Thursday Feb 19, 2026

Thursday Feb 19, 2026

Monday, 14 July 2025 01:53 - - {{hitsCtrl.values.hits}}

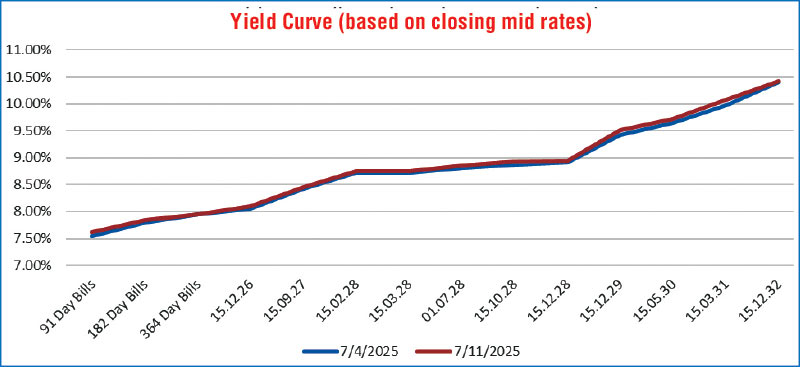

By Wealth Trust Securities

The Secondary bond market started off last week with yields holding broadly steady as market participants were seen adopting a wait-and-see approach ahead of the upcoming Treasury bond auction due last Friday and the anticipated final decision on the United States ‘Reciprocal Tariffs’. Market activity throughout the week was subdued and stayed range-bound, leading to a period of consolidation and characterised by sideways movement. On last Thursday (a Poya Holiday), it was announced that US President has issued a letter to Sri Lanka President, setting a 30% tariff, down from an original proposed 44%. Subsequently as the market opened on Friday, coinciding with the Rs. 200.00 b T-bond auction, the news drew positive reactions. However, this was met with selling pressure as some market participants looked to book profit ahead of T-bonds auction.

The Secondary bond market started off last week with yields holding broadly steady as market participants were seen adopting a wait-and-see approach ahead of the upcoming Treasury bond auction due last Friday and the anticipated final decision on the United States ‘Reciprocal Tariffs’. Market activity throughout the week was subdued and stayed range-bound, leading to a period of consolidation and characterised by sideways movement. On last Thursday (a Poya Holiday), it was announced that US President has issued a letter to Sri Lanka President, setting a 30% tariff, down from an original proposed 44%. Subsequently as the market opened on Friday, coinciding with the Rs. 200.00 b T-bond auction, the news drew positive reactions. However, this was met with selling pressure as some market participants looked to book profit ahead of T-bonds auction.

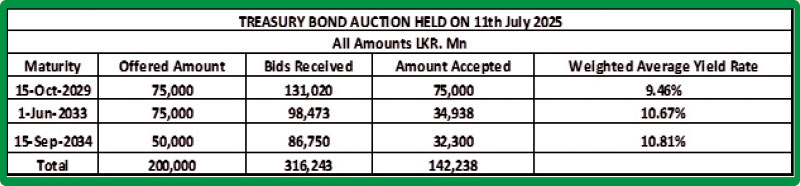

The three Treasury bond auctions saw only an amount of Rs. 142.24 billion (71.12%) accepted in total against an offered total of Rs. 200 billion, despite total bids received exceeding the offered amount by 1.58 times.

The results continued to reflect the inclination of traders to favour shorter duration maturities as the 15.10.29 maturity (10.35% coupon) was fully subscribed in the first phase in competitive bidding at a weighted average yield of 9.46%, coming in line with market expectations. For comparison, it was traded at rate of 9.45% just prior to the auction.

Yet again, the 2033 maturity failed to raise the entire maturity-wise offered amount of Rs. 75.00 billion at the 1st phase, which prompted the opening of the 2nd phase. The auctioned 01.06.33 maturity saw only 46.58% or Rs. 34.94 billion raised in successful bids at a weighted average rate of 10.67%.

The long tenor 15.09.34 maturity also was undersubscribed at the 1st phase which prompted the opening of the 2nd phase. The maturity raised only Rs. 32.30 billion in successful bids against its offered amount of Rs. 50.00 billion and was issued at a weighted average of 10.81%.

The weekly Treasury bill auction held last Wednesday was undersubscribed, raising only Rs. 66.51 billion or 91.74% of the Rs. 72.50 billion offered in the first phase of competitive bidding. This occurred despite total bids amounting to 1.72 times the offered amount. The weighted average yields rose across all tenors.

The weekly Treasury bill auction held last Wednesday was undersubscribed, raising only Rs. 66.51 billion or 91.74% of the Rs. 72.50 billion offered in the first phase of competitive bidding. This occurred despite total bids amounting to 1.72 times the offered amount. The weighted average yields rose across all tenors.

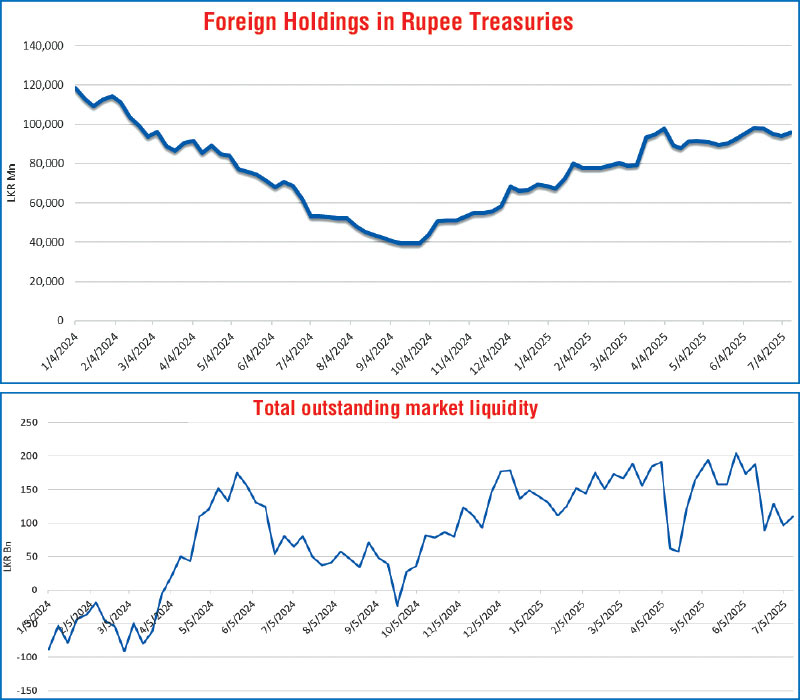

Nevertheless, the foreign holding in Rupee Treasuries recorded a net inflow for the first time three weeks, amounting to Rs. 1.70 billion and as a result the total holding increased to Rs. 95.62 billion as at 10 July 2025.

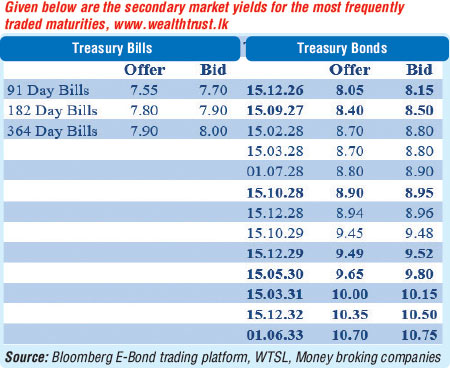

The limited secondary market activity during the week centred on the selected maturities. The 01.05.27 and 15.09.27 maturities were seen trading at the rates of 8.30% and 8.45% respectively. The 15.03.28 and 01.05.28 maturities at the rates of 8.75% and 8.80%-8.77% respectively. In addition, the 01.09.28 and 15.12.29 maturities were seen transacting at the rate of 8.95%-8.90%, and 9.51%-9.42% respectively. Post auction the 01.06.33 maturity was seen trading at the rate of 10.70%.

The daily secondary market Treasury bond/bill transacted volumes for the first three days of the week averaged at Rs. 23.85 billion.

In money market, the total outstanding liquidity surplus in the inter-bank money market increased to Rs. 109.50 billion as at the week ending 11 July, 2025, from Rs. 96.53 billion recorded the previous week. The weighted average interest rates on call money and repo were recorded within the ranges of 7.75% and 7.75%-7.77% respectively while the Central Bank of Sri Lanka’s (CBSL) holding of Government Securities was registered at Rs. 2,508.92 billion as at the 11 July, 2025, unchanged against the previous week’s closing level.

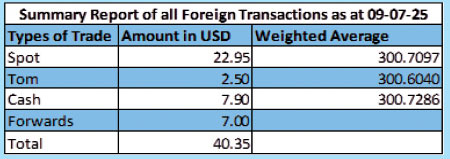

In the Forex market, the USD/LKR rate on spot contracts was seen depreciating to close the week at Rs. 300.70/301.00 as against the previous week’s closing level of Rs. 300.10/300.20, subsequent to trading at a high of Rs. 300.18 and a low of Rs. 301.40.

The daily USD/LKR average traded volume for the first three trading days of the week stood at $ 59.58 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)