Sunday Feb 22, 2026

Sunday Feb 22, 2026

Monday, 4 August 2025 04:29 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The Secondary Government securities market last week, initially kicked off on a subdued note, with activity and volumes remaining muted up to midweek. Yields were seen edging higher at the start of the week amidst a cautious sentiment, as market participants stayed largely on the sidelines ahead of the back-to-back Treasury Bond and Bill auctions and the anticipated 1 August deadline for the US Reciprocal Tariff decision. Tuesday’s Rs. 122 billion bond auction outcome left overall market dynamics broadly unchanged, with trading remaining confined to a few selected maturities. A slight pick-up in activity was observed on Wednesday following the announcement of the T-Bill auction results, which saw a marginal downward movement in yields.

The Secondary Government securities market last week, initially kicked off on a subdued note, with activity and volumes remaining muted up to midweek. Yields were seen edging higher at the start of the week amidst a cautious sentiment, as market participants stayed largely on the sidelines ahead of the back-to-back Treasury Bond and Bill auctions and the anticipated 1 August deadline for the US Reciprocal Tariff decision. Tuesday’s Rs. 122 billion bond auction outcome left overall market dynamics broadly unchanged, with trading remaining confined to a few selected maturities. A slight pick-up in activity was observed on Wednesday following the announcement of the T-Bill auction results, which saw a marginal downward movement in yields.

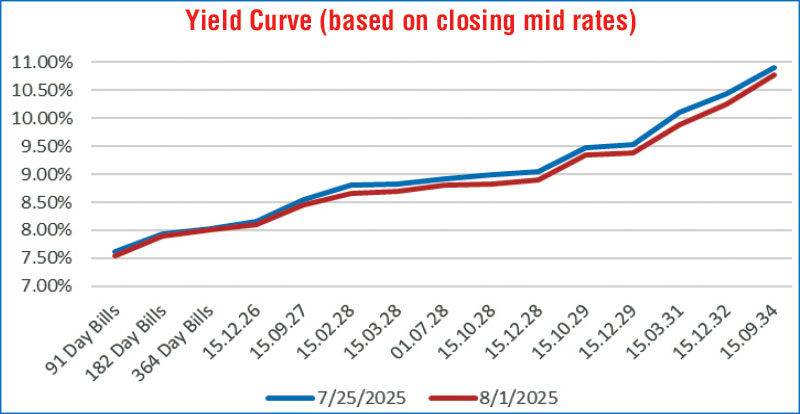

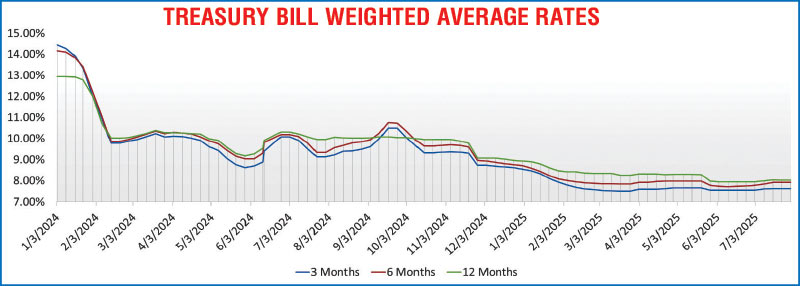

A shift in market tone was observed from Thursday onwards, as yields were observed edging downwards with large volumes transacted ahead of the anticipated announcement due for 1 August (Friday) regarding the ‘final’ outcome of the US Reciprocal Tariffs. A bulk of Thursday’s activity was centred on 2031 and beyond tenors. Friday was the highlight of the week, as the market witnessed a notable turnaround following the official announcement that the US had reduced Reciprocal Tariffs for Sri Lanka to 20%, triggering a rally in the Secondary bond market. This announcement triggered a decisive change in sentiment. Demand and transaction volumes surged in response, driving yields lower across maturities. This improved sentiment was further supported by the Colombo Consumer Price Index (CCPI; Base 2021=100) for the month of July coming in at -0.3% (point-to-point), marking the 11th consecutive month of deflation. The combined effect of easing external trade pressure and continued deflationary signals led to a pronounced repricing of risk. This movement was closely matched by optimism in the local equity market and international markets as well. As a result, secondary market two-way quotes closed lower on a week-on-week basis, accompanied by a clear downward shift of the yield curve.

The 01.05.28 and 15.10.28 maturities traded down from intraweek highs to lows of 8.93%-8.72% and 9.04%-8.85% respectively. The 15.10.29 and 15.12.29 maturities were seen trading down from intraweek highs to lows of 9.50%-9.35% and 9.55%-9.39% respectively. The 01.07.30 which was issued at a weighted average of 9.77%, just earlier in the week rallied down to trade at a low of 9.50%. The 15.03.31 maturity also traded down the range of 10.15%-9.90%. The 15.12.32 and 01.11.33 maturities traded down the ranges of 10.45%-10.25% and 10.82%-10.65% respectively.

The 01.05.28 and 15.10.28 maturities traded down from intraweek highs to lows of 8.93%-8.72% and 9.04%-8.85% respectively. The 15.10.29 and 15.12.29 maturities were seen trading down from intraweek highs to lows of 9.50%-9.35% and 9.55%-9.39% respectively. The 01.07.30 which was issued at a weighted average of 9.77%, just earlier in the week rallied down to trade at a low of 9.50%. The 15.03.31 maturity also traded down the range of 10.15%-9.90%. The 15.12.32 and 01.11.33 maturities traded down the ranges of 10.45%-10.25% and 10.82%-10.65% respectively.

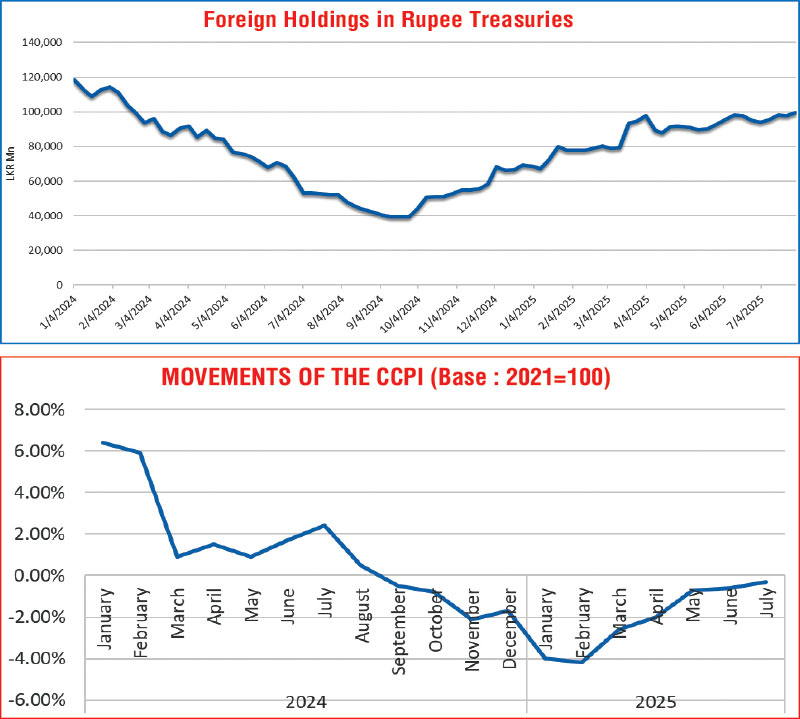

The foreign holding in Rupee Treasuries recorded a weekly net inflow, amounting to Rs. 1.66 billion and as a result the total holding increased to Rs. 99.45 billion as at 31 July 2025, coming in just shy of Rs. 100.00 billion. This marks the highest value in almost one and a half years since the week ending 22 February 2024.

The Treasury bond auctions held last Tuesday with a total offered amount of Rs. 122.00 billion across two available maturities, went undersubscribed. The auctions raised only Rs. 71.06 billion or 58.24% in successful bids across both phases, despite total bids received exceeding the offered amount by 1.70 times. This marked the third consecutive bond auction to raise less than the offered amount. Maturity-wise the results were as follows:

1: The 01.07.2030 maturity (9.75% coupon) was issued at a weighted average yield of 9.77%, coming in line with market expectations. For comparison, this was in between the Secondary market two-way quote of 9.70% / 9.80% on the comparable 15.05.30 maturity just prior to the auction. However, the maturity went undersubscribed at the first phase in competitive bidding. This prompted the opening of the second phase which resulted in Rs. 50.21 billion or 55.78% out of the Rs. 90.00 billion being raised in successful bids across both phases.

2: The 01.07.37 maturity (10.75% coupon) also failed to raise the entire maturity-wise offered amount of Rs. 32.00 billion at the first phase, which prompted the opening of the second phase. Only 65.16% or Rs. 20.85 billion was raised in successful bids at a weighted average rate of 11.08%. The weighted average came in at a narrow term premium over the nearest actively quoted 15.09.34 maturity 10.90%/11.00%, just prior to the auction.

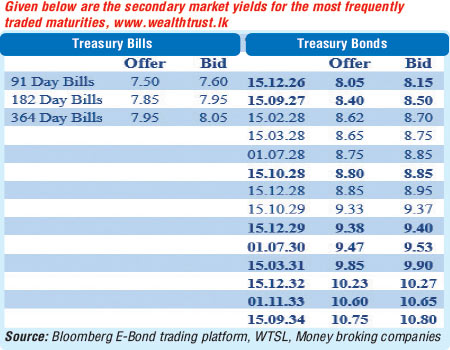

Subsequently, at the weekly Treasury bill auction held last Wednesday, weighted average yield rates remained stable, for the second consecutive week. Accordingly, the weighted average rate on the 91-day tenor stayed flat at 7.62%, the 182-day tenor remained unchanged at 7.91% and the 364-day tenor was also steady at 8.03%. However, the auction raised only 71.49% or Rs. 66.13 billion out of the total offered amount of Rs. 92.50 billion in successful bids at its first phase. This marked the second consecutive Treasury bill auction to go undersubscribed. However, a further Rs. 23.01 billion was raised in total from the second phase of the auction, bringing the total amount raised to Rs. 89.14 billion, just shy of its total offered amount. This was a drastic improvement in subscription over the previous week.

The daily Secondary market Treasury bond/bill transacted volumes for the first four days of the week averaged at Rs. 24.21 billion.

In the money market, the total outstanding liquidity surplus in the inter-bank money market reduced to Rs. 76.29 billion as at the week ending 1 August 2025, from Rs. 93.89 billion recorded the previous week. The weighted average interest rates on call money and repo were recorded within the ranges of 7.80%-7.84% and 7.83%-7.86% respectively while the Central Bank of Sri Lanka’s (CBSL) holding of Government Securities was registered at Rs. 2,508.92 billion as at 25 July 2025, unchanged against the previous week’s closing level.

Forex market

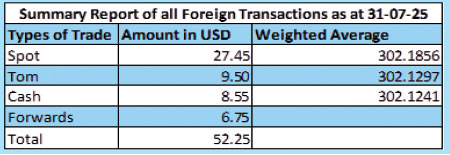

In the Forex market, the USD/LKR rate on spot contracts was seen appreciating to close the week at Rs. 301.20/301.30 as against the previous week’s closing level of Rs. 301.90/302.00, subsequent to trading at a high of Rs. 301.25 and a low of Rs. 302.30.

The daily USD/LKR average traded volume for the first four trading days of the week stood at $ 63.50 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)