Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Monday, 23 June 2025 03:33 - - {{hitsCtrl.values.hits}}

By WealthTrust Securities

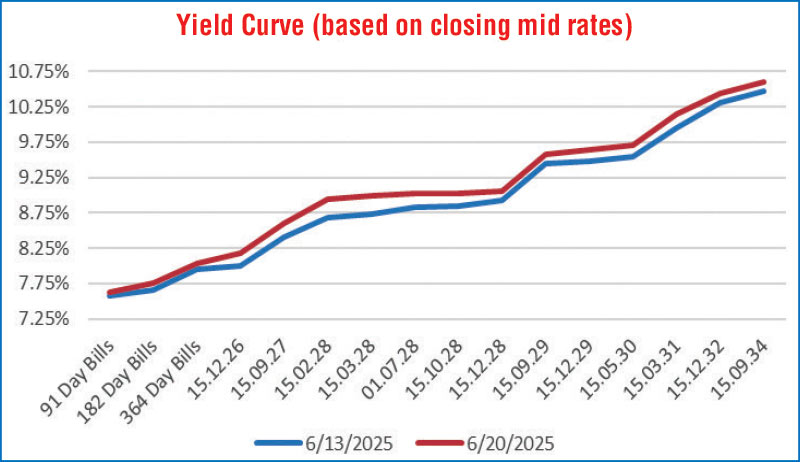

The Secondary Bond market witnessed yields trending higher throughout the week as investor sentiment turned increasingly bearish. The primary driver was escalating geopolitical tensions stemming from the Israel-Iran conflict, including reports that the US President has privately approved attack plans against Iran — though no final order has been given — and the continuation of tit-for-tat strikes between the two nations. This was compounded by local factors, including the undersubscription at the weekly Treasury bill auction, which saw yields on the 182-day tenor edge higher, and a decline in liquidity that further weighed on market sentiment. Traders also took note of the US Federal Reserve’s decision to keep policy rates unchanged at its June meeting. As a result, yields rose considerably, although renewed buying interest at elevated levels helped to moderate further increases. Trading activity featured brief bursts of intensity but remained largely subdued overall.

The Secondary Bond market witnessed yields trending higher throughout the week as investor sentiment turned increasingly bearish. The primary driver was escalating geopolitical tensions stemming from the Israel-Iran conflict, including reports that the US President has privately approved attack plans against Iran — though no final order has been given — and the continuation of tit-for-tat strikes between the two nations. This was compounded by local factors, including the undersubscription at the weekly Treasury bill auction, which saw yields on the 182-day tenor edge higher, and a decline in liquidity that further weighed on market sentiment. Traders also took note of the US Federal Reserve’s decision to keep policy rates unchanged at its June meeting. As a result, yields rose considerably, although renewed buying interest at elevated levels helped to moderate further increases. Trading activity featured brief bursts of intensity but remained largely subdued overall.

The total outstanding liquidity surplus in the inter-bank money market decreased sharply to Rs. 89.15 billion as at the week ending 20 June, from Rs. 187.53 billion recorded the previous week. This marks the lowest weekly closing total outstanding liquidity surplus since 17 April.

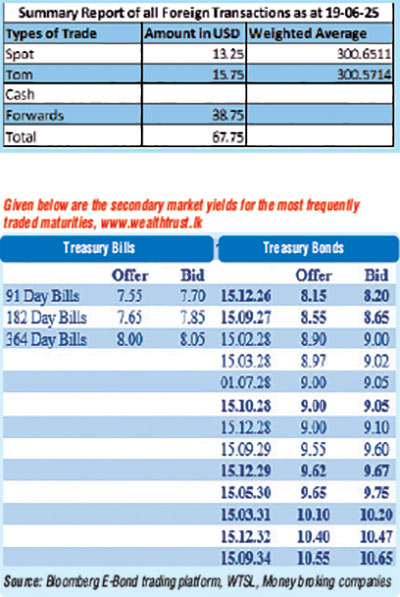

The weekly Treasury bill auction conducted last Wednesday (18 June) ended in undersubscription, with only 86.83% of the total Rs. 132 billion offered — amounting to Rs. 114.62 billion — being accepted through successful bids. The weighted average yield on the 182-day tenor edged up by 1 basis point to 7.73%, while yields on the 91-day and 364-day tenors remained unchanged at 7.55% and 7.94%, respectively.

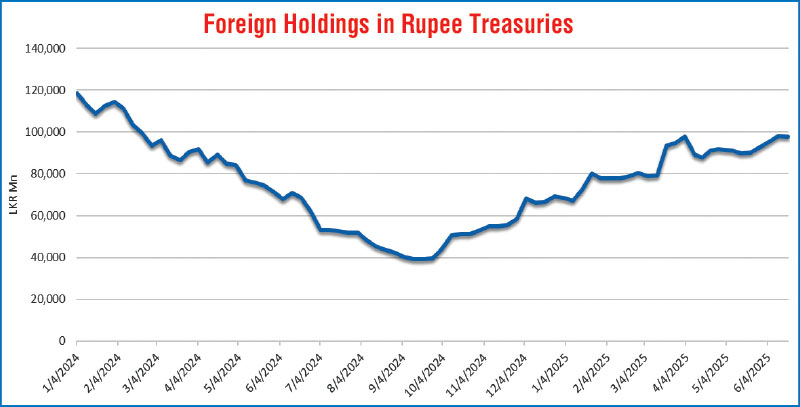

Furthermore, the foreign holding in rupee bonds was seen reversing its increasing trend witnessed over the previous four weeks to record an outflow of Rs. 165 million for the week, ending 19 June.

In Secondary Bond markets, the 15.12.26 maturity traded up the range of intraweek low and high of 8.00%-8.15%. The 01.05.27 and 15.09.27 maturities were seen trading at the rates of 8.35%-8.45% and 8.50%-8.55% respectively. The 15.03.28 maturity was seen moving up the range of 8.80% to 9.00%. The 15.06.29 and 15.09.29 maturities traded up the ranges of 9.50%-9.60% and 9.46%-9.55%. The 15.12.29 maturity traded up from an intraweek low of 9.53% to a high of 9.65%. The yield on the 15.12.32 maturity increased from a low of 10.31% to a high of 10.45% at the close of the week. The 15.09.34 maturity traded up the range of 10.45%-10.60%.

The daily secondary market Treasury bond/bill transacted volumes for the first four days of the week averaged at Rs. 30.79 billion.

In money market, the weighted average interest rates on call money and repo were recorded within the ranges of 7.69%-7.73% and 7.72%-7.74% respectively while the Central Bank of Sri Lanka’s (CBSL) holding of Government Securities was registered at Rs. 2,508.92 billion as at 20 June, unchanged against the previous week’s closing level.

Forex market

In the Forex market, the USD/LKR rate on spot contracts was seen depreciating, to close the week at Rs. 300.50/300.65 as against the previous week’s closing level of Rs. 299.70/300.00 and subsequent to trading at a high of Rs. 300.00 and a low of Rs. 301.60.

The daily USD/LKR average traded volume for the first four trading days of the week stood at $ 61.00 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)