Saturday Feb 21, 2026

Saturday Feb 21, 2026

Thursday, 25 September 2025 02:53 - - {{hitsCtrl.values.hits}}

|

CAM Managing Director Dulindra Fernando

|

Ceylon Asset Management (CAM) yesterday said that its flagship Ceylon Dollar Bond Fund (CDBF) had delivered a US dollar return of 12.3% year-to-date as of 14 September 2025, reflecting renewed investor confidence in Sri Lanka’s Sovereign Bonds.

In a statement CAM said that the fund, which invests exclusively in Sri Lankan International Sovereign Bonds (ISBs), has benefited from rising ISB prices following the successful debt restructure in December 2024 and the country’s improving economic fundamentals.

Central Bank of Sri Lanka (CBSL) Governor Dr. Nandalal Weerasinghe also stated that Sri Lanka can expect a country rating upgrade from the current rating of ‘CCC+’ to ‘B-’ by 2027.

CAM Managing Director Dulindra Fernando said: “Sri Lanka’s macroeconomic stability has supported the fund’s strong performance.

CBSL has successfully guided the economy out of default, rebuilding foreign reserves to $ 6.2 billion, stabilising interest rates, and strengthening the currency. Inflows from worker remittances, tourism, and foreign direct investments are also expected to contribute positively during 2025.”

He added: “Foreign investors are now confident of Sri Lanka’s ability to service its debt commitments since the Government has already fulfilled its obligations on the new sovereign bonds since the restructure.”

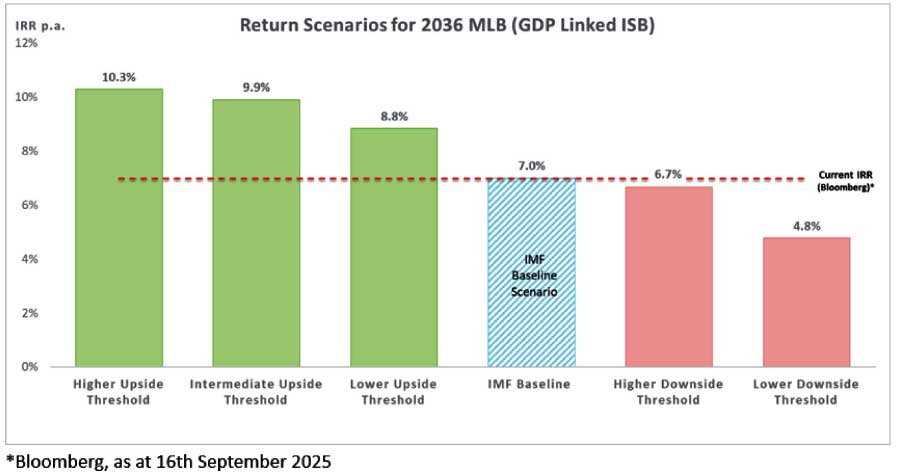

The GDP-linked Macro Linked Bonds (MLBs) are expected to reach the highest return threshold if Sri Lanka’s GDP growth exceeds an average of 3% p.a. between 2025 and 2027 as per Verité Research.

Standard Chartered Bank assigns a probability of 67.5% for MLBs to reach the highest upside GDP threshold, while assigning a probability of 72.4% for the GLB coupon reduction of 0.75%. Accordingly, the IRR for the 2036 MLB is likely to increase from the current 7% to 10.3% p.a.

The Ceylon Dollar Bond Fund is promoted to the Sri Lankan diaspora and investors across South Asia, the Middle East, and Australia. It is managed by Ceylon Asset Management, with Deutsche Bank serving as Trustee and Custodian Bank. CAM is regulated by the Securities and Exchange Commission of Sri Lanka and is an Associate Company of Sri Lanka Insurance Corporation (SLIC).