Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Friday, 1 December 2023 00:10 - - {{hitsCtrl.values.hits}}

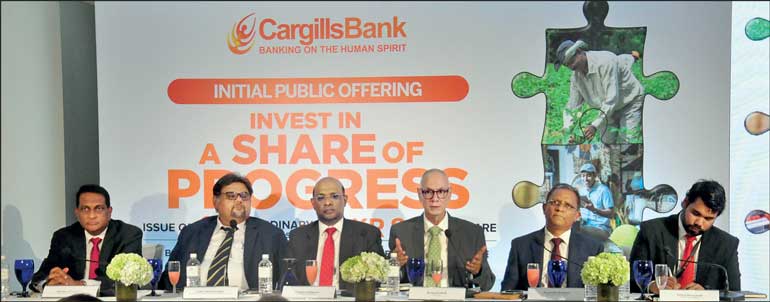

NDB Investment Bank CEO Darshana Perera, CT CLSA Group COO and Head of Investment Bank Zakir Mohamedally, Cargills Bank COO Prabhu Mathavan, Cargills Bank Chairman Richard Ebell, Cargills Bank MD CEO Senarath Bandara, Cargills Bank Chief Strategy Officer Talaal Maruzook

Cargills Bank Chairman Richard Ebell

Cargills Bank MD and CEO Senarath Bandara

Cargills Bank COO Prabhu Mathavan

Cargills Bank yesterday announced its lnitial Public Offering (lPO) to raise Rs.500 million of Tier 1 capital through the issuance of 62.5 million shares at Rs.8l- per share, marking a significant milestone in the Bank's journey.

The IPO is now open for applications, and the opening of the subscription list will be on 14 December 2023.

Speaking at the launch of IPO, Cargills Bank Managing Director/CFO Senarath Bandara, said: "Over the past three years, despite the difficult economic and operating conditions, the Bank has stabilised its course, and is now positioned for growth. We have recorded a 20% year-to-date growth in net assets this year, and plan to accelerate this growth in the coming years through our scheduled initiatives. Our approach to business is different to others in the industry. We have a development orientation in our approach, but we do not disregard the commercial banking aspect, that is important for us to achieve our growth aspirations. Although we are the latest addition to the banking industry, we have a firm footing with the network and opportunities presented within the Cargills ecosystem. Thank you for believing in our vision and our growth prospects. Your partnership is not just an investment; it's a shared commitment to success. We respectfully invite you to take a share of our progress by investing in the Cargills Bank IPO."

With a vision to be Sri Lanka's most inclusive bank harnessing the spirit of progress in every Sri Lankan, Cargills Bank is the financial services arm of the Cargills Group, providing a full range of banking and financial services. The Bank carries a supported National Long-Term Rating of A(lka) by Fitch Ratings Lanka. The Bank's distinctive retail banking model comprises 24 fully-fledged branches supported by the Cargills Bank MlNl service channel located at 29 selected Central Bank-approved Cargills supermarket outlets, giving the Bank a network of over 50 touchpoints through which customers can easily start and manage their banking relationship. Capitalising on the strength of the Cargills Retail network, the bank facilitates deposits, withdrawals, domestic fund transfers and collection account services at 478 Cargills supermarket outlets across the country. Cargills Bank also provides a range of flexible and convenient digital banking services, including internet banking and a mobile app, that complement the physical touchpoints, offering customers flexibility in accessing banking services on the go. A 24/7 trilingual call centre provides immediate support, ensuring a seamless customer experience. The Bank has embraced the Central Bank's vision of promoting a cashless society and was the first to issue and acquire LankaQR transactions in Sri Lanka and support fintechs to offer cashless payments through the JustPay real-time payments system, driving island-wide technology-based payment solutions. Cargills Bank is headquartered in Colpetty in Colombo and maintains branches at Maitland Crescent, Maharagama, Old Moor Street, Wattala, Kandy, Peradeniya, Nuwara Eliya, Chilaw, Fort, Rajagiriya, Ratnapura, Thanamalwila, Matara, Galle, Kurunegala, Kaduruwela, Vavuniya, Chunnakam, Jaffna, Nawalapitiya, Negombo, Anuradhapura and Bandarawela.

- Pix By Sameera Wijesinghe