Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Monday, 21 July 2025 03:52 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

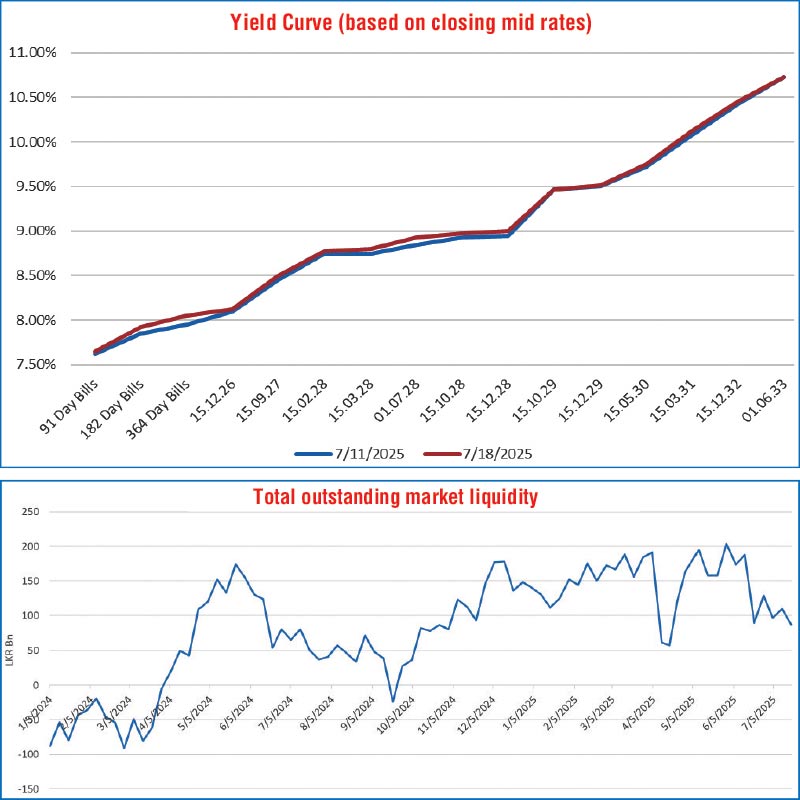

The dull sentiment in the secondary bond market saw limited trades taking place across the yield curve within a narrow range during the trading week ending 18 July.

The dull sentiment in the secondary bond market saw limited trades taking place across the yield curve within a narrow range during the trading week ending 18 July.

The continued uncertainty over the United States Reciprocal Tariffs along with the drop in liquidity was seen as the reasons behind this sentiment.

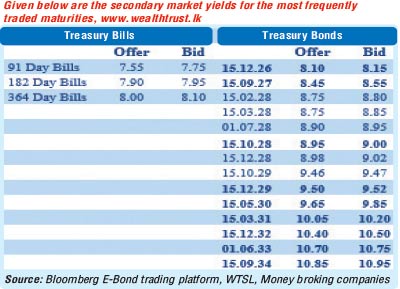

In Secondary Bond market, the short-dated 01.02.26 traded at 7.90%, followed by the 01.05.27 at 8.35%–8.45% and the 15.09.27 at 8.50%-8.53%. Among the 2028 maturities, the 15.03.28 traded at 8.76%, the 01.05.28 at 8.85%, the 01.07.28 at 8.92%, the 01.09.28 at 8.95%, the 15.10.28 at 8.97%, and the 15.12.28 within the range of 8.99%–9.01%. Moving into the 2029 space, the 15.10.29 traded at 9.47%–9.48%, and the 15.12.29 between 9.50%–9.52%. The 15.12.32 saw trades at 10.46%, while the 01.06.33 and 01.11.33 were active at 10.72% and 10.80% respectively. At the far end of the curve, the 15.09.34 changed hands at 10.85%–10.86%.

At the weekly Treasury Bill auction held last Wednesday, the weighted average yield rates increased across all three tenors for the second consecutive week. The 91-day yield rose by 2 basis points to 7.62%, the 182-day by 7 basis points to 7.91%, and the 364-day by 5 basis points to 8.04%. However, the auction was fully subscribed at the first phase of competitive bidding, successfully raising the total offered amount of Rs. 85.00 billion.

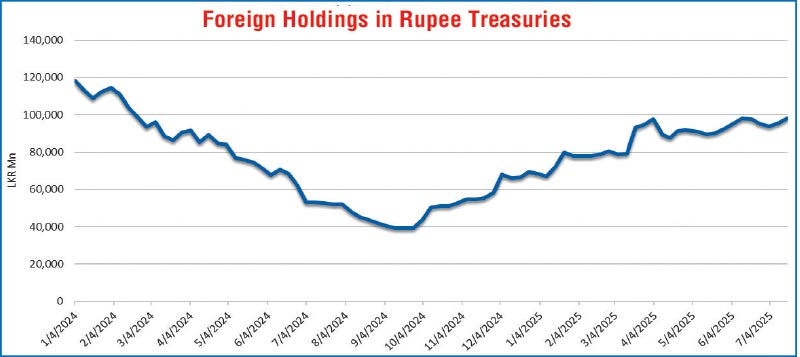

Nevertheless, the foreign holding in Rupee Treasuries recorded a net inflow for the second straight weeks, amounting to Rs. 2.57 billion and as a result the total holding increased to Rs. 98.19 billion as at 17 July.

The daily secondary market Treasury Bond/Bill transacted volumes for the first four days of the week averaged at Rs. 20.67 billion.

In money market, the total outstanding liquidity surplus in the inter-bank money market decreased to Rs. 87.01 billion as at the week ending July 18th, 2025, from Rs. 109.50 billion recorded the previous week. The weighted average interest rates on call money and repo were recorded within the ranges of 7.75%-7.79% and 7.76%-7.80% respectively while the Central Bank of Sri Lanka’s (CBSL) holding of Government Securities was registered at Rs. 2,508.92 billion as at the 18 July, unchanged against the previous week’s closing level.

Forex Market

In the Forex market, the USD/LKR rate on spot contracts was seen depreciating to close the week at Rs. 301.65/301.85 as against the previous week’s closing level of Rs. 300.70/301.00, subsequent to trading at a high of Rs. 300.97 and a low of Rs. 301.80.

The daily USD/LKR average traded volume for the first four trading days of the week stood at $ 57.23 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)