Friday Feb 20, 2026

Friday Feb 20, 2026

Monday, 5 December 2022 00:43 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

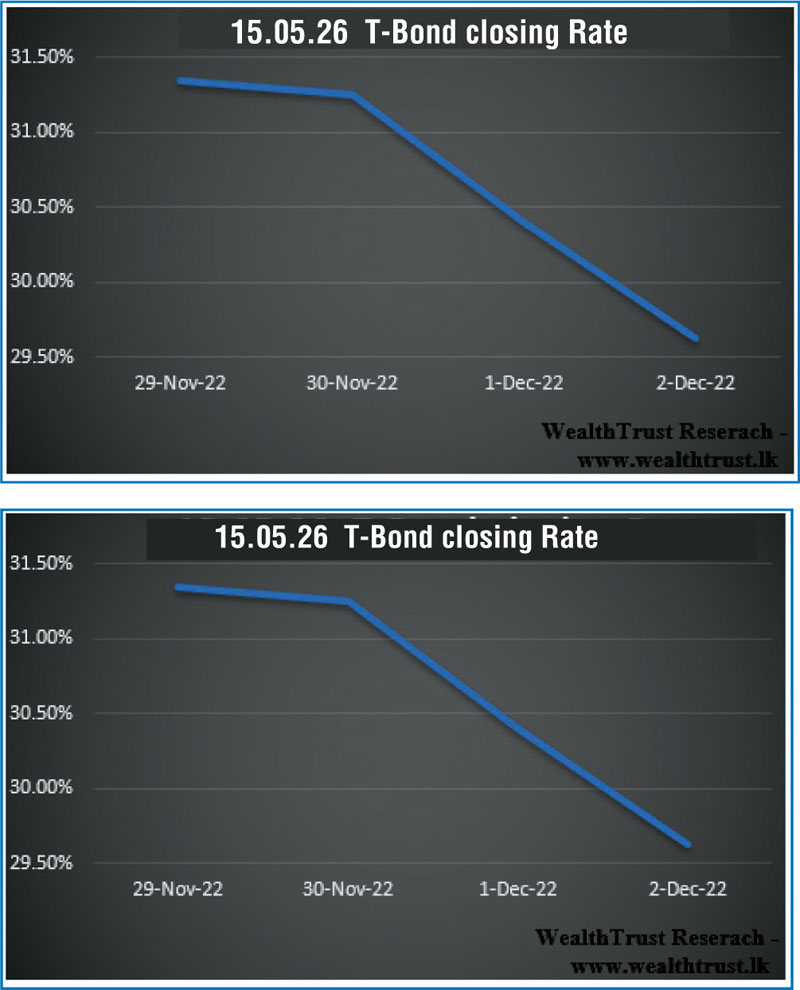

The bullish rally in the secondary bond market, which gathered momentum towards the later part of the previous week, was seen continuing during the week ending 2 December, as yields continued to tumble on the back of local and foreign buying interest and impressive outcomes at the primary auctions.

The bullish rally in the secondary bond market, which gathered momentum towards the later part of the previous week, was seen continuing during the week ending 2 December, as yields continued to tumble on the back of local and foreign buying interest and impressive outcomes at the primary auctions.

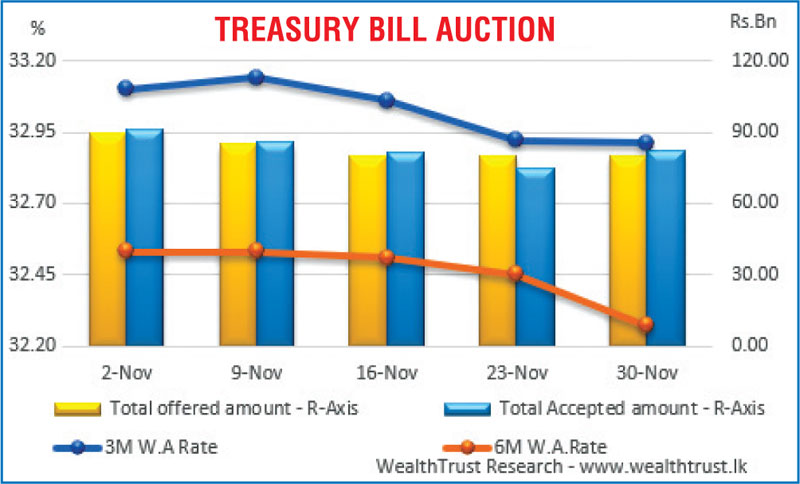

The two Treasury bond auctions conducted on Tuesday drew over Rs. 51 billion in successful bids at its Phase I, Phase II and Direct Issuance Window over its initial offered total amount of Rs. 50 billion as the auctioned maturities of 01.05.24 and 15.05.26 recorded impressive weighted averages rates of 32.71% and 31.69% respectively. At the weekly Treasury bill auction, weighted average rates decreased across the board for a third consecutive week, with the total offered amount of Rs. 80.00 billion been accepted at its 1st phase of the auction. A further amount of Rs. 2.00 billion was raised at its phase II as well.

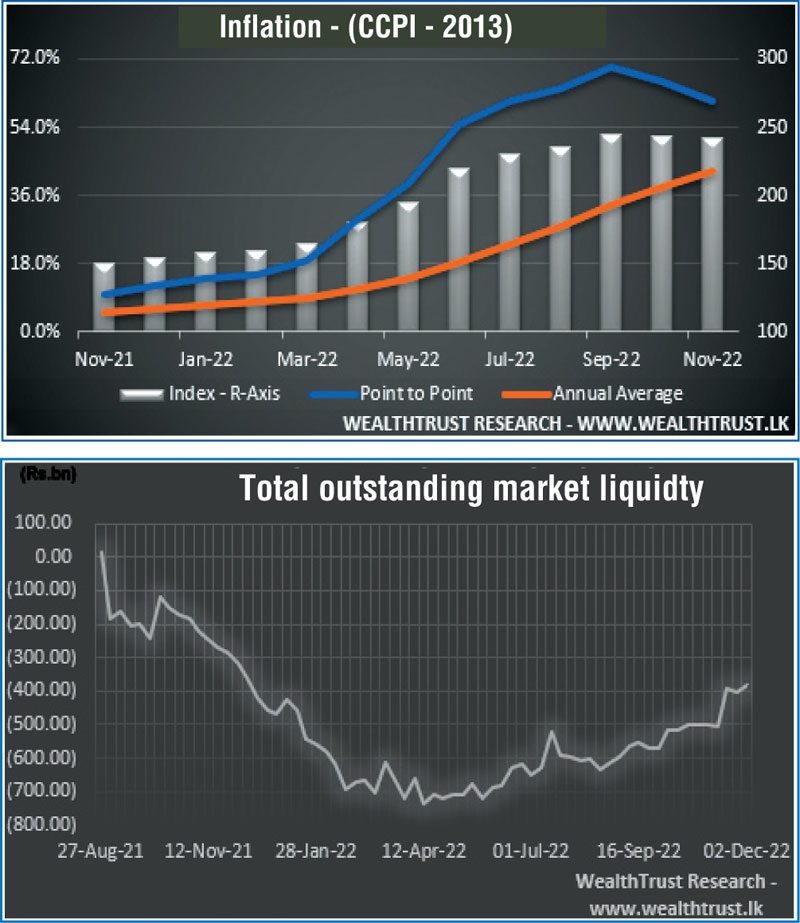

The positive momentum was further supported by Inflation (CCPI) numbers for the month of November 2022, which decreased for a second consecutive month to 61% on its point to point against 66% recorded in October and 69.8% in September.

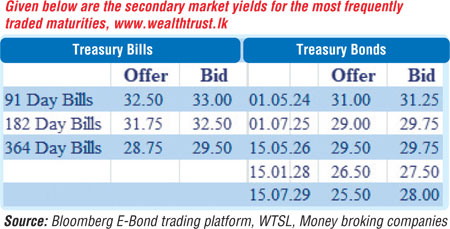

In active trading, yields on the liquid maturities of 01.05.24 and 15.05.26 were seen dipping considerably to weekly lows of 30.25% and 29.20% respectively against its auction weighted average rates of 32.71% and 31.69%. Nevertheless, selling interest at these levels on the back of profit taking saw yields pull back once gain to close the week marginally higher. In addition, maturities of 01.07.25, 15.01.28 and 01.07.32 traded within the range of 30.85% to 30.90%, 27.00% to 28.00% and 28.50% to 28.55% as well.

The foreign holding in rupee bonds remained steady at Rs. 24.90 billion for the week ending 30 November while the daily secondary market Treasury bond/bill transacted volumes for the first four trading days of the week averaged Rs. 16.51 billion.

In money markets, the Domestic Operations Department (DOD) of the Central Bank of Sri Lanka was seen conducting auction for outright purchase of Treasury bills for the first time since December 2019. However, the auction failed to infuse any liquidity to the system as no bids were received.

The total outstanding liquidity deficit was registered at Rs. 384.81 billion by the end of the week against its previous week’s of Rs. 401.31 billion while CBSL’s holding of Government Securities stood at Rs. 2,543.05 billion against its previous week’s of Rs. 2,544.49 billion.

USD/LKR

In the forex market, the middle rate for USD/LKR spot contracts depreciated marginally during the week to close the week at Rs. 363.19 against its previous week’s closing of Rs. 363.00.

The daily USD/LKR average traded volume for the first four trading days of the week stood at $ 65.91 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)