Thursday Feb 19, 2026

Thursday Feb 19, 2026

Friday, 1 July 2022 00:00 - - {{hitsCtrl.values.hits}}

Despite the economic downturn, the insurance industry saw double digit growth in the first quarter according to the Insurance Regulatory Commission of Sri Lanka.

Despite the economic downturn, the insurance industry saw double digit growth in the first quarter according to the Insurance Regulatory Commission of Sri Lanka.

Following is a review of the insurance industry during the period 1 January 2022 to 31 March 2022 by IRCSL.

Gross Written Premium

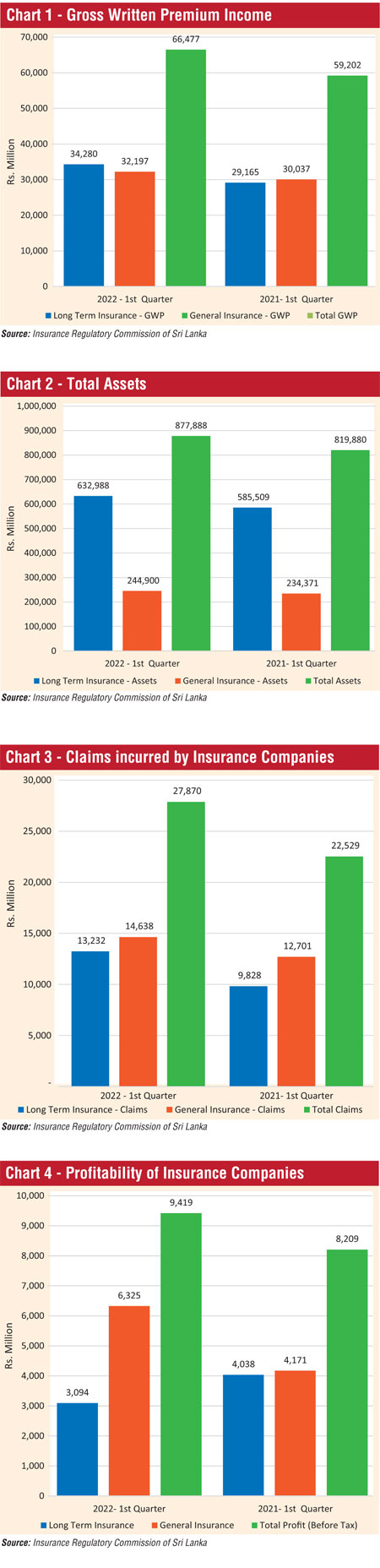

The insurance industry had achieved a growth of 12.29% in terms of overall Gross Written Premium (GWP), during the 1st Quarter of 2022, recording a GWP increase of Rs. 7,275 million when compared to the same period in the year 2021. GWP of Long-Term Insurance and General Insurance Businesses was Rs. 66,477 million compared to the 1st Quarter of 2021, amounting to Rs. 59,202 million.

The GWP of Long-Term Insurance Business amounted to Rs. 34,280 million (Q1, 2021: Rs. 29,165 million) recording a growth of 17.54%. The GWP of General Insurance Business amounted to Rs. 32,197 million (Q1, 2021: Rs. 30,037 million) recording a growth of 7.19%.

Total assets

The value of the total assets of insurance companies have increased to Rs. 877,888 million at the end of 1st Quarter 2022, when compared to Rs. 819,880 million recorded as at the end of Q1 2021, reflecting a growth of 7.08%. The assets of Long-Term Insurance Business amounted to Rs. 632,988 million (Q1 2021: Rs. 585,509 million) depicting a growth rate of 8.11%, mainly due to an increase in business volume which is represented by investments in government debt securities and corporate debts. The assets of General Insurance Business amounted to Rs. 244,900 million (Q1, 2021: Rs. 234,371 million) depicting a growth of 4.49%.

Investment in Government Securities

Investments in Government Debt Securities amounted to Rs. 277,612 million (Q1, 2021: Rs. 232,081 million) representing 49.03% of the total investments of Long-Term Insurance Business and increased by 19.62%, while such investment of the total investment of General Insurance Business amounted to Rs. 79,620 million (Q1, 2021: Rs. 68,805 million) representing 50.11% and increased by 15.72%. Accordingly, the total investment in Government Securities in the two businesses amounted to Rs. 357,232 million (Q1, 2021: Rs. 300,886 million), showing an overall increase of 18.73%.

Claims incurred by insurance companies

The value of claims incurred by insurance companies in both Long-Term Insurance Business and General Insurance Business was Rs. 27,870 million (Q1, 2021: Rs. 22,529 million) showing an increase in total claims incurred amount by 23.71% year-on-year. The Long-Term Insurance claims, including maturity and death benefits, amounted to Rs. 13,232 million (Q1, 2021: Rs. 9,828 million). The claims incurred in the General Insurance Business, including Motor, Fire, Marine, SRCC and other categories, amounted to Rs. 14,638 million (Q1, 2021: Rs. 12,701 million). Hence, during the 1st Quarter of 2022, there is an increase in claims incurred by 34.63% and 15.26% for Long Term Insurance and General Insurance Businesses respectively, when compared to the same period in 2021.

Profit (Before Tax) of insurance companies

The Profit Before Tax (PBT) of insurance companies as at the end of 1st Quarter 2022 in both Long-Term Insurance Business and General Insurance Business amounted to Rs. 9,419 million (Q1, 2021: Rs. 8,209 million) showing an increase of total profit amount by 14.74%. The PBT of Long-Term Insurance Business amounted to Rs. 3,094 million (Q1, 2021: Rs. 4,038 million), a decrease of 23.37% while the PBT of General Insurance Business amounted to Rs. 6,325 million (Q1, 2021: Rs. 4,171 million) an increase of 51.64%.

Insurers

Out of 27 insurance companies (Insurers) in operation as at 31 March 2022, 13 companies are engaged in Long-Term (Life) Insurance Business, 12 companies are engaged in General Insurance Business and two companies function as composite companies (dealing in both Long Term and General Insurance Businesses). However, MBSL Insurance Company Ltd. has ceased to underwrite new Long-Term (Life) insurance business with effect from 1 June 2020.

Insurance brokers

Seventy-three insurance brokering companies were registered with the Commission as at 31 March 2022. Total assets of insurance brokering companies have increased to Rs. 7,776 million as at the end of 1st Quarter 2022, when compared to Rs. 7,047 million recorded at the same period of 2021, indicating a growth of 10.35% However the total assets of the insurance brokering companies for the 1st Quarter 2022 does not include the asset value of 13 brokering companies due to non-submission of quarterly returns.