Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Thursday, 25 September 2025 02:37 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

At the fifth Monetary Policy Review for 2025 announced yesterday, the Central Bank of Sri Lanka (CBSL) decided to hold the Overnight Policy Rate at 7.75%. This marked the second consecutive monetary policy decision to keep rates on hold. The Standing Deposit Facility Rate (SDFR) and Standing Lending Facility Rate (SLFR), which are linked to OPR with pre-determined margins of ± 50 basis points, also remained unchanged at 7.25% and 8.25%, respectively. The statutory reserve rate was left unchanged at 2%.

At the fifth Monetary Policy Review for 2025 announced yesterday, the Central Bank of Sri Lanka (CBSL) decided to hold the Overnight Policy Rate at 7.75%. This marked the second consecutive monetary policy decision to keep rates on hold. The Standing Deposit Facility Rate (SDFR) and Standing Lending Facility Rate (SLFR), which are linked to OPR with pre-determined margins of ± 50 basis points, also remained unchanged at 7.25% and 8.25%, respectively. The statutory reserve rate was left unchanged at 2%.

The official press release stated that the Board arrived at the decision after carefully assessing both domestic and global developments. The Board noted that inflation has turned positive after nearly a year of deflation and is projected to gradually rise towards the 5% target by mid-2026, supported by strengthening domestic demand and anchored medium-term expectations. Economic growth of 4.8% in the first half of 2025, alongside broad-based private sector credit expansion, reflects continued recovery momentum. The external sector also remained resilient, with improved inflows from tourism and remittances, stable reserves and currency conditions, and recent sovereign rating upgrades. Against this backdrop, the Board judged that the current policy stance remains appropriate to guide inflation towards target while supporting sustained economic growth.

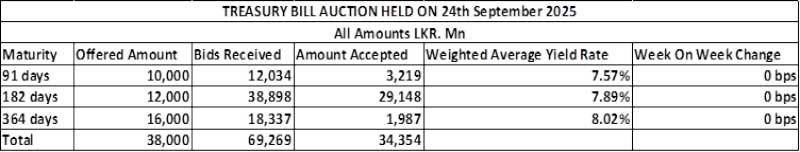

Meanwhile, the weighted average yields at yesterday’s weekly Treasury bills auction remained unchanged. Accordingly, the rate on the 91-day, 182-day and 364-day tenors remained unchanged at 7.57%, 7.89% and 8.02%. This marks the 10th week where T-Bill rates have stayed mostly unchanged at

auctions.

However, in terms of subscription, 90.41% of the total offered amount was raised, with successful bids amounting to Rs. 34.35 billion against the Rs. 38 billion on offer in the first phase of competitive bidding. This marked the fifth consecutive auction that fell short of fully raising the targeted amount. Nevertheless, this represented a notable improvement compared to last week’s 72% subscription.

The Phase II of subscription on for 91- and 364-day tenors is now open until 3 p.m. of business day prior to settlement date (i.e., 25.09.2025) at the WAYRs determined for the said ISINs at the auction.

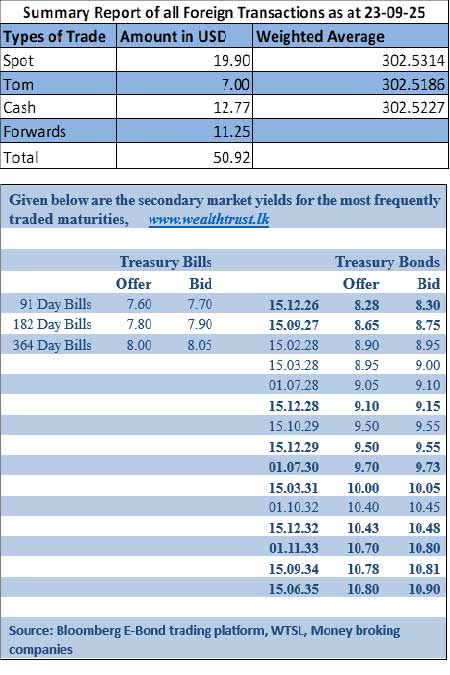

The Secondary Bond market yesterday remained broadly stable, with yields holding steady. Trading was largely confined to a narrow range as the monetary policy announcement was widely anticipated and largely priced in.

The 15.05.26 and 15.01.27 maturities were seen trading at the rate of 8.18-8.15% and 8.30% respectively. The 15.02.28 and 15.03.28 maturities were seen trading at the rates of 8.93% and 8.95% respectively. The 01.07.30 maturity traded at the rate of 9.71%. The 01.10.32 and 15.12.32 maturities were seen trading at the rates of 10.40% and 10.45% respectively. The 01.06.33 maturity was seen trading at the rate of 10.73%.

In the Secondary Bills market, trades were observed on December 2025, January and August 2026 maturities at the rate of 7.65%, 7.70% and 8.04% respectively.

The total secondary market Treasury bond/bill transacted volume for 23 September was Rs. 10.54 billion.

In money markets, the weighted average rates on overnight call money and Repo stood at 7.86% and 7.87% respectively.

The net liquidity surplus was recorded at Rs. 136.64 billion yesterday. An amount of Rs. 2.90 billion was withdrawn from the Central Banks SLFR (Standing Lending Facility Rate) of 8.25%, while an amount of Rs. 139.54 billion was deposited at Central Banks SDFR (Standard Deposit Facility Rate) of 7.25%.

Forex market

In the forex market, the USD/LKR rate on spot contracts to closed stable 302.45/302.55 as against its previous day’s closing level of Rs. 302.45/302.60.

The total USD/LKR traded volume for 23 September 2025 was $ 50.92 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking

companies)