Sunday Feb 22, 2026

Sunday Feb 22, 2026

Thursday, 21 March 2024 00:02 - - {{hitsCtrl.values.hits}}

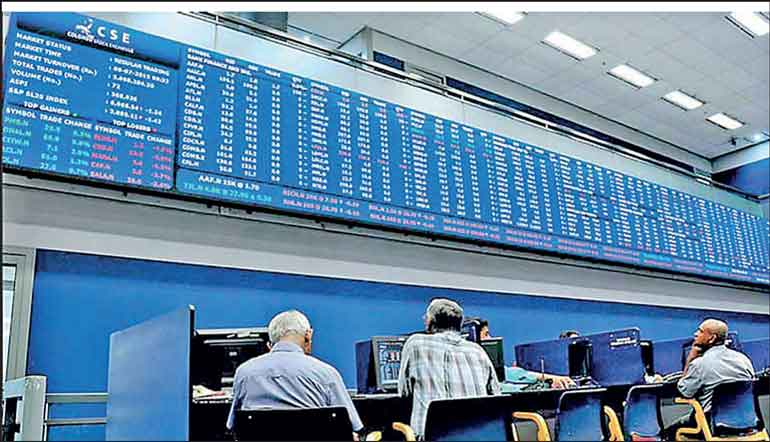

The Colombo stock market yesterday slumped to lacklustre mode with below average turnover and dip in indices.

Turnover was Rs. 910 million involving 45 million shares. The benchmark ASPI was down by 0.3% and the active S&P SL20 was flat.

Asia Securities said the indices closed lower with notable price losses recorded by MGT (-2.6%), CCS (-2.7%), CALT (-2.6%), CFVF (-0.9%) and JKH (-0.5%). On the contrary, price gains were recorded in PLR (+9.1%), WATA (+2.6%), AAIC (+2.6%), and PABC (+1.5%). DIAL (+3 points), COMB (+2 points), and HAYL (+2 points) were the key index drivers during the session while CINS (-20 points) ended as the biggest laggard on the ASPI. Overall, 85 stocks ended in green while 90 ended with losses.

Turnover was led by SAMP

(Rs. 123mn), JKH (Rs. 55mn), and PLR (Rs. 47mn).

Foreigners recorded a net inflow of Rs. 1.9mn. Net foreign buying topped in HNB.N at Rs. 16.7mn and selling topped in JKH at Rs. 38.0mn.

First Capital said the bourse took a dip for the second day straight, as profit-taking persisted, causing the index to slip into the red, which closed at 11,241, down by 35 points.

The day saw a fairly neutral contribution to the index, with the banking sector displaying mixed sentiment throughout the day, whilst active collection was evident on SAMP and PABC. Additionally, active investor participation was also observed on PD counters, primarily FCT during the day. Meanwhile, the market turnover dipped to its lowest level for the month and 47.8% below the month’s daily average, following a notable spike on Tuesday.

The Banking, Capital Goods, and Food, Beverage & Tobacco sectors jointly contributed 57% of the overall turnover during today’s trading session. Moreover, the total number of trades for the day reached only 11,517, marking nearly a three-week low.

NDB Securities said high net worth and institutional investor participation was noted in John Keells Holdings. Mixed interest was observed in Sampath Bank, Prime Lands Residencies and Pan Asia Banking Corporation whilst retail interest was noted in LOLC Finance, Browns Investments and Kotagala Plantations.

The Banking sector was the top contributor to the market turnover (due to Sampath Bank and Pan Asia Banking Corporation) whilst the sector index edged down by 0.08%. The share price of Sampath Bank increased by 10 cents to Rs 78. The share price of Pan Asia Banking Corporation recorded a gain of 30 cents to

Rs. 20.

The Capital Goods sector was the second highest contributor to the market turnover (due to John Keells Holdings) whilst the sector index decreased by 0.43%. The share price of John Keells Holdings lost one Rupee to

Rs. 189.25.

Prime Lands Residencies and Hayleys Fabric were also included amongst the top turnover contributors. The share price of Prime Lands Residencies moved up by 70 cents to Rs. 8.40. The share price of Hayleys Fabric declined by

Rs. 1.10 to Rs 42.