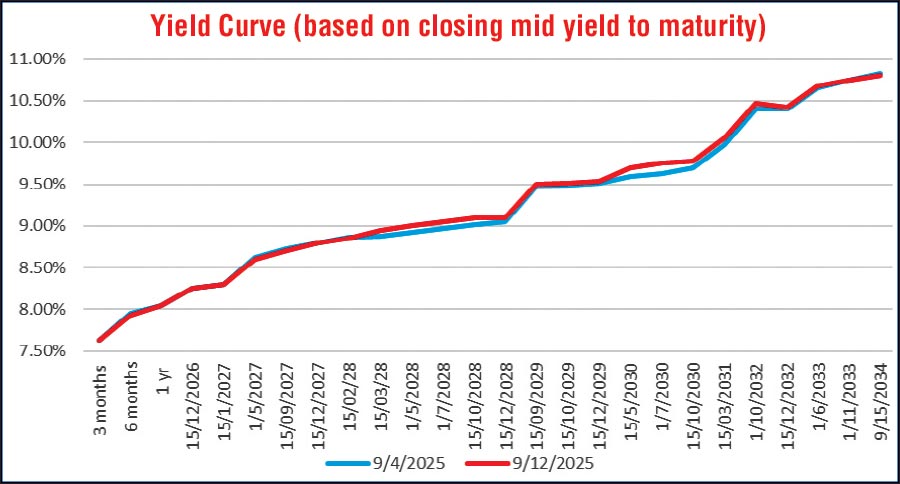

The Secondary Bond market witnessed subdued overall activity and relatively low transaction volumes, with trading largely confined to selected maturities through the early part of the week. Yields were observed edging higher during this period, as investor sentiment remained cautious with participants largely on the sidelines ahead of the back-to-back primary auctions. Following the bond auction, however, renewed buying interest emerged at the elevated yield levels, driving a stabilisation and subsequent consolidation in rates toward the latter part of the week. This recovery in sentiment was accompanied by an improvement in both volumes and trading activity. In particular demand was observed on the medium to longer tenor bonds as reflected in the Treasury Bond auction outcome as well. Despite this notable rebound in sentiment, two-way quotes in the Secondary Bond market closed the week marginally higher on a week-on-week basis.

This recovery coincided with a Reuters article citing comments from CBSL Governor P. Nandalal Weerasinghe, who, in an interview ahead of the 23 September policy meeting, noted that the Central Bank has room to cut interest rates further but is proceeding cautiously to preserve a buffer against potential external shocks.

In the Secondary Bond market, the 15.02.28 and 15.03.28 maturities were seen trading within intraweek lows to highs of 8.85%–8.96%. The 01.07.28 maturity traded in a narrow range of 9.00%–9.01%, while the 15.10.28 and 15.12.28 maturities changed hands at 9.08% and 9.11% respectively. In the 2029 space, the 15.09.29 and 15.12.29 maturities traded within intraweek ranges of 9.50%–9.55%. Moving further along, the 15.05.30 maturity traded between 9.63%-9.70%, while the 01.07.30 maturity was seen trading from 9.70% up to 9.76%. The 15.03.31 maturity changed hands at 10.05%, while in the longer end, the 15.12.32 and 01.11.33 maturities traded at 10.40% and 10.75% respectively. The 15.09.34 saw large blocks trade at the rate of 10.80%. The 15.06.35 maturity was seen changing hands within 10.94%–10.95%.

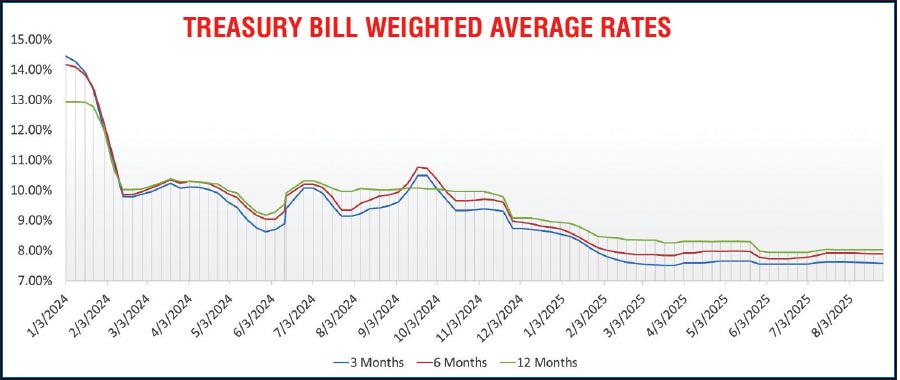

At the weekly Treasury Bill auction held last Wednesday, weighted average yields remained broadly steady, with the rate on the 91-day, 182-day remaining unchanged at 7.58% and 7.89% respectively. The 364-day maturity registered a marginal dip of 01 basis point to 8.02%. However, only 76.85% of the total offered amount was raised, with successful bids amounting to Rs. 59.18 billion against the Rs. 77.00 billion on offer in the first phase of competitive bidding. This marked the third consecutive auction that fell short of fully raising the targeted amount. However, no further subscription was made under the second phase for the second consecutive week.

This was followed by a round of Treasury Bond auctions held last Thursday (11 Sept.), with a total offered amount of Rs. 155.00 billion across three maturities. The round of auctions overall raised only Rs. 116.16 billion, or 74.94% of the total offered amount, despite total bids received exceeding the offer by 1.75 times. This marked the fifth consecutive T-Bond auction to raise less than the offered amount. Interestingly, despite the auction outcome reflecting a shortfall on the mid-tenor 2030 maturity, demand at the longer maturities was notable, with both the 2032 and 2035 maturities fully subscribed.

The demand at the bond auction for the longer tenor 2032 and 2035 tenors spilled over to the Direct Issuance Window with Rs. 7 billion, being the maximum amount offered, raised out of the total market subscription of Rs. 14.95 billion.

The daily secondary market Treasury Bond/Bill transacted volumes for the first four days of the week averaged at Rs. 23.29 billion.

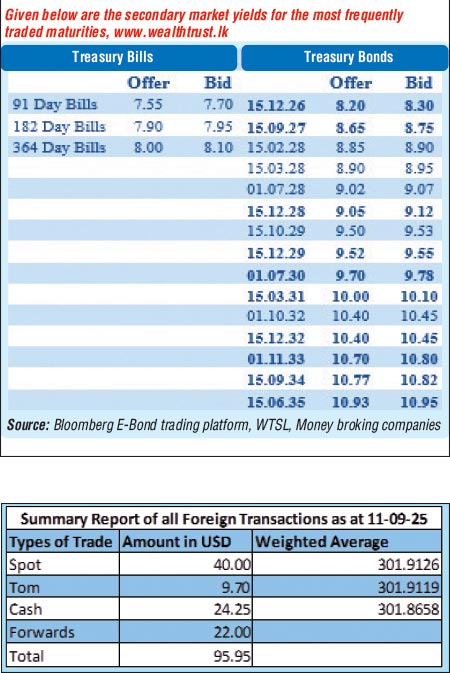

Forex market

In the Forex market, the USD/LKR rate on spot contracts was seen closing the week appreciating slightly at Rs. 301.90/301.95 as against the previous week’s closing level of Rs. 301.97/302.02. However, this was subsequent to trading at a high of Rs. 301.78 and a low of Rs. 302.07.

The daily USD/LKR average traded volume for the first four trading days of the week stood at $ 93.04 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)