Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Monday, 12 February 2024 01:46 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

By Wealth Trust Securities

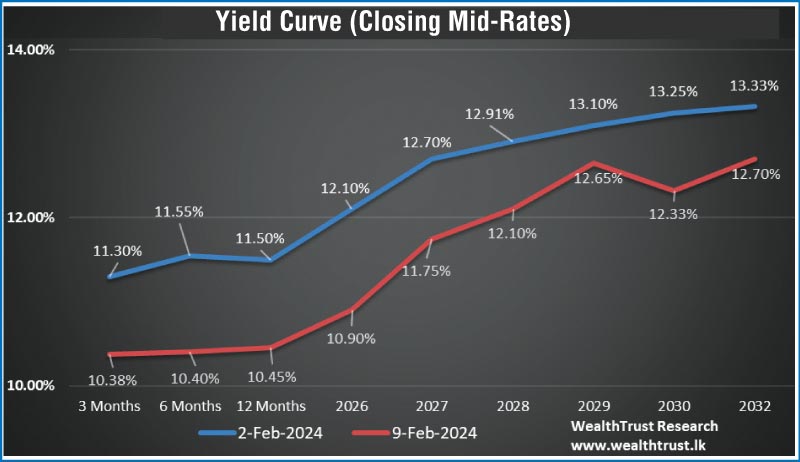

The secondary bond market continued its bull run during the trading week ending 9 February, driven by the plunge in weighted averages at the weekly Treasury bill auction for a third consecutive week and the relaxation of restrictions for Licensed Commercial Banks’ access to CBSL’ s Standing Facilities under its Open Market Operations. Bond yields were seen hitting lows last seen in March 2022 while the overall yield curve recorded a steep parallel shift downwards for a third consecutive week, especially on the very short end of the curve.

Aggressive buying interest continued to be centred on the short end of the yield curve, centring on 2026-2030 durations. Despite occasional bouts of slight profit taking pressure, yields closed the week considerably lower on a resoundingly bullish note.

Accordingly, the maturities of three 26’s (01.02.26, 01.06.26 and 01.08.26), two 27’s (01.05.27 and 15.09.27), four 28’s (of 15.03.28, 01.05.28, 01.07.28 and 15.12.28) and 15.05.30 were seen trading within the range of an intraweek high and low of 12.10% to 10.90%, 12.60% to 11.65%, 12.60% to 12.00%, 12.55% to 12.25% respectively, on the back of considerable activity and large volumes transacted.

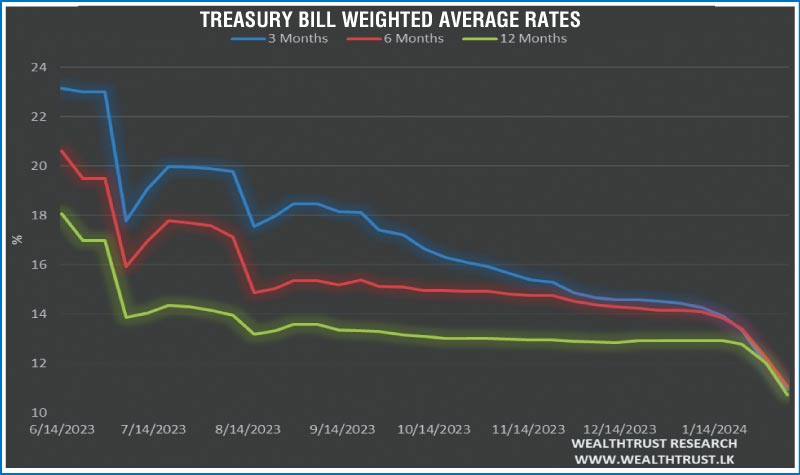

At the weekly Treasury bill auction last week, the weighted averages yields dropped dramatically across the board, for a third consecutive week. The total offered amount of

Rs. 145.00 billion was raised at the 1st phase of the auction. The heavy demand witnessed led to the steep declines, as total bids received exceeded the offered amount by 2.58 times. The 91-day maturity plunged by 101 basis points to 10.96%, the 182-day maturity by 113 basis points to 11.07% and the 364-day maturity by 127 basis points to 10.73%. The weighted averages on the 3 months and 1-year bills were recorded below 11.00% for the first time since March 2022, hitting almost 2-year lows. A further Rs. 36.25 billion was raised at the 2nd phase, being the maximum offered, on the 182-day and 364-day maturities at the weighted averages determined at the 1st phase. The 2nd phase also went oversubscribed with bids exceeding Rs. 183 billion. The accumulated drop in averages over the last 3 week’s stand at 295 basis points, 276 basis points and 219 basis points the 91-day, 182-day and 364-day maturities respectively.

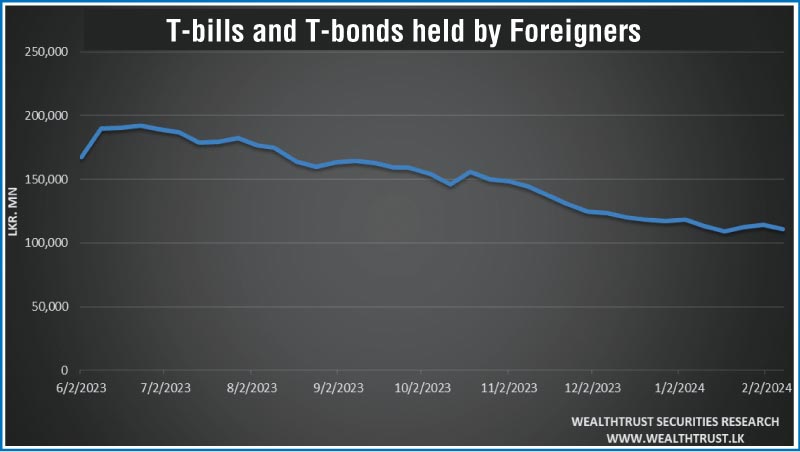

The foreign holding in Rupee bonds and bills for the week ending 8 February recorded a net outflow of Rs. 3.27 billion, while the total holding decreased to Rs. 111.15 billion.

The daily secondary market Treasury bond/bill transacted volumes for the first four days of the week averaged at Rs. 47.55 billion.

In money markets, the total outstanding liquidity deficit decreased to Rs. 18.68 billion by the week ending 9 February from its previous week’s deficit of Rs. 36.61 billion. The Domestic Operations Department (DOD) of Central Bank continued to inject liquidity during the week by way of overnight reverse repo auctions at weighted average yields ranging from 9.09% to 9.46%.

The Central Bank of Sri Lankas (CBSL) holding of Government Securities was registered at

Rs. 2,735.62 billion as at 9 February, down from its previous week’s level of Rs. 2,755.62.

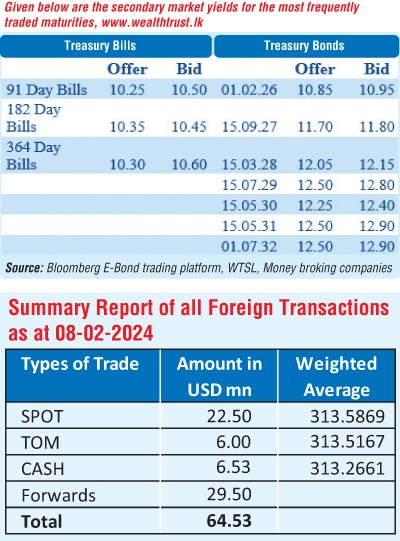

Forex Market

In the Forex market, the USD/LKR rate on spot contracts was seen depreciating slightly during the week to close at Rs. 313.00/313.10. This is as against its previous weeks closing level of

Rs. 312.25/312.60 and subsequent to trading at a high of Rs. 315.40 and a low of Rs. 312.60.

The daily USD/LKR average traded volume for the first four trading days of the week stood at $ 63.00 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)