Saturday Feb 14, 2026

Saturday Feb 14, 2026

Wednesday, 6 August 2025 00:04 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

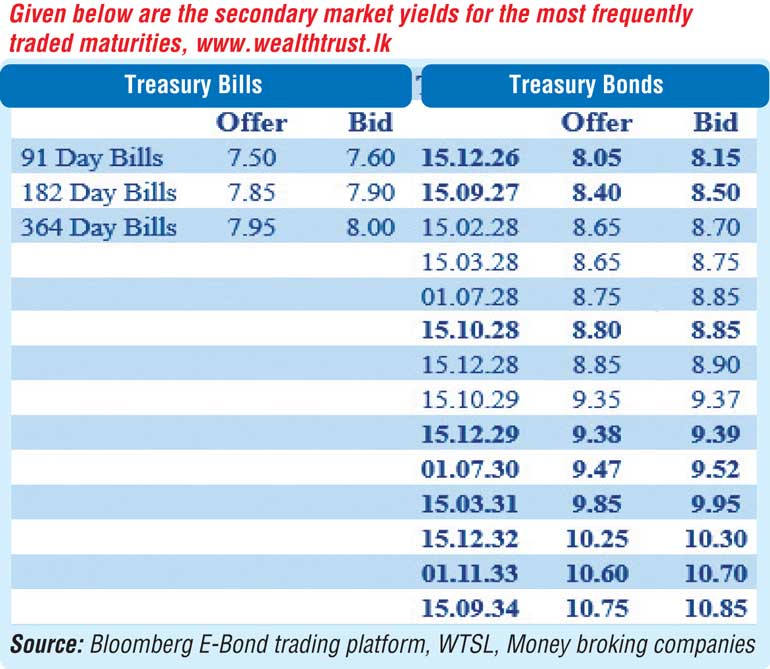

The secondary bond market yesterday saw yields remaining anchored broadly around prevailing levels.

Trades were observed focused on the short end of the yield curve. The 15.06.29, 15.09.29 and 15.12.29 maturities were seen trading at the rates of 9.30%, 9.36%-9.35% and 9.39% respectively. The 15.05.30, 01.07.30 and 15.10.30 maturities were seen trading at the rates of 9.47%, 9.45% and 9.55% respectively.

This comes ahead of the Treasury bill auction due today. The auction will have on offer a total amount of Rs. 82.00 billion on offer, a decrease of Rs. 10.50 billion over the previous week. This will consist of Rs. 25.00 billion on the 91-day maturity, Rs. 30.00 billion on the 182-day and Rs. 27.00 billion on the 364-day maturity.

For reference, at the weekly Treasury bill auction held last Wednesday (30/07/25), weighted average yield rates remained stable, for the second consecutive week. Accordingly, the weighted average rate on the 91-day tenor stayed flat at 7.62%, the 182-day tenor at 7.91% and the 364-day tenor at 8.03%. However, the auction raised only 71.49% or Rs. 66.13 billion out of the total offered amount of Rs. 92.50 billion in successful bids at its 1st Phase. This marked the second consecutive Treasury bill auction to go undersubscribed. However, a further Rs. 23.01 billion was raised in total from the 2nd phase of the auction, bringing the total amount raised to Rs. 89.14 billion, just shy of its total offered amount. This was a drastic improvement in subscription over the previous week.

The total secondary market Treasury bond/bill transacted volume for 04 August was Rs. 5.74 billion.

In money markets, the weighted average rates on overnight call money and Repo stood at 7.83% and 7.86% respectively.

The net liquidity surplus was recorded at Rs. 93.31 billion yesterday. An amount of Rs. 0.15 billion was withdrawn from the Central Banks SLFR (Standing Lending Facility Rate) of 8.25%, while an amount of Rs. 93.46 billion was deposited at Central Banks SDFR (Standard Deposit Facility Rate) of 7.25%.

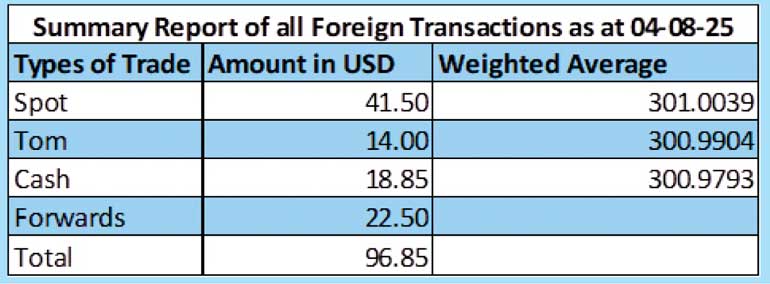

Forex market

In the Forex market, the USD/LKR rate on spot contracts closed the day appreciating to Rs. 300.88/300.90 as against Rs. 301.20/301.30 the previous day.

The total USD/LKR traded volume for 04 August was $ 96.85 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)