Sunday Feb 15, 2026

Sunday Feb 15, 2026

Tuesday, 21 January 2020 00:00 - - {{hitsCtrl.values.hits}}

The fresh trading week commenced on a moderate note yesterday as trades were seen taking place within a very narrow range and closing the day broadly steady.

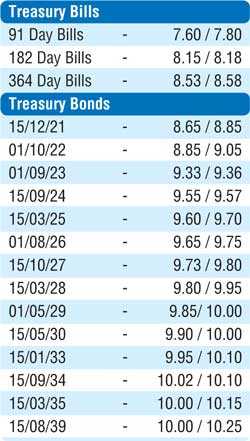

The yields of the liquid 01.09.23 and two 2024s (i.e. 15.06.24 and 15.09.24) maturities were seen changing hands at levels of 9.33% to 9.35% and 9.55% to 9.56% respectively against their previous day’s closing levels of 9.35/40, 9.56/58 and 9.55/58. In addition, the short dated maturity of 01.05.20 traded at levels of 7.65% to 7.75% as well.

Meanwhile, in the secondary bill market, March 2020, April 2020 and January 2021 maturities were seen changing hands at levels of 7.35%, 7.38% to 7.55% and 8.55% respectively.

The total secondary market Treasury bond/bill transacted volume for 17 January 2020 was Rs. 3.98 billion.

In money markets, overnight call money and repo rates averaged 7.50% and 7.53% respectively as the Domestic Operations Department (DOD) of the Central Bank of Sri Lanka was seen injecting an amount of Rs. 14.6 billion at a weighted average of 7.53% by way of an overnight reverse repo auction. The overnight net liquidity surplus in the system stood at Rs. 26.69 billion yesterday.

Rupee loses marginally

The USD/LKR rate on spot contracts was seen closing the week marginally lower at Rs. 181.30/35 in comparison to its previous week’s closing of Rs. 181.20/30, on the back of buying interest by banks.

The total USD/LKR traded volume for 17 January 2020 was $ 51.12 million.

Some of the forward USD/LKR rates that prevailed in the market were one month - 181.80/95; three months - 182.80/00 and six months - 184.35/55.