Monday Feb 23, 2026

Monday Feb 23, 2026

Monday, 11 August 2025 04:56 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

By Wealth Trust Securities

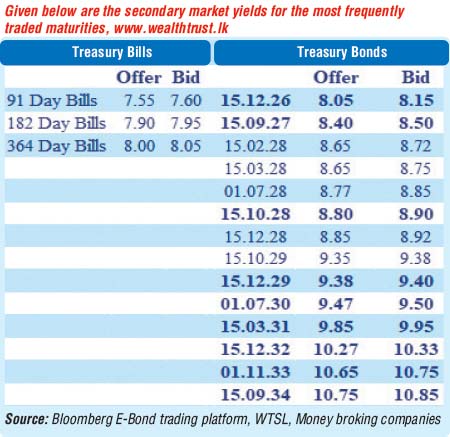

At the weekly Treasury Bill auction held last Wednesday, weighted average yield rates remained broadly stable, for the third consecutive week. Accordingly, the weighted average rate on the 182-day tenor and the 364-day tenor remained unchanged at 7.91% and 8.03% respectively. However, the 91-day tenor registered a marginal decline of 01 basis point to 7.61%. The auction raised the entire total offered amount of Rs. 82.00 billion at the first phase in competitive bidding. This marked the first instance of full subscription following two consecutive weekly Treasury Bill auctions going undersubscribed. Further to the T-bill auction held on 6 August, Rs. 8.20 billion being the maximum aggregate amount offered was raised at the second phase across all three maturities, out of a total market subscription of Rs. 13.70 billion.

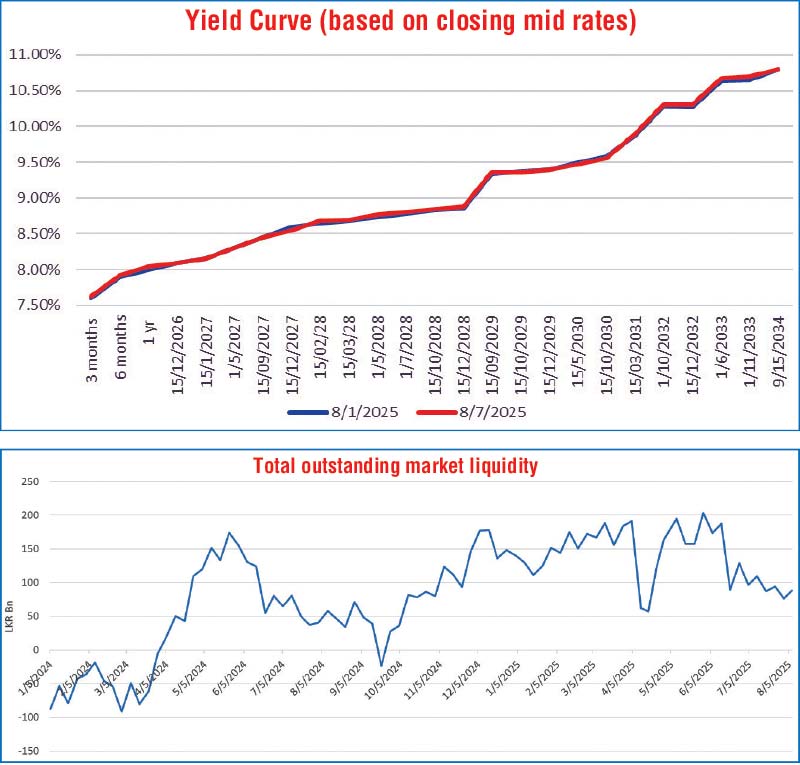

Overall activity in the Secondary bond market remained relatively subdued during the holiday shortened week last week. Yields stayed anchored around prevailing levels, with trading occurring in a narrow band. Trading volumes were moderate and confined primarily to a handful of benchmark maturities. Due to the sideways trading action, Secondary bond market two-way quotes closed broadly steady week-on-week and the yield curve remained mostly unchanged.

On the short-end of the yield curve the 15.02.28 and 01.07.28 maturities traded between 8.685%-8.67% and 8.82%-8.80% respectively, while the 15.10.28 maturity changed hands within 8.85%-8.82%. In the 2029 space, the 15.06.29 maturity traded at 9.30%, the 15.09.29 and 15.10.29 maturities ranged between 9.38%-9.35%, and the 15.12.29 maturity saw yields move between 9.43%-9.39%. On the medium end of the curve, the 15.05.30, 01.07.30, and 15.10.30 maturities were traded at 9.47%, 9.51%-9.45%, and 9.55% respectively. The 01.07.32 and 15.12.32 maturities were seen trading at the rates of 10.45% and 10.30% respectively.

These developments come ahead of a Treasury Bond auction due to be held this week, scheduled to be conducted on the 12 August (tomorrow). The round of auctions will have a total offered amount of Rs. 65.00 billion across two available maturities.

The auction will be comprised of:

The settlement for which will be held on 15 August 2025.

The daily secondary market Treasury bond/bill transacted volumes for the first three days of the week averaged at Rs. 14.61 billion.

In money market, the total outstanding liquidity surplus in the inter-bank money market increased to Rs. 88.52 billion as at the shortened week ending 7 August from Rs. 76.29 billion recorded the previous week. The weighted average interest rates on call money and repo were recorded within the ranges of 7.83%-7.85% and 7.86% respectively while the Central Bank of Sri Lanka (CBSL) holding of Government Securities was registered at Rs. 2,508.92 billion as at 25 July 2025, unchanged against the previous week’s closing level.

Forex market

In the Forex market, the USD/LKR rate on spot contracts was seen appreciating to close the week at Rs. 300.70/300.78 as against the previous week’s closing level of Rs. 301.20/301.30, subsequent to trading at a high of Rs. 300.70 and a low of Rs. 301.02.

The daily USD/LKR average traded volume for the first three trading days of the week stood at $ 93.61 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)