Saturday Feb 21, 2026

Saturday Feb 21, 2026

Monday, 3 November 2025 03:45 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

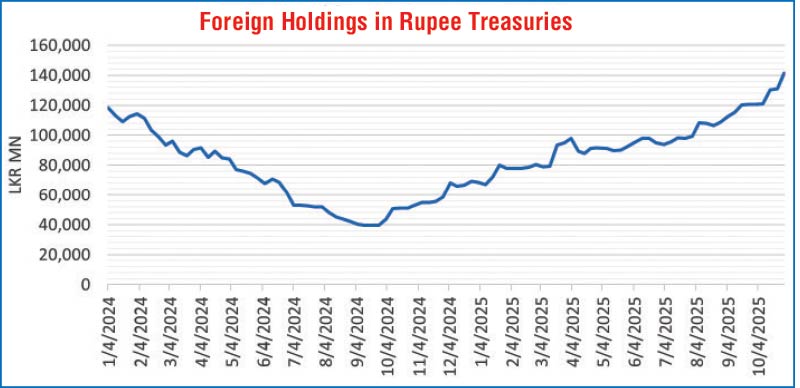

Foreign holdings of rupee-denominated Government securities increased further last week, recording a net inflow of Rs. 10.36 billion during the week ending 31 October, the largest weekly inflow in 32 weeks.

Foreign holdings of rupee-denominated Government securities increased further last week, recording a net inflow of Rs. 10.36 billion during the week ending 31 October, the largest weekly inflow in 32 weeks.

This marks the fourth consecutive week of inflows. As a result, total foreign holdings rose to Rs. 141.32 billion by the end of the week, hitting the highest level in two years (since Mid-November 2023). This trend underscores a robust rebound in foreign investor appetite for domestic Treasury bills and bonds, up 259% from a low of Rs. 39.38 billion recorded in September 2024. This robust demand comes against the backdrop of the US Fed’s monetary policy easing by 25 basis points and halt of quantitative easing.

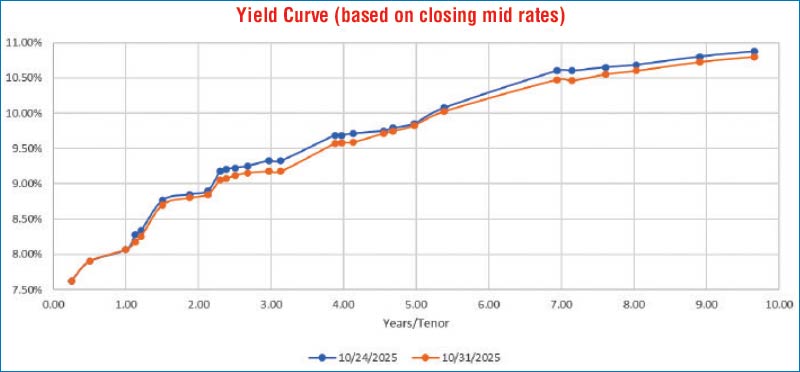

The secondary Bond market last week initially started off slowly, with overall activity observed at moderate levels amid a restrained investor tone. Yields held broadly steady across the curve as the market continued to consolidate in the absence of strong directional signals.

However, on last Tuesday momentum shifted sharply following the release of the Ministry of Finance’s Fiscal Review for January–September 2025, which highlighted a significant fiscal outperformance relative to IMF benchmarks.

The report highlighted a 54.5% narrowing in the Budget deficit and a robust primary surplus of Rs. 1.46 trillion, well above program targets, on the back of stronger-than-expected revenue performance.

Complementing this, a Bloomberg report noting that inflation was likely to remain below target in the 4th quarter of 2025 further boosted sentiment. These developments spurred a rally, with renewed buying interest and a surge in transaction volumes leading to notable yield declines across the 2028–2030 maturities.

The bullish momentum extended into the midweek sessions as yields continued to drop, particularly on the 2032 and other longer-tenor bonds, reflecting sustained demand across the curve.

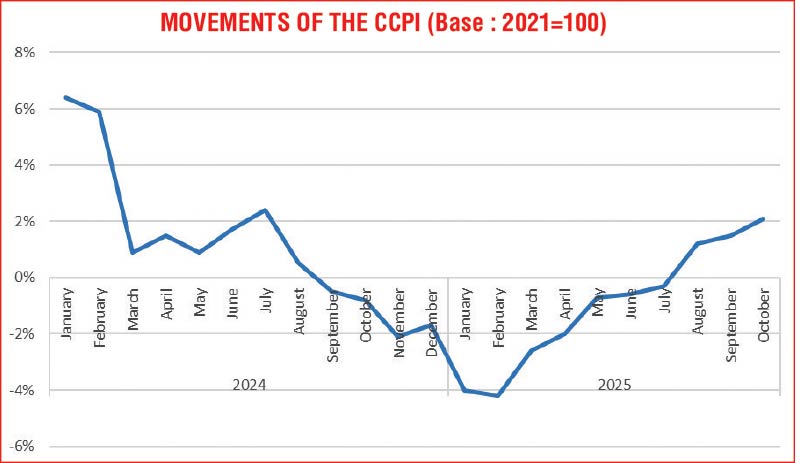

Toward the end of the week, mild profit-taking was observed following the recent rally, though this was swiftly absorbed by fresh buying interest. This resulted in a further dip in rates. Sentiment remained buoyant following the US Federal Reserve’s decision to cut policy rates and the announcement of the end of quantitative tightening by December. As well as the release of the latest CCPI inflation data for October which continues to remain moderate and below the Central Bank target.

The October CCPI inflation (Base 2021=100) accelerated to +2.1% year-on-year, up from +1.5% in September, marking the third consecutive month of positive inflation following nearly a year of deflationary conditions. Despite this upward trend, inflation continues to remain moderate and below the Central Bank’s medium-term target of 5% and even below the lower bound of the target range of 3.00%. The annual average stood at -1.2%.

Overall, the week was characterised by a pronounced shift to bullish sentiment, driven by fiscal over-performance, easing global monetary conditions, and optimism of increased foreign participation. In conclusion secondary bond market two-way quotes closed lower on a week-on-week basis, resulting in a downward shift of the yield curve.

In terms of the weekly secondary Bond market trade summary, during the week the 01.06.26 maturity was seen trading at the rate of 8.25% to 8.05% while the 01.08.26 maturity was seen trading at a low of 8.10%.

Among the 2028 maturities, the 15.02.28 maturity traded at 9.07%, while the 15.03.28 maturity was seen trading down the range of 9.20%–9.09%. The 01.05.28 maturity traded down from an intraweek high to a low of 9.25%–9.10%, while the 01.07.28 maturity was seen trading down the range of 9.27%–9.15%. The 01.09.28 maturity traded at levels of 9.30% down to 9.16%, while the 15.10.28 and 15.12.28 maturities traded down the ranges of 9.30%–9.20% and 9.25%-9.20% respectively.

Moving to the 2029 maturities, the 15.06.29 maturity was seen trading down the range of intraweek highs and lows of 9.60%–9.52%, while the 15.10.29 and 15.12.29 maturities traded down the ranges of 9.68%–9.60% and 9.63%–9.60% respectively.

The 15.05.30 maturity saw its yield decline down the range of 9.78%–9.73%, while the 01.07.30 and 15.10.30 maturities were seen trading lower, dropping down the ranges of 9.78%–9.74% and 9.80% respectively.

On the longer end of the yield curve, the 01.07.32 maturity was seen trading down the range of 10.80%–10.60%, while the 15.12.32 maturity traded between 10.58%–10.45%. The 01.11.33 maturity was seen trading within the range of 10.63%–10.57%, while the 15.09.34 maturity traded down the range of 10.75%–10.70% during the week.

The details of the upcoming Treasury Bill auction scheduled for this Tuesday 4 November - were announced, with a total offer amount of Rs. 77 billion, comprising Rs. 7.50 billion in 91-day Bills, Rs. 30.00 billion in 182-day Bills, and Rs. 40.00 billion in 364-day Bills. This marks the second consecutive auction where the offered amount is considerably below the maturing volume, which is estimated at around Rs. 106.40 billion.

For context, the weekly Treasury Bill auction held last Wednesday (29 October) was fully subscribed, successfully raising the entire Rs 57 billion on offer. The bids received to the offered amount ratio stood at 2.21 times. This marked the first auction to be fully subscribed in four weeks. The weighted average rates held largely steady, with the yield on the 91-day tenor remaining unchanged at 7.52%. However, the 182-day and 364-day tenors registered marginal increases of 01 basis point to 7.90% and 02 basis points to 8.04% respectively.

The daily secondary market Treasury Bond/Bill transacted volumes for the first four days of the week averaged at Rs. 15.50 billion.

In the money market, the total outstanding liquidity surplus in the inter-bank money market increased by 20.10% to Rs. 155.05 billion as at the week ending 31 October, from Rs. 129.13 billion recorded the previous week. The weighted average interest rates on call money and repo were recorded within the ranges of 7.89%-7.91% and 7.92%-7.93% respectively while the Central Bank of Sri Lanka’s (CBSL) holding of Government Securities was registered at Rs. 2,508.92 billion as at 31 October, unchanged against the previous week’s closing level.

Forex Market

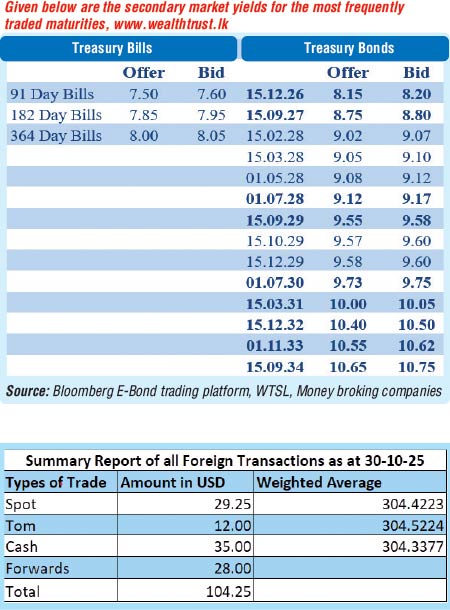

In the Forex market, the USD/LKR rate on spot contracts was seen closing the week depreciating to Rs. 304.35/304.45 as against the previous week’s closing level of Rs. 303.70/303.85. This was subsequent to trading at a high of Rs. 303.95 and a low of Rs. 304.60.

The daily USD/LKR average traded volume for the first four trading days of the week stood at $ 73.87 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)