Saturday Feb 21, 2026

Saturday Feb 21, 2026

Thursday, 31 July 2025 04:36 - - {{hitsCtrl.values.hits}}

By Securities and Exchange Commission of Sri Lanka

By Securities and Exchange Commission of Sri Lanka

Understanding where your money goes and how businesses grow

Picture this: You have some extra money sitting in your drawer, while across town, an established manufacturing company with a solid track record desperately needs funds to expand their operations and hire more workers. How do these two needs meet? Welcome to the fascinating world of capital markets – Sri Lanka’s financial matchmaking service.

What exactly are capital markets?

Think of capital markets as giant marketplaces where money changes hands. Just like in an ordinary marketplace, companies come to capital markets to “buy” money (through borrowing or selling shares), while people with extra cash come to “sell” their money (by investing) in exchange for returns.

In simple terms, capital markets help channel money from people who have it (savers and investors) to people who need it (businesses and governments) to grow and create jobs.

Breaking free from the middleman: Why direct investment matters

It is the general consensus that the depositing your hard-earned money in a bank is the safest option, what’s with the collective financial trauma Sri Lankans have gone through via experiences like the Golden Key Scandal and the Sakvithi Debacle.

For years, the journey of your money looked like this: You earn money → deposit it in a bank → bank lends it to businesses → bank keeps most of the profit. In fact, according to the Economic Financial Review 2024, published by The Central Bank of Sri Lanka, showed that deposits, collectively racked up to an amount of Rupees 17,969.4 billion which accounted for 81% of the banking industry’s total liabilities and equity at the end of 2024. This reveals how there is a massive deposit concentration in the economy created by the overwhelming confidence in the banking sector. It is obvious that Sri Lankans understand the vitality of the banks and that they provide essential services, keep our money safe, and fund countless businesses. Essentially, they have become the backbone of Sri Lanka’s financial system.

However, this system has natural limitations. Banks must be careful with depositors’ money, so they’re selective about who gets loans. Interest rates stay high because banks need to cover their costs and risks. Many promising small businesses get turned away simply because they don’t fit standard lending criteria.

The Bottom Line is that Banks have served Sri Lanka well and continue to play a crucial role. But very little of your bank savings are used for the overall development of the country. So where do we go from here?

The game changer: Direct connection to Funds via the capital market

Enter capital markets with a revolutionary idea: “Why not let savers and borrowers deal directly with each other?” Essentially cutting out of the middleman which simply means “removing the go-between.”

Moving away from the role of banks, capital markets offer something additional: the power for ordinary people to directly participate in building the economy while growing their own wealth. It’s not about choosing sides – it’s about having more financial freedom and opportunities.

Instead of your money sitting in a bank that decides who gets it, you can now directly choose to invest in companies you believe in. It’s like buying directly from the farmer instead of going through multiple middlemen.

Two roads to raising Money: Equity vs Debt

When companies need money, they have two main paths in capital markets:

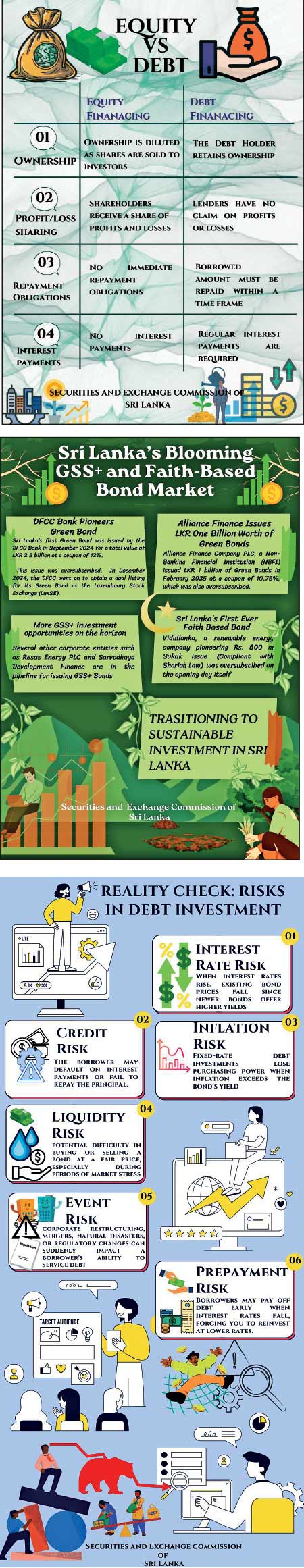

When it comes to the ownership in terms of Equity, the ownership dilutes with each share issue but in terms of debt . the holder retains the ownership. In equity shareholders receive a share of their profits and losses but in debt, the holder has no claim on profit and losses

1.The ownership route: Equity markets

Imagine you and your friends want to start a restaurant. Instead of borrowing money, you decide to sell small pieces of ownership to raise funds. This is exactly what happens in equity markets. Companies sell shares, which represent small pieces of ownership, to the public to raise capital. When you buy shares, you become a part-owner of the company, and if the company performs well, your shares become more valuable. Additionally, you might receive dividends, which are your share of the company’s profits distributed to shareholders.

2.The lending route: Debt markets

Sometimes companies prefer to borrow money rather than give away ownership, which is where debt markets come in. In this scenario, companies issue IOUs called bonds or debentures to raise funds. When you buy these securities, you’re essentially lending money to the company, and they promise to pay you back with interest over a specified period. You receive regular interest payments throughout the loan term until they repay the full principal amount. Think of it like this: if equity is like having a business partner, debt is like being a money lender with a written promise of repayment.

Things that set apart: Equity Vs Debt

Ownership – When it comes to equity financing, ownership is diluted as shares are sold to investors. However, in debt financing, the debt holder retains ownership.

Profit/Loss Sharing – In equity financing, shareholders receive a share of profits and losses, as opposed to debt financing in which lenders have no claim on profits or losses

Repayment obligations – No immediate repayment obligations in equity financing. In debt financing however, the borrowed amount must be repaid within a time frame.

Interest payments – In terms of equity financing, there are no interest payments but in debt financing regular interest payments are required.

Debentures decoded: The company IOU system

Debentures are essentially formal IOUs that companies give you when you lend them money. What makes them particularly attractive to investors is their predictable nature and security features. They offer fixed returns, meaning you know exactly how much you’ll earn or can predict your return with certainty. Most debentures provide regular income through interest payments made every six months, creating a steady cash flow for investors. Each debenture comes with a specific maturity date when the company must repay the full principal amount you originally lent them. Perhaps most importantly, debenture holders enjoy priority treatment in the company’s capital structure, which means if the company faces financial difficulties, debenture holders get paid before shareholders, providing an additional layer of security for your investment.

The flip side: What could go wrong?

Like any investment, debentures come with risks:

Interest Rate Risk - When interest rates rise, existing bond prices fall since newer bonds offer higher yields. Long-term bonds are more sensitive to rate changes than short-term ones. This creates potential capital losses if you need to sell before maturity.

Credit Risk - The borrower may default on interest payments or fail to repay the principal. This is particularly relevant to corporate bonds, high-yield bonds, and emerging market debt. Even government bonds aren’t immune, as sovereign defaults can occur.

Inflation Risk - Fixed-rate debt investments lose purchasing power when inflation exceeds the bond’s yield. Your real return (after inflation) may be negative even if you receive all promised payments.

Liquidity Risk - Potential difficulty in buying or selling a bond at a fair price, especially during periods of market stress. This risk arises because some corporate bonds may have fewer buyers and sellers compared to government bonds, making it harder to execute trades quickly without impacting the price significantly.

Event Risk Corporate restructuring, mergers, natural disasters, or regulatory changes can suddenly impact a borrower’s ability to service debt, even for previously stable issuers.

Prepayment Risk Borrowers may pay off debt early when interest rates fall, forcing you to reinvest at lower rates. This is common with mortgage-backed securities and callable bonds.

Tips on how to balance the devil on your shoulder: Guide to risk management

The array of debt securities facilitated; Invest in what you believe in

The Securities and Exchange Commission of Sri Lanka serves as both the gatekeeper and facilitator of bond investments. Acting like a financial referee, the SEC creates rules and approval processes that allow companies to borrow money from the public through bonds while protecting investors from fraud and misinformation. Their dual role as regulator and facilitator has enabled the development of innovative bond markets, ensuring that when companies want to issue bonds, they must provide complete and honest information about their finances and intentions. Through this careful oversight and facilitation, the SEC has made possible the following bond categories that serve both investor returns and broader societal goals:

Corporate promises of economic affluence: Corporate Bonds

The corporate bond market presents a fascinating risk-reward spectrum. At one end, bonds offered from established corporations with good credit ratings offer reliable returns slightly higher than government securities. At the other end, high-yield or “junk” bonds from less financially stable companies entice investors with premium interest rates to compensate for elevated risk.

The corporate bond market offers remarkable diversity, allowing investors to precisely calibrate their desired balance between safety and yield.

Save the planet and make profit: Unlocking value through GSS+ Bonds

GSS+ refers to a category of financial products designed to fund projects with positive environmental and social impacts. The Regulatory Framework for listing and trading the following Bond categories have been enabled at the CSE:

Green Bonds - Green Bonds debt securities specifically designed to fund projects with positive environmental or climate benefits.

Blue Bonds - Blue Bonds are debt securities designed specifically to finance projects related to ocean conservation and sustainable marine activities.

Social Bonds - Social Bonds are debt securities that raise funds specifically for projects delivering positive social outcomes and addressing social challenges. They offer investors a way to generate financial returns while supporting social welfare initiatives.

Sustainability Linked Bonds - Sustainability Linked Bonds differ from the other types of GSS+ Bonds in that their proceeds are not used to finance specific projects but are instead made available for general corporate purposes, with the issuer contractually undertaking to achieve predefined, measurable sustainability targets or Key Performance Indicators (KPIs).

“Faith-based finance finds home”: Shariah-compliant Debt securities

Shariah compliant Debt Securities, commonly known as Sukuk, represent Shariah-compliant financial certificates that embody partial ownership in an underlying asset, usufruct, service, project, business, or investment. Unlike conventional bonds that create debt obligations with interest payments, sukuk are structured as investment certificates that provide returns derived from asset performance rather than interest.

Enabling this product at the CSE is expected to attract previously untapped capital by opening doors to foreign portfolio investments from Shariah seeking investors.

Sri Lanka’s blooming GSS+ and faith-based Bond market

DFCC Bank Pioneers Green Bond

Sri Lanka’s first Green Bond was issued by the DFCC Bank in September 2024 for a total value of LKR 2.5 billion at a coupon of 12%.

This issue was oversubscribed. In December 2024, the DFCC went on to obtain a dual listing for its Green Bond at the Luxembourg Stock Exchange (LuxSE).

Alliance Finance Issues LKR One Billion Worth of Green Bonds

Alliance Finance Company PLC, a Non-Banking Financial Institution (NBFI) issued LKR 1 billion of Green Bonds in February 2025 at a coupon of 10.75%, which was also oversubscribed.

Sri Lanka’s First Ever Faith Based Bond

Vidullanka, a renewable energy company pioneering Rs. 500 m Sukuk issue (Compliant with Shariah Law) was oversubscribed on the opening day itself.

More GSS+ investment opportunities on the horizon

Several other corporate entities such as Resus Energy PLC and Sarvodhaya Development Finance are in the pipeline for issuing GSS+ Bonds

Building tomorrow today: Infrastructure Bonds

The introduction of Infrastructure Bonds marks a significant step toward addressing the nation’s infrastructure financing gap. These specialised debt instruments will channel private capital into critical projects spanning transportation, energy, water, and digital infrastructure.

With extended maturities designed to match the long-term nature of infrastructure assets, these bonds offer investors stable, predictable returns while contributing to national development priorities.

Infrastructure Bonds will create a win-win scenario where investors gain exposure to essential assets with inflation-protected returns, while the country benefits from accelerated infrastructure development.

Capital fortified: Unlocking value through Basel III Tier 2 instruments

Basel III-compliant debentures represent a specialised category of debt instruments that adhere to the regulatory standards established by the Basel Committee on Banking Supervision in response to the 2007-2008 global financial crisis. These debentures are designed to strengthen bank capital requirements, stress testing, and market liquidity risk management.

Endless opportunities”: Perpetual Bonds

True to its name, Perpetual Bonds are debt securities with no maturity date and pays interest indefinitely. These instruments offer unique advantages for both issuers seeking stable long-term funding and investors looking for consistent income streams.

Unlike conventional bonds, perpetuals remain outstanding until the issuer chooses to redeem them, typically after a specified initial period.

Perpetual Bonds represent financial innovation at its finest. They provide corporates with quasi-equity financing without diluting ownership, while investors benefit from higher yields compared to traditional fixed-income products.

Higher risk, higher reward”: High-yield Bonds

Rounding out the new offerings are High-Yield Bonds, sometimes known as “junk bonds,” which carry higher interest rates to compensate for their greater risk profile. These instruments typically come from issuers with lower credit ratings or newer enterprises without established credit histories.

Market participants have welcomed the addition, noting it completes the CSE’s fixed-income ecosystem by catering to investors with more aggressive risk appetites.

High-yield bonds fill a crucial gap in our market. They offer potentially attractive returns in a low-interest environment and provide companies that might not qualify for investment-grade ratings with vital access to capital. Currently this is facilitated for entities regulated by the CBSL or the Insurance Regulatory Commission of Sri Lanka (IRCSL)

Why capital markets matter: The win-win story

For companies raising money:

Cheaper Funding: Instead of paying high bank interest rates, companies can often raise money more cheaply through capital markets.

No Collateral Hassles: Unlike bank loans that require mortgaging property, companies can raise funds based on their business prospects.

Flexibility: They can choose between giving away ownership (equity) or borrowing (debt) based on their needs.

Growth Capital: Access to large amounts of money helps companies expand, hire more people, and in turn contribute to economic growth.

For everyday investors:

Better Returns: Instead of earning a lesser return from bank deposits, you might be able to earn significantly higher returns in the capital market

Choice and Control: You decide which companies to support with your money.

Wealth Building: Over time, successful investments can significantly grow your wealth.

Economic Participation: You become part of Sri Lanka’s economic growth story.

The bigger picture: Building tomorrow’s Sri Lanka

Capital markets aren’t just about making money – they’re about building the future. When you invest in a renewable energy company’s debenture, you’re funding clean power for Sri Lanka. When you buy shares in a tech startup, you’re supporting innovation and job creation.

Getting started: Your first steps

Ready to explore capital markets? Start small:

1.Learn the basics through free regulatory sources like Securities and Exchange Commission of Sri Lanka

2.Open a trading account with a licensed stockbroker

3.Start with blue-chip companies – established firms with good track records

4.Diversify your investments – don’t put all eggs in one basket

5.Think long-term – capital markets reward patience

Still feeling apprehensive? Try Unit Trusts

Unit Trust Funds are a collective investment scheme that is a pooling vehicle of your funds, offering professionally managed investment pools with various risk profiles suitable for unsophisticated investors.

Minimum investment begins from as low as LKR 1,000.00. Risk level varies based on type of the Scheme who creates a diversified portfolio based on the fund’s parameters to earn a return.

Then your money is used by professional fund managers who know what they’re doing. They take everyone’s money and buy a mix of different investments - like shares in companies, government bonds, and other financial assets.

Steps to follow;

1.Choose a licensed managing company and open a unit trust account

2.Open your account with as little as Rs.1000

3.Choose the Scheme - Once your account is open, you need to choose a fund to invest in. You can choose from a range of funds such as Growth funds, Income funds, Balanced funds, Money Market funds, Sector Funds and Index Funds. Each fund has different risks and returns, so you need to decide which is the best fit for your goals and risk appetite.

4.Monitor your investment

The beauty of unit trusts is their simplicity – investors receive the benefit of professional management without needing to be a financial expert.

Finally, it’s important to remember, all investments carry risks. Never invest money you can’t afford to lose and always do your homework before making investment decisions.

Capital markets have democratised finance in Sri Lanka, giving everyone a chance to participate in the country’s economic growth, offering opportunities to grow your wealth while supporting businesses that create jobs and drive progress.

1.Direct Investment Revolution Capital Market enables direct investor-business connections, which bypasses middlemen, offering higher returns vs common traditional saving routes

2.Diverse SEC-Regulated Options From Green Bonds to Sukuk to Infrastructure Bonds - SEC’s framework provides investment choices aligned with different values and risk appetites.

3.Democratised Access Capital markets are accessible to all Sri Lankans and interested foreign investors, with educational resources and investor protection.

4.National Development Contribution SEC facilitates the channeling of private capital via the capital market into critical infrastructure and development projects, fueling economic growth while generating investor returns.