Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Monday, 27 October 2025 02:34 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The secondary Bond market opened the holiday-shortened week on a steady note, with overall activity remaining moderate amid a cautious investor tone.

The secondary Bond market opened the holiday-shortened week on a steady note, with overall activity remaining moderate amid a cautious investor tone.

Trading was largely confined to selected maturities, as most market participants adopted a wait-and-see approach following the long weekend. Yields held broadly steady across the curve, reflecting the absence of strong directional sentiment.

As the week progressed, the market continued to exhibit a subdued tone, with activity remaining relatively muted through midweek sessions. Limited trades on select maturities characterised market behaviour, as participants stayed largely on the side-lines and yields continued to consolidate.

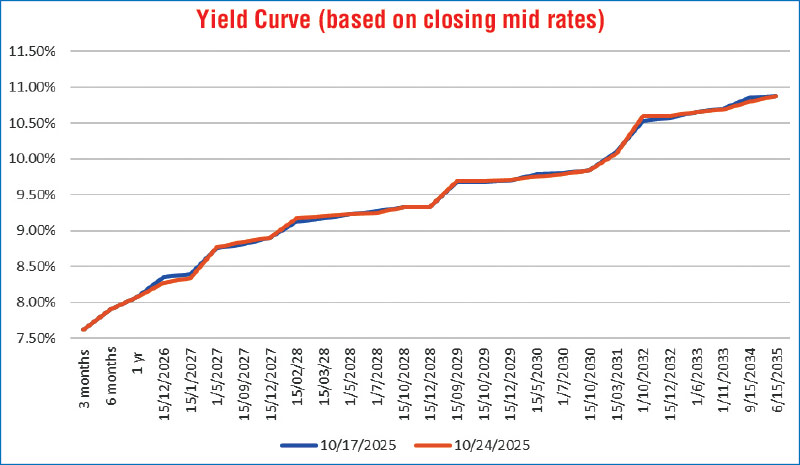

Despite the quiet start, renewed buying interest emerged towards the later part of the week, driving a sharp increase in activity and transaction volumes. The focus shifted toward the short end of the yield curve, particularly the 2026–2029 maturities, which saw yields drop marginally amid strong demand.

Overall, the week’s trading reflected a steady yet cautious market sentiment, with activity skewed toward shorter tenors and sentiment gradually improving toward the end of the week as investors began to re-engage ahead of upcoming primary market events. The details of the upcoming Treasury Bill auction scheduled for this Wednesday were announced.

The auction will have on offer a total amount of Rs. 57 billion, consisting of Rs. 12 billion on the 91-day maturity, Rs. 30 billion on the 182-day and a further Rs. 15 billion on the 364-day maturity.

This is well below the maturity in line with the scheduled auction, which is estimated to be approximately Rs. 104.16 bn.

In terms of the weekly secondary Bond market trade summary, during the week the 01.06.26 maturity was seen trading at the rate of 8.25%, while the 01.08.26 maturity traded down the range of 8.30%–8.20%.

The 15.12.26 maturity was seen trading within the range of 8.37%–8.32%. The 15.01.27 maturity traded at levels of 8.39%–8.35%, while the 01.05.27 maturity was seen trading at 8.77%. The 15.09.27 maturity traded down the range of 8.89%–8.87%.

On the mid-term maturities, the 15.02.28 maturity traded at 9.18%, while the 15.03.28 maturity was seen trading within the range of 9.25%–9.20%. The 01.05.28 maturity traded between 9.25%–9.23%, and the 01.07.28 maturity was seen trading within 9.27%–9.20%.

The 01.09.28 and 15.12.28 maturities traded at 9.30% and 9.33% respectively. The 15.09.29 maturity traded at 9.70%, while the 15.10.29 maturity was seen trading within the range of 9.72%–9.70%. The 15.12.29 maturity traded at 9.71%. The 15.05.30 maturity traded within the range of 9.80%–9.74%, while the 01.07.30 maturity was seen trading at 9.79%–9.78%. The 15.03.31 maturity traded at 10.10%.

Moving to the longer end, the 01.10.32 maturity was seen trading within the range of 10.55%–10.68%, while the 01.11.33 maturity traded between 10.72%–10.70% during the week.

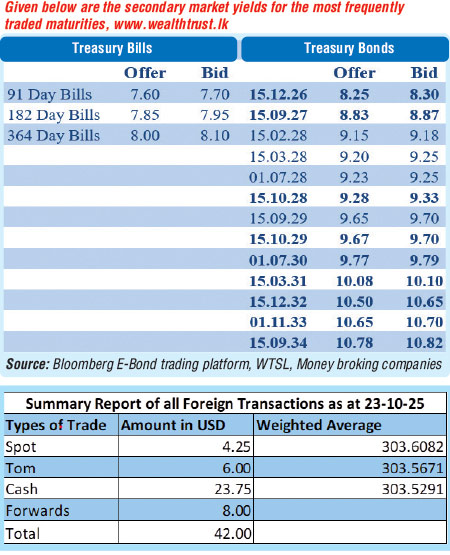

At the weekly Treasury Bill auction held last Wednesday (8 October), the weighted average rates held largely steady, with a total amount of Rs. 39.62 billion accepted against a total offered amount of Rs.70 billion.

Accordingly, the weighted average rates of the 91-day, 182- day and 364-maturities stood at 7.52%, 7.89% and 8.02% respectively.

Foreign holdings of rupee-denominated Government securities increased further last week, recording a net inflow of Rs. 608 million during the week ending 23 October. This marks the third consecutive week of inflows. As a result, total foreign holdings rose to Rs. 130.96 billion by the end of the week.

The daily secondary market Treasury Bond/Bill transacted volumes for the first four days of the week averaged at Rs. 17.39 billion.

In the money market, the total outstanding liquidity surplus in the inter-bank money market dipped marginally to Rs. 129.13 billion as at the week ending 24 October 2025, from Rs. 133.22 billion recorded the previous week.

The weighted average interest rates on call money and repo were recorded within the ranges of 7.89%-7.90% and 7.91%-7.92% respectively while the Central Bank of Sri Lanka’s (CBSL) holding of Government Securities was registered at Rs. 2,508.92 billion as at the 24 October 2025, unchanged against the previous week’s closing level.

In the Forex market, the USD/LKR rate on spot contracts was seen closing the week depreciating to Rs. 303.70/307.85 as against the previous week’s closing level of Rs. 302.90/303.00. However, this was subsequent to trading at a high of Rs. 302.95 and a low of Rs. 304.00.

The daily USD/LKR average traded volume for the first three trading days of the week stood at $ 73.87 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)